Looking for a tax-saver Mutual Fund that has given great returns in the long run? Then, you will like this fund.

If you want to invest for tax-saving purposes and are new to equity Mutual Funds, then DSP Tax Saver Fund will be the fund of your choice. You can claim deductions of up to Rs. 1.5 lakhs by investing in ELSS as per section 80C of the Income Tax Act, 1961. Tax-Saver Mutual Funds have the lowest lock-in period and provide higher returns on investments.

Fund Strategy

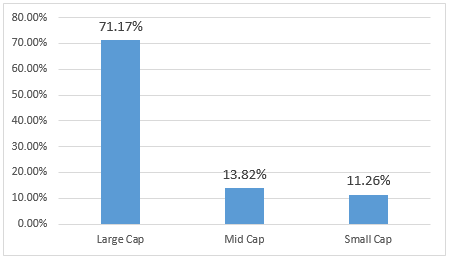

The fund does not have any market cap restrictions. It provides a well-diversified equity portfolio with a diligent mix of large cap, mid cap and small cap companies. The fund’s portfolio currently tilts towards large-caps.

Source: DSP Mutual Fund (Fact Sheet). Data as on Jan 31, 2019

Additional Reading: ICICI Prudential Long Term Equity Fund

Fund Management Team & Philosophy

Rohit Singhania manages this fund since July 2015 and he has an overall experience of 18 years.

Consistent Performance

The fund has continued to do well across different market conditions, as is evident from the rolling returns of the fund over the last few years. The consistent outperformance shows that the fund manager employs a stable strategy.

| 10 year (%) | 5 year (%) | 3 year (%) | |

| Minimum Return | 9.38 | -0.47 | -3.28 |

| Maximum Return | 19.62 | 24.61 | 32.05 |

| Average Return | 14.04 | 15.14 | 15.30 |

Source: DSP Mutual Fund (Fact Sheet). Data as on Jan 31, 2019

The fund has outperformed both the benchmark index and the category average. If you had invested Rs. 10,000 at launch (January 2007) in the fund, the value of your investment would be Rs. 44,180 in the fund vis-à-vis Rs. 30,377 in the benchmark.

The fund has beaten the benchmark by a strong margin over the long term.

SIP Performance

Assuming Rs. 2000 is invested every month, here are the returns.

| Period | Total Amount Invested | Market Value | SIP Returns (%) |

| Last 1 Year | 24,000 | 23,000 | -5.55 |

| Last 3 Years | 72,000 | 79,000 | 5.82 |

| Last 5 Years | 1,20,000 | 1,54,000 | 9.85 |

| Since Inception | 2,90,000 | 6,98,000 | 13.67 |

Date of inception: 18 January 2007. Returns of more than one year are on compounded annualized basis and as on 31 Jan 2019. Past performance may or may not be sustained in future

Additional Reading: How ELSS Funds Can Be Great For You | Save Tax & Grow Your Wealth

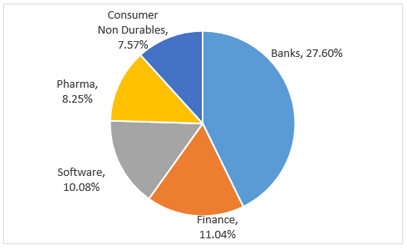

Portfolio and Sector Allocation

Banking sector is the top allocation in the fund with 27.6%. The top five sectors in the fund as on January 2019 are

Top 5 Holdings

| Company | % Assets |

| ICICI Bank | 8.49% |

| HDