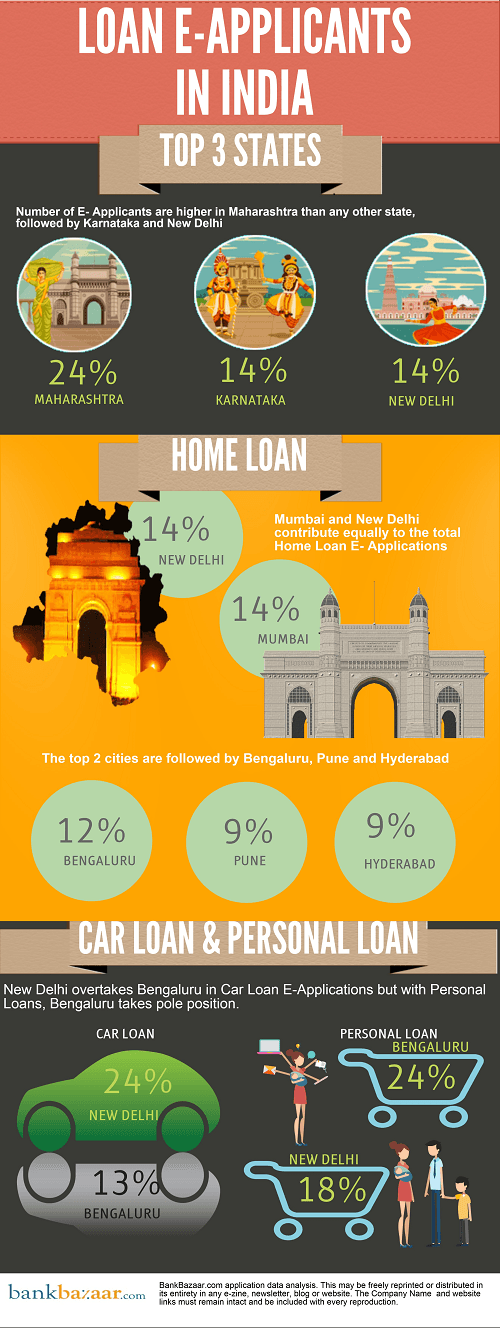

SBI’s New FlexiPay Home Loan Scheme

Nothing shouts ‘security’ more than owning an asset, such as a house or an apartment, and people usually put great efforts into saving up enough to be able to afford one. With such a great market going for them, financial institutions are going out of their way to make Home Loans accessible to the masses.