Want to learn more about the features of the UPI-based digital payments application, BHIM? Read on.

With the launch of the Unified Payments Interface (UPI) app, we witnessed a lot of UPI-based players entering the market and Bharat Interface for Money was one among them. Commonly referred to as BHIM, this basic UPI-based app is considered as the simplest and easiest UPI app available in the market today.

According to data from the National Payments Corporation of India (NPCI), there have been approximately 913 million BHIM UPI transactions since its launch (FY 2018; Source – Economic Times). The BHIM app is available on Google Play Store and App Store.

Additional Reading: UPI: A Step Towards A Banking Revolution

What is BHIM?

It is basically a digital payments application which is based on UPI. Developed by the National Payments Corporation of India (NPCI), BHIM allows you to transfer money between accounts by using your smartphone. As compared to other similar apps, BHIM stands out as a simple and easy means of payment and fund transfer. The plus point is that you can transact without having to fill your Credit Card details, wallet passwords or internet banking details, or even your IFSC code. You don’t even need a smartphone. A feature phone is more than enough!

Features of BHIM

With the BHIM app, you can immediately transfer money to any bank account using your phone. These transactions can be done at any time too, be it in the middle of the night or on a public holiday (24×7, 365 days).

In addition to this, you do not have to register the payee or even know his or her bank account number. You can transfer money instantly by just using the payee’s Virtual Payment Address (VPA) or mobile number. In case you’re sending money to a payee who doesn’t have a UPI-based bank account, then you can send money to them using their Indian Financial System Code (IFSC) and Mobile Money Identifier (MMID).

Authenticating the fund transfers are also easy on the BHIM app. You just need to enter the UPI PIN you created when you had created your Virtual Payment Address (VPA).

Remember that the VPA is all that you need to carry out transactions. So, while creating your VPA, please keep it simple (for example, you can stick to something like your name/mobilenumber@yourbankname, etc.). You’ll just need to share your VPA if you want to receive money from anyone. Similarly, if you need to send money to anyone, you’ll just need their VPA. Bye-bye, account numbers and IFSC Codes!

Besides these features, the BHIM app also comes with a clean and simple interface. The app lets you save your beneficiaries for future use, generate your own QR code, access your transaction history and request for your account balance whenever you require it. And, as mentioned before, you do not need a smartphone to access the app. Those who are stuck with feature phones can also access the BHIM app by dialling *99# on their phone.

Additional Reading: Why You Should Give UPI & BHIM A Chance

Get Started With BHIM

If you’re a first-time user, here’s what you’ve got to do to start using BHIM’s unique features:

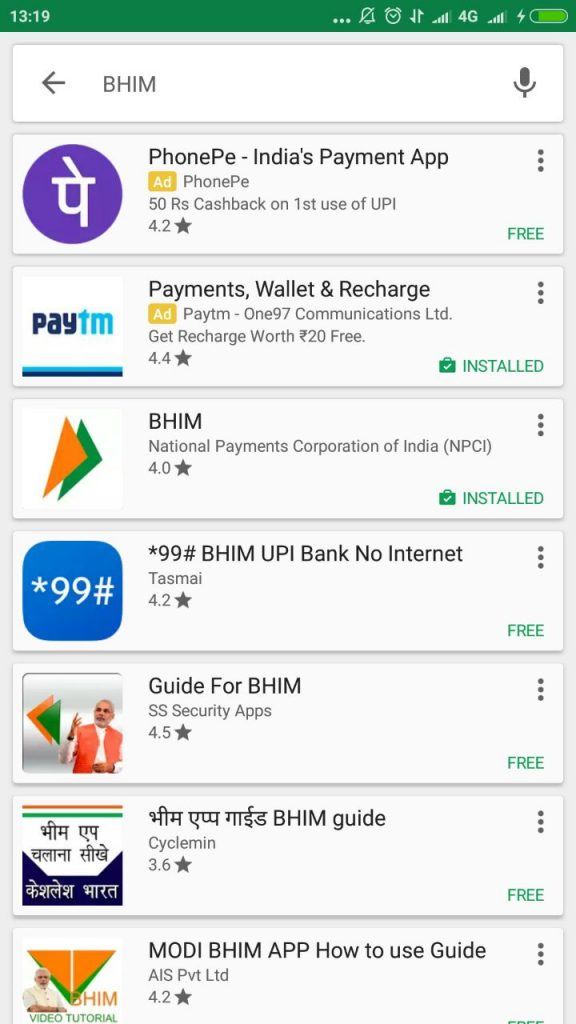

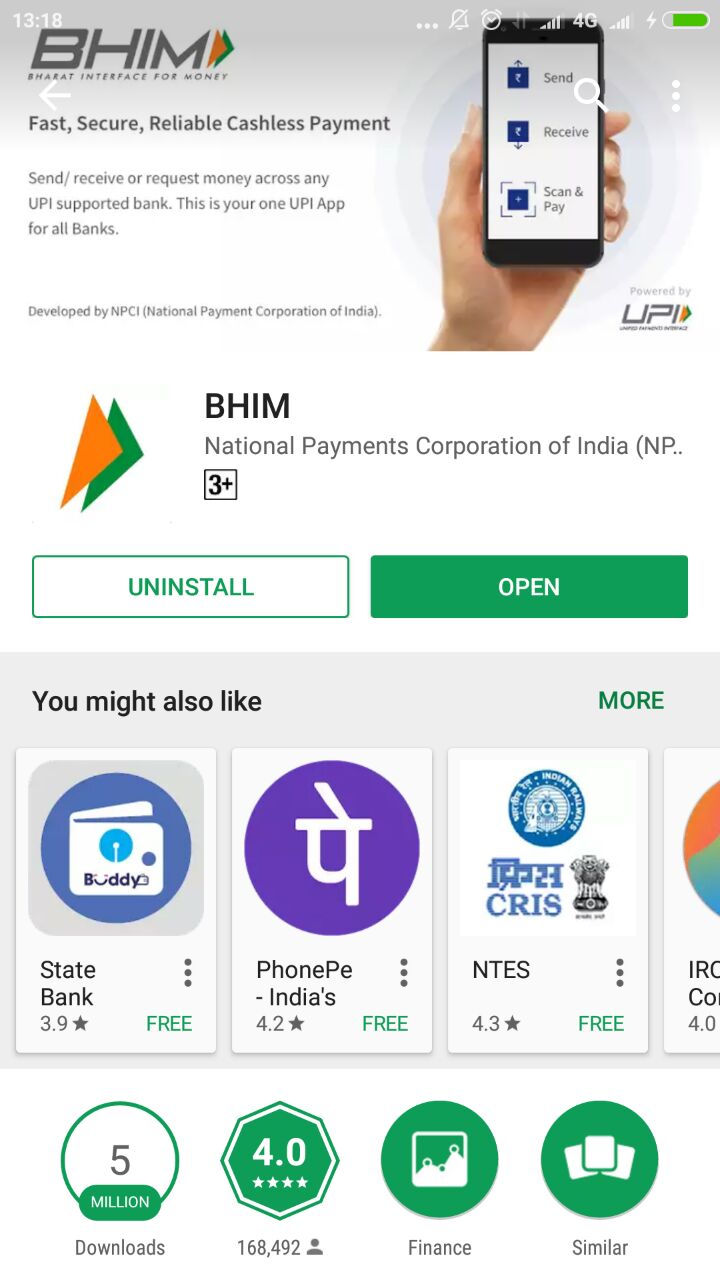

1: Download the BHIM app from Play Store or App Store.

Before you download the app from the Play Store, ensure that you’re downloading the right app. There are quite a few fake BHIM apps in the Play Store. The original BHIM app will have National Payments Corporation of India (NPCI) as its developer.

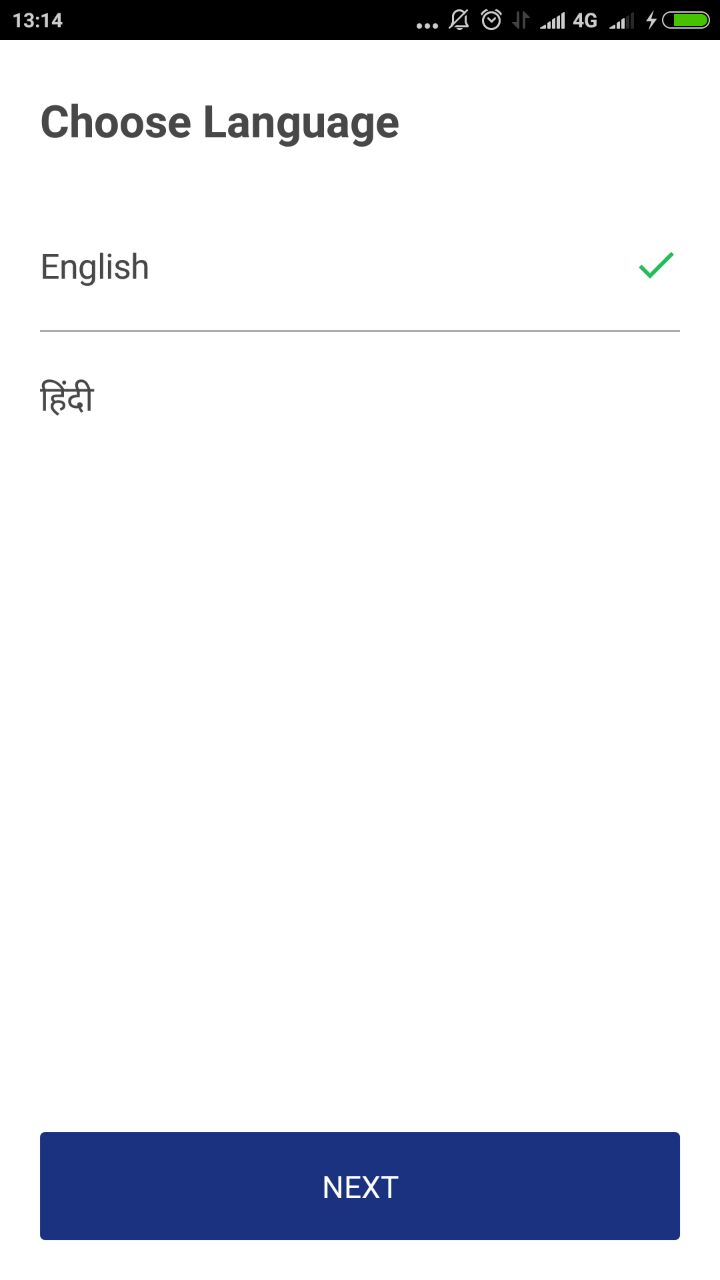

2: You’ll be asked to select your preferred language.

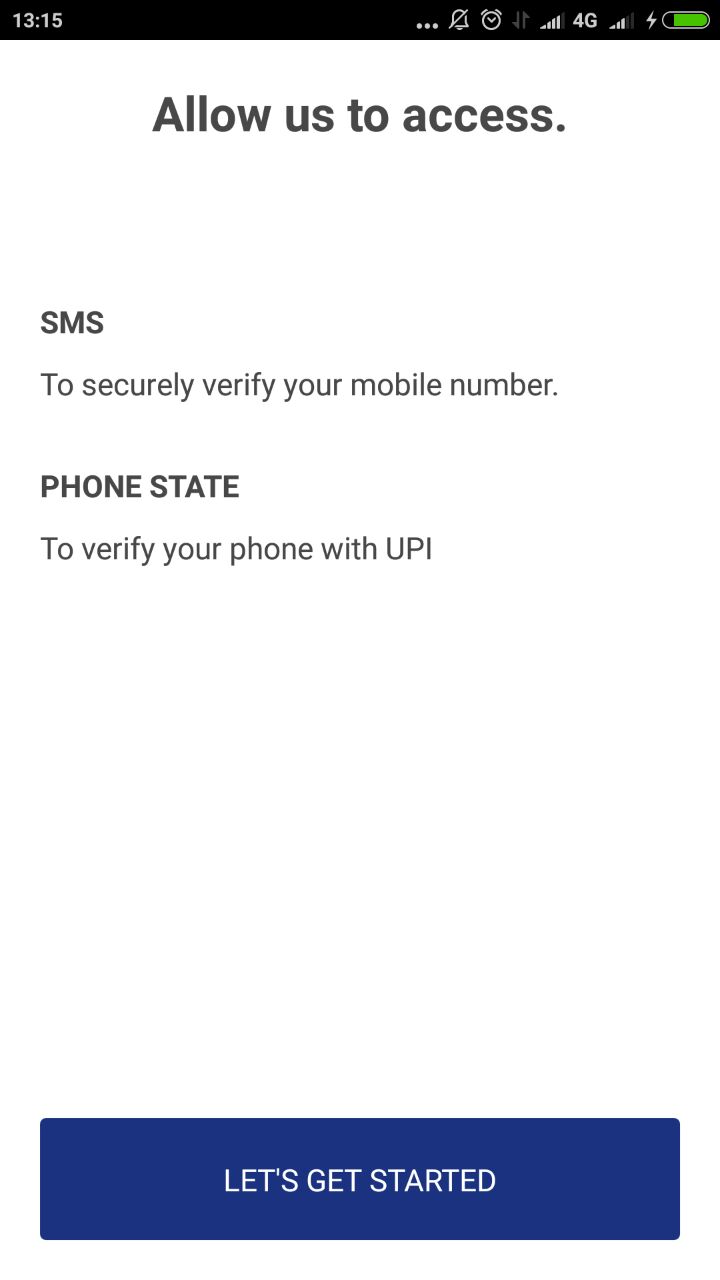

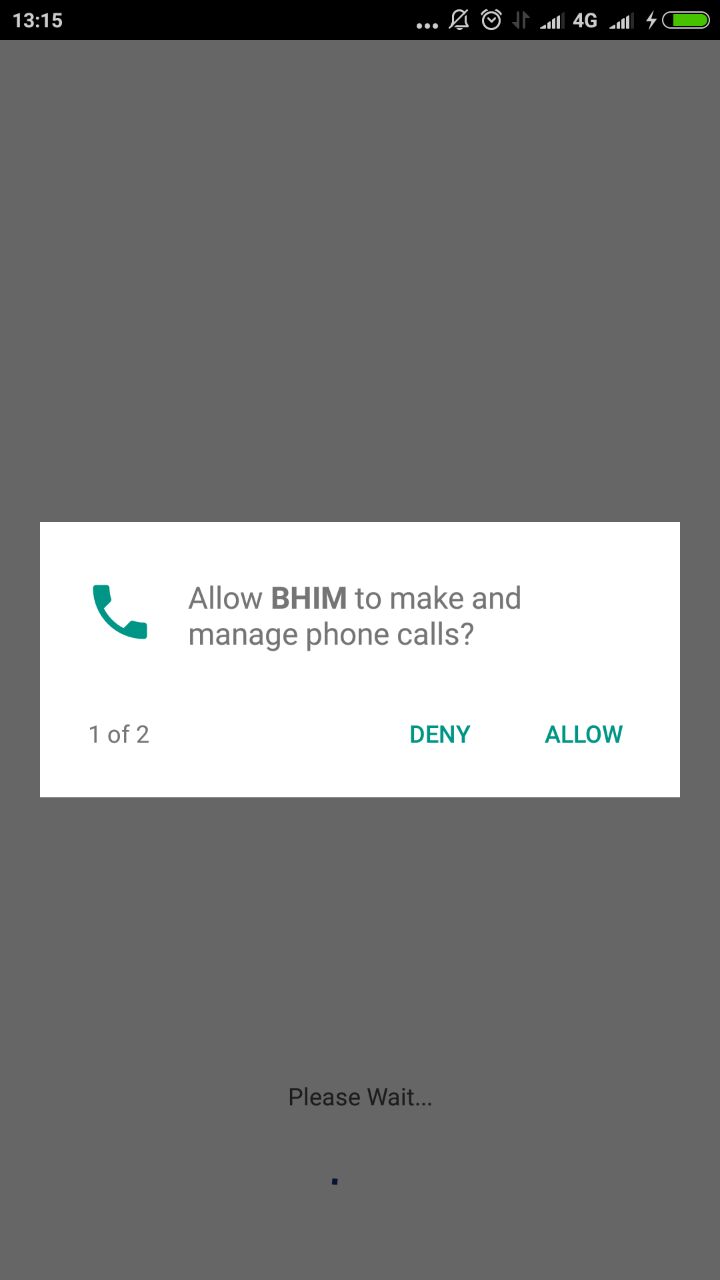

3: Next, you’ll have to permit the app to manage SMSes and phone calls on your device.

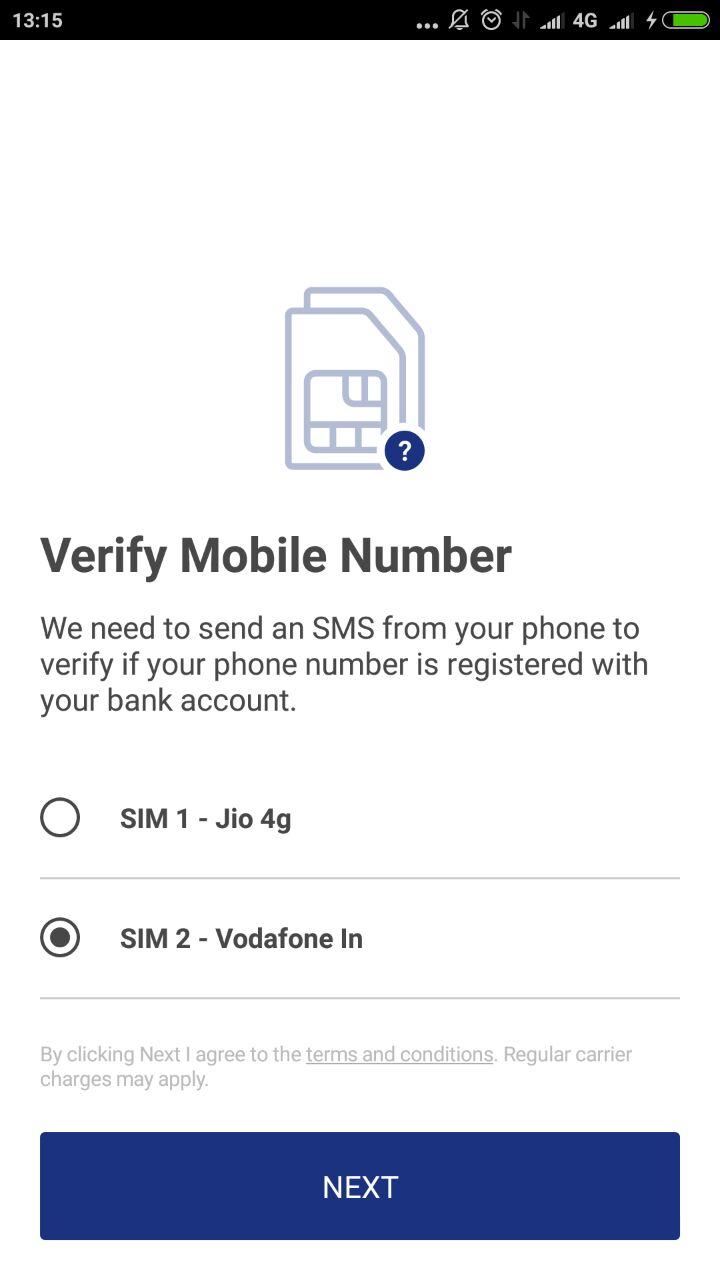

4: If you’re using a dual SIM phone, you’ll be asked to choose the number that is linked to your preferred bank account.

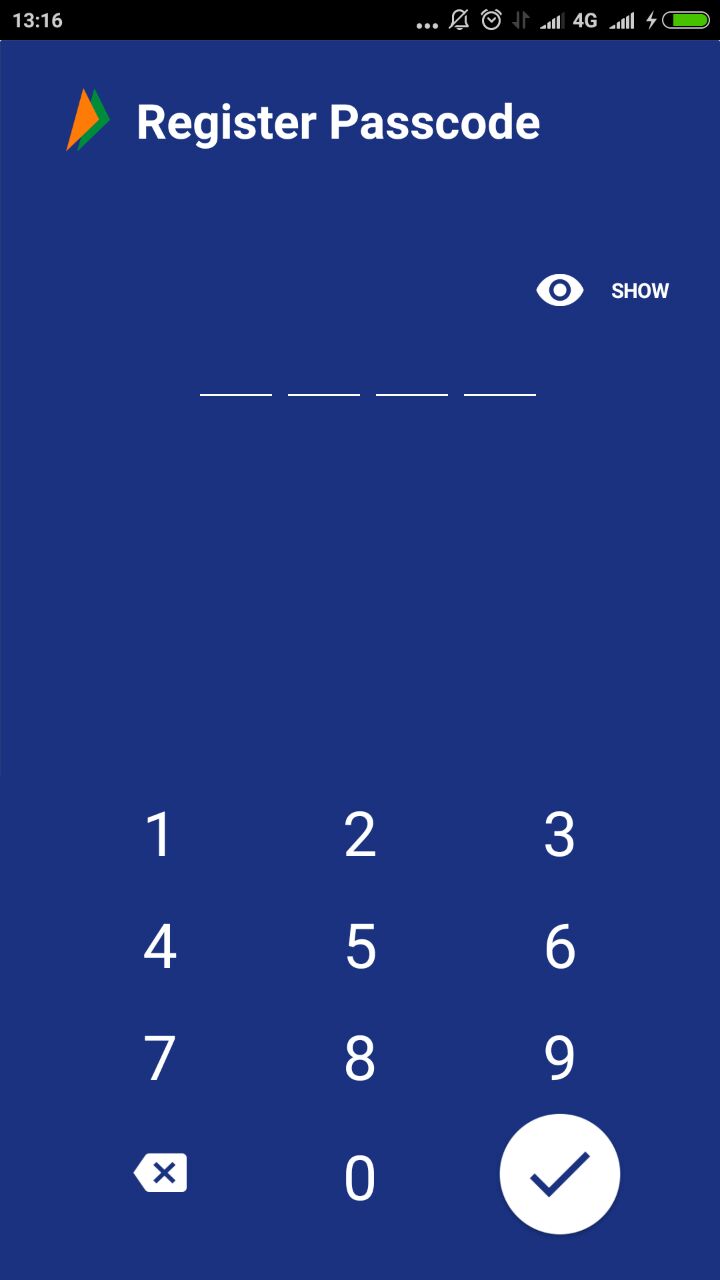

5: Next, you’ll be asked to set a 4-digit passcode to log into the application.

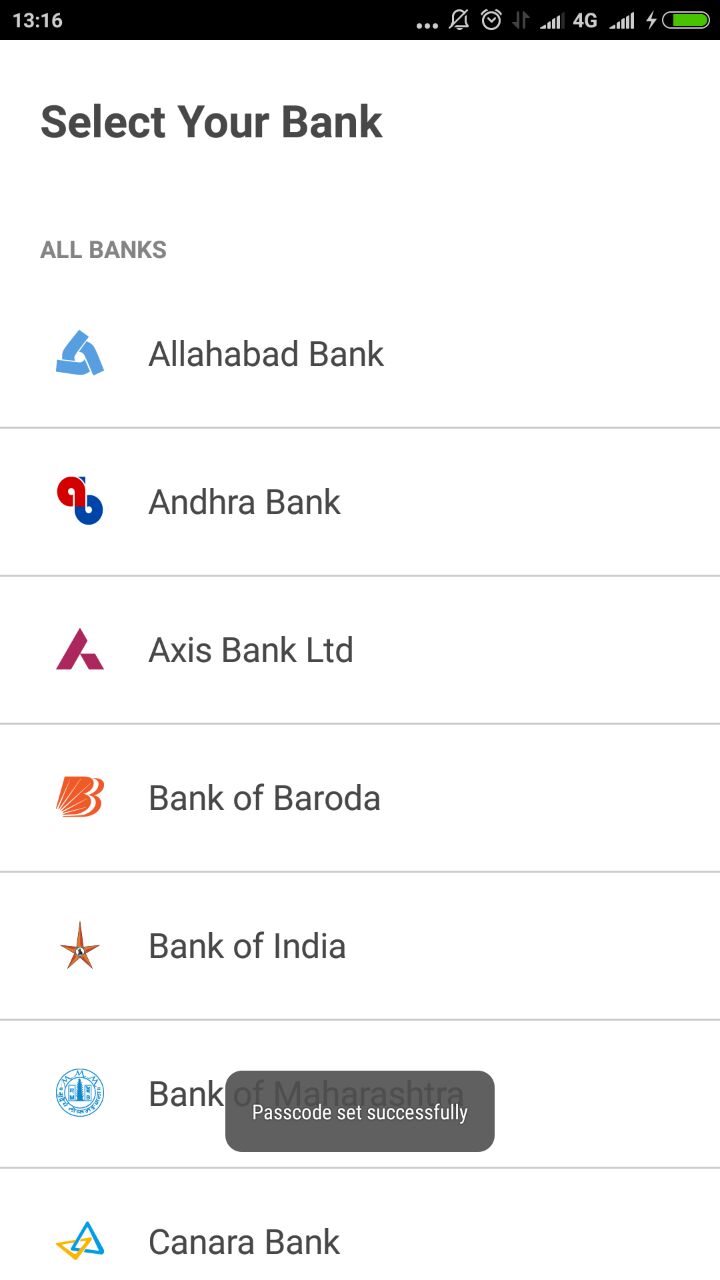

6: Once you’ve logged in, you’ll be asked to link your bank account. This can be done through the Bank Account option (available on the home page) also. As of now, you can link only one account with the BHIM app. If you wish to change your linked account at any time, you can choose to change the account by going to the Bank Account option on the home page.

7: From the home page, you can set your Virtual Payment Address (VPA) and UPI PIN.

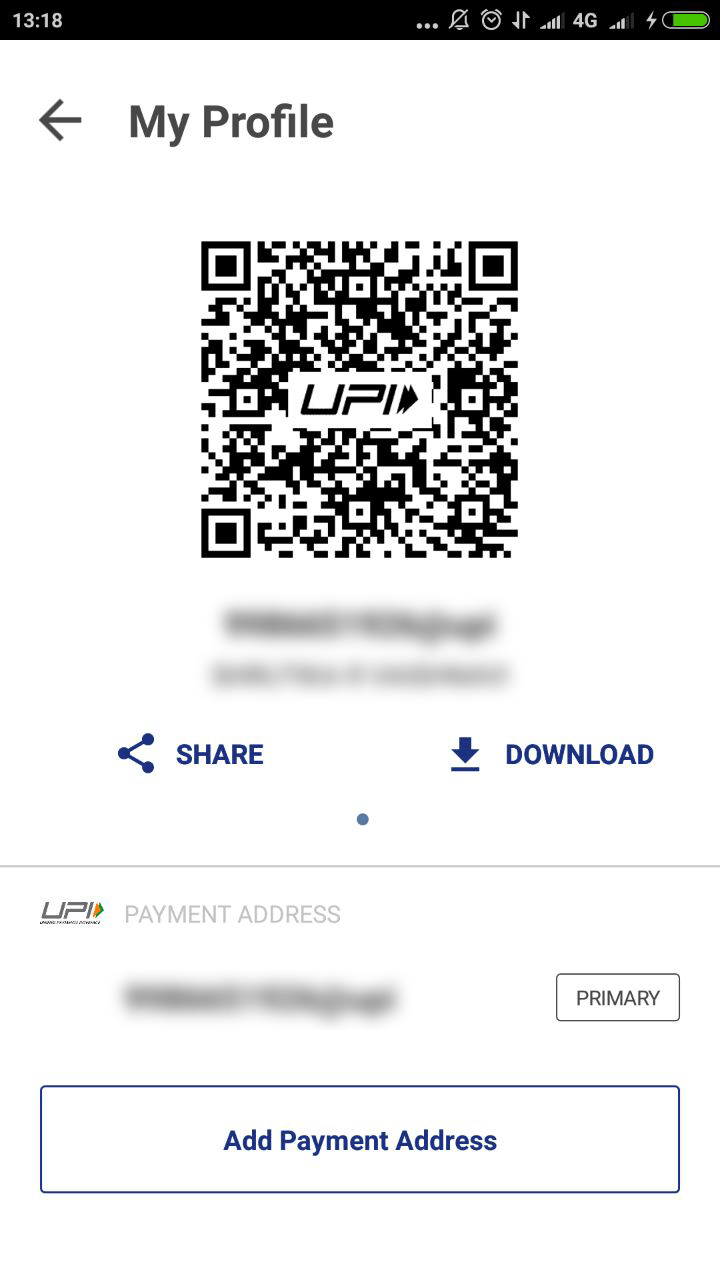

For VPA – Go to Profile and set it. You’ll be allowed to set two VPAs, one of these should be your primary one.

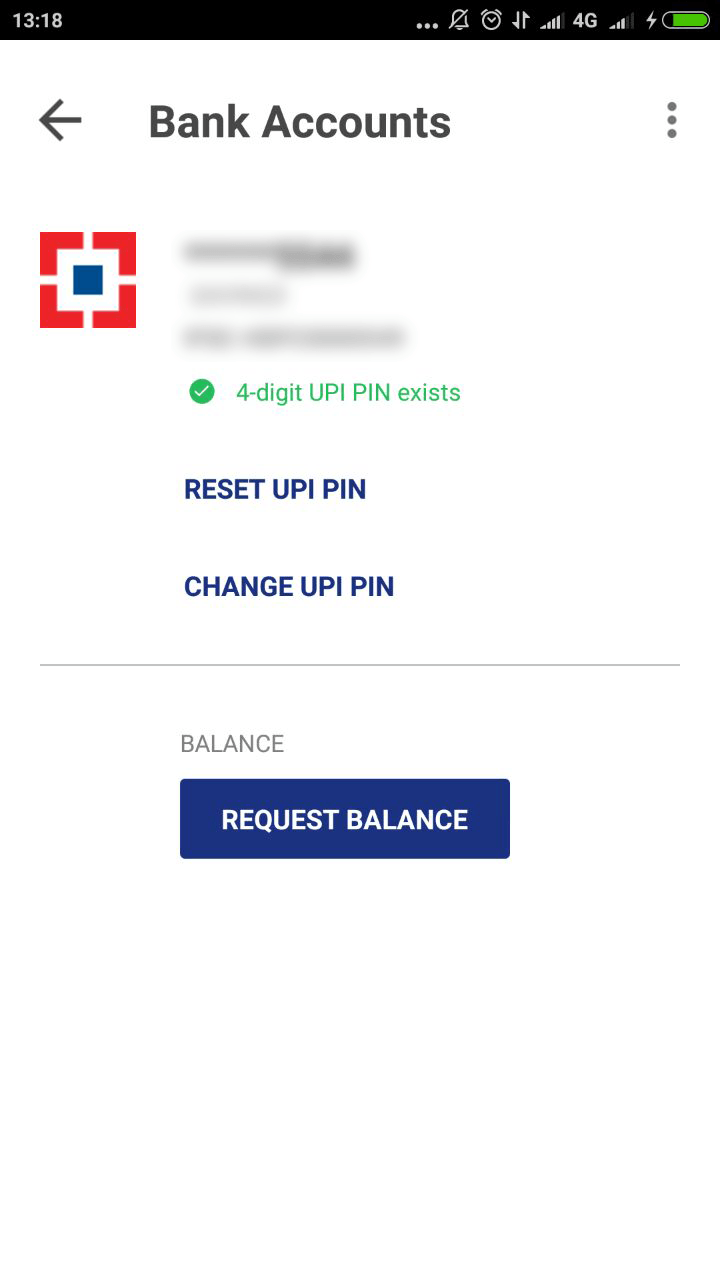

For UPI PIN – Go to the Bank Account option to set, reset, or change your UPI PIN. If you’re setting it for the first time, you’ll be asked to provide the last six digits of your Debit Card as well as the expiry date.

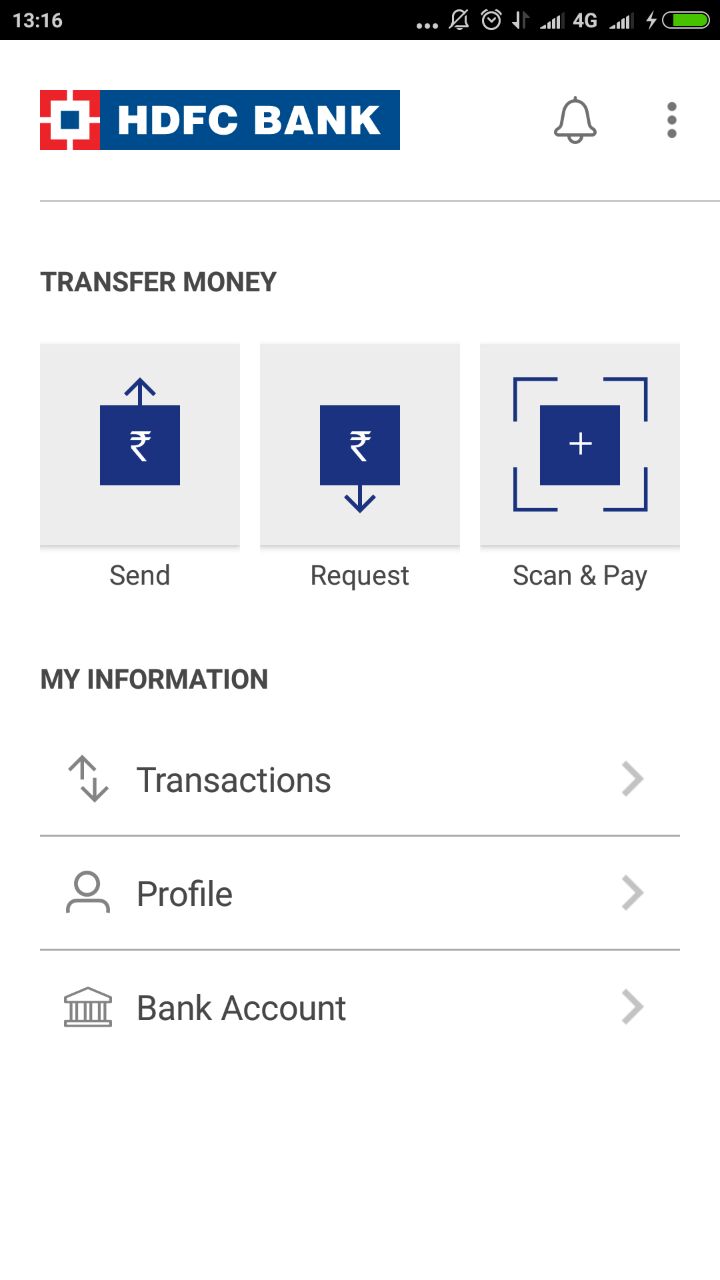

8: Now, you’re all set to use the BHIM app. Send money, receive money and make payments using your VPA, account number/IFSC code option, or using QR codes to scan and pay.

8: Now, you’re all set to use the BHIM app. Send money, receive money and make payments using your VPA, account number/IFSC code option, or using QR codes to scan and pay.

Let us now quickly look at the different services that are offered on the BHIM app. Shall we begin?

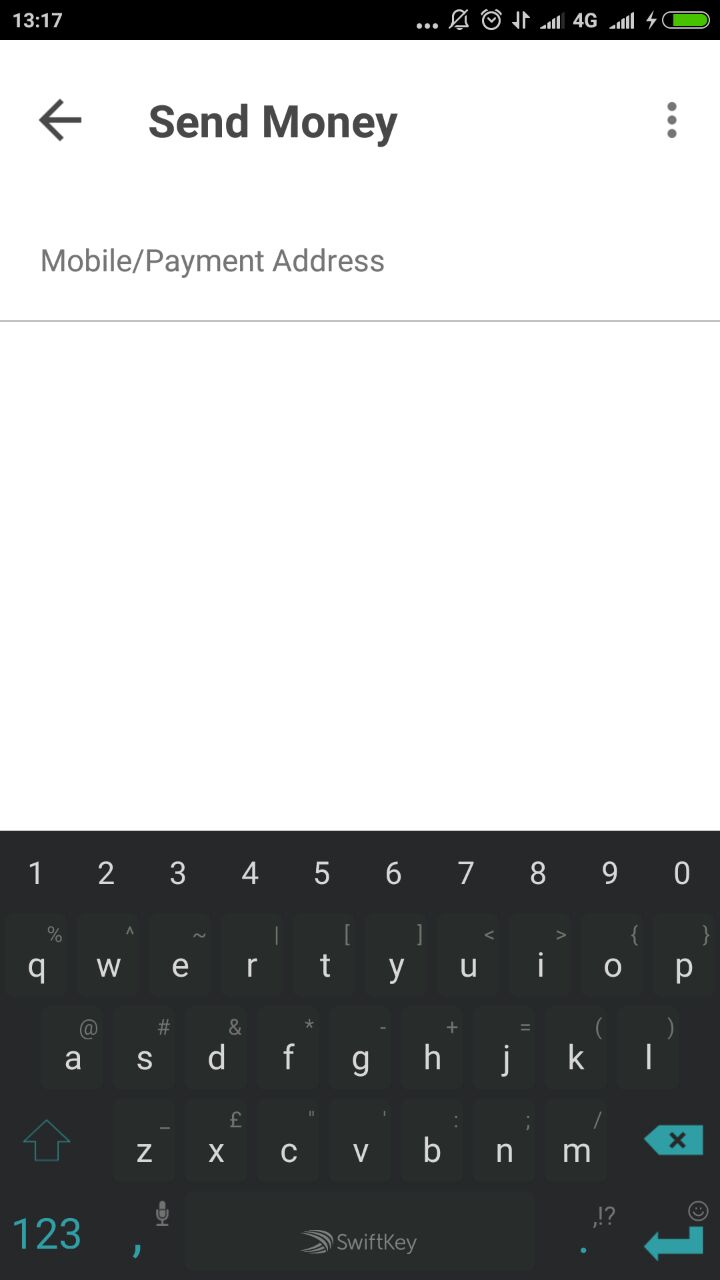

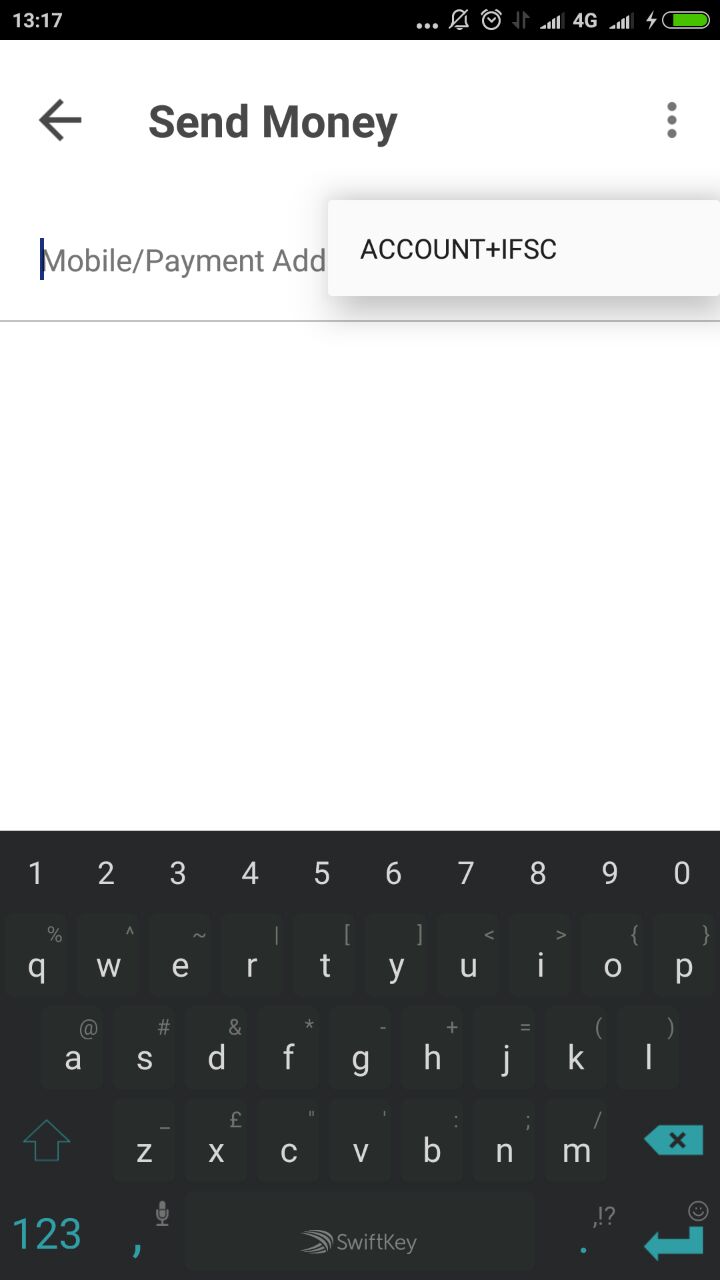

Send Money

On the home page of the app, you’ll find the Send Money option. Using this option, you’ll be able to send money to another account using the payee’s VPA or using their mobile number. If the payee doesn’t have a UPI-based bank account, you can send money using the account number and IFSC option. You can choose this option from the top right corner on the Send Money page.

Whichever option you choose, you’ll be asked to enter your UPI PIN and authenticate the transaction before the transaction goes through.

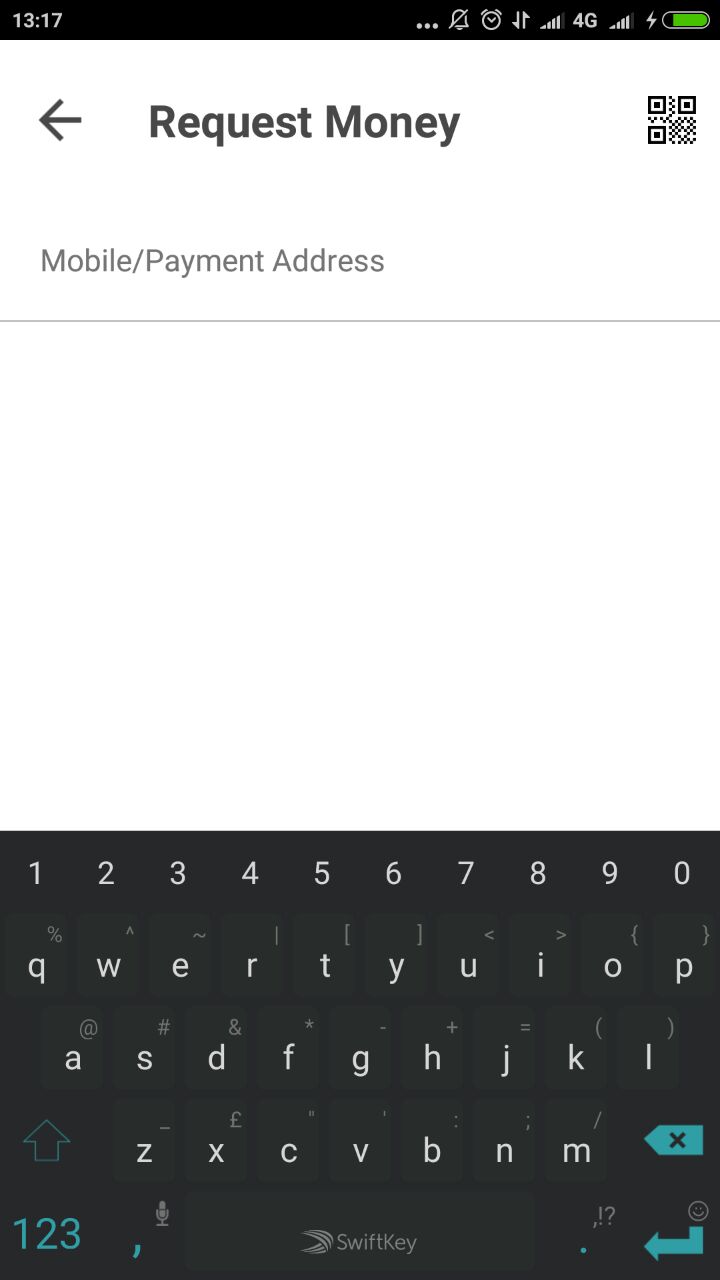

Request Money

You can collect money from anyone using the BHIM app. To initiate a transaction, click on the Receive Money option. There are three ways to request money – using the VPA of the payer, using the mobile number of the payer, or by generating a QR code and sharing it with the payer. You’ll be notified once the payer accepts or rejects your request for money.

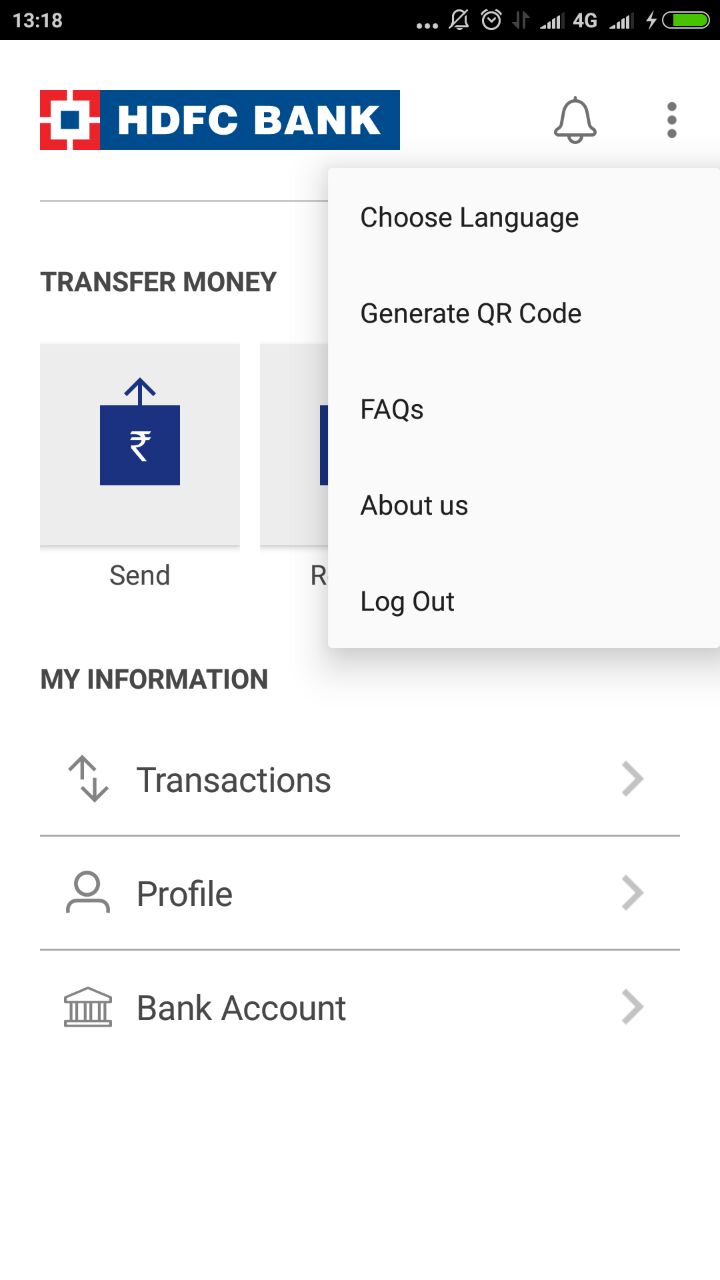

Wondering how to generate a QR code? It’s pretty simple! You just need to choose the Generate QR Code option from the top right corner of the home page of the BHIM app.

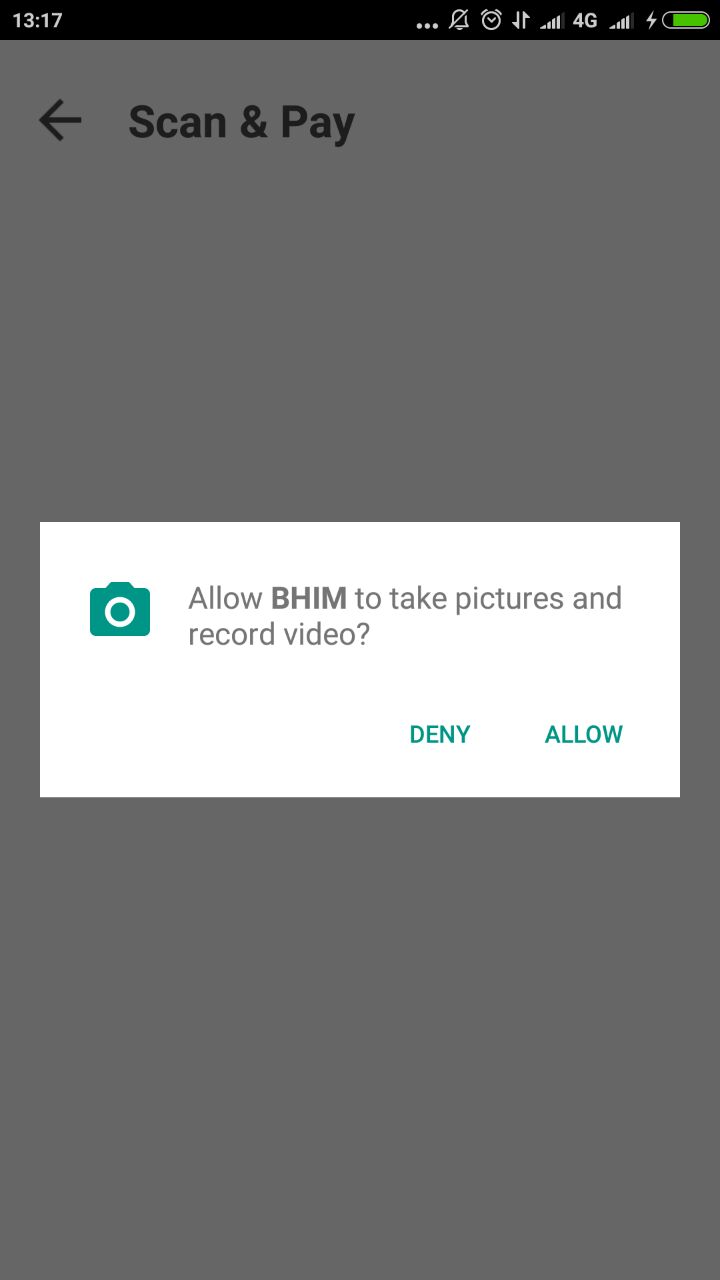

Scan & Pay

With this option, you just need to scan the QR code to make payments. Tapping on this option will automatically open the QR code scanner. Scan the QR code and make payments directly.

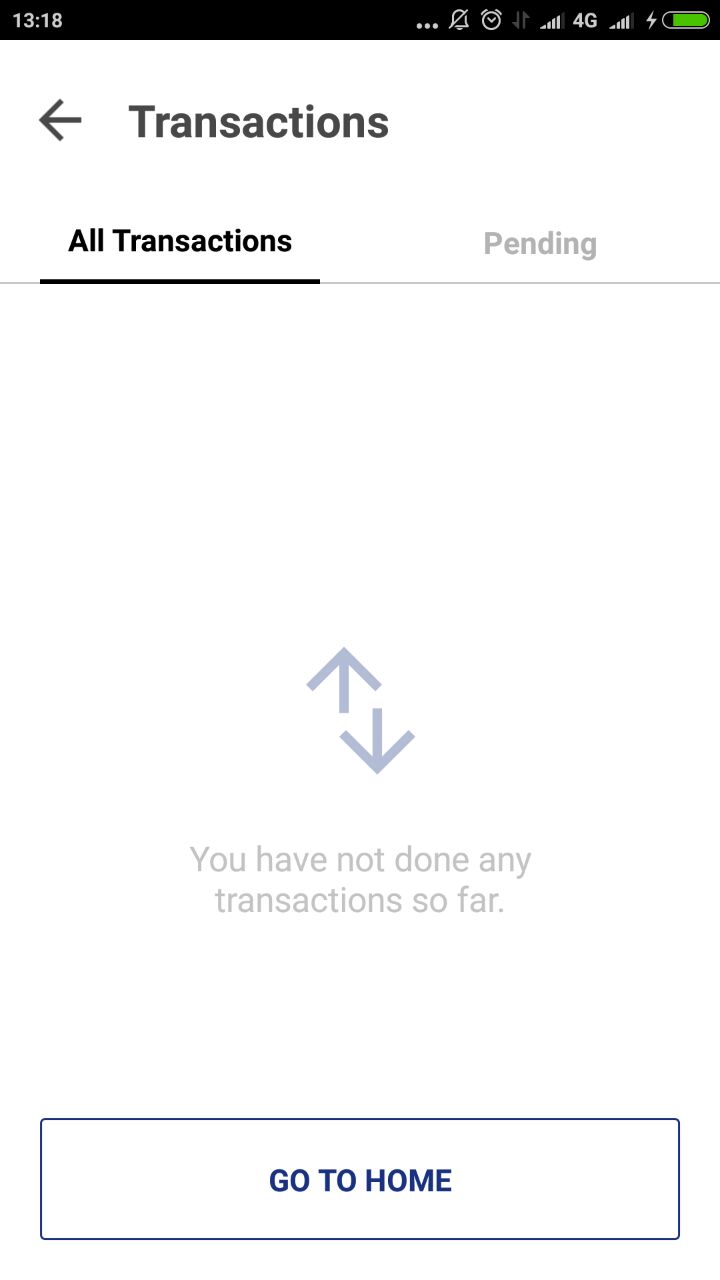

Transactions

Tap on Transactions to view your transaction history. Got a complaint against any declined transactions? You can report it by clicking on the Report Issue option.

Profile

In the Profile section, you can access your static QR code and payment addresses. You can also share your static QR code or download it from this section.

Bank Account

Tap on the Bank Account section to see the details of your bank account which is linked to the BHIM app. You can also reset or change your UPI PIN here. In addition, you can check your account balance (account linked to the app) at any time by clicking on Request Balance.

Now that you’re all wised-up about the BHIM app, maybe it’s time you give it a try and help Modi achieve his cashless economy dream! If you’ve already been using the BHIM app, leave a comment in the comments section below and let us know how you find the app!

Very informative article! Any idea when this will be available for iOS?

Hi Taheer, Thank you! The iOS app will be available soon. Cheers, Team BankBazaar

thanks for sharing this blog, I like this page and get more information related to bhim app, India’s best payment system at BHIM app.

Hi Sanvi,

We’re glad you found our article helpful. Keep reading!

Cheers,

Team BankBazaar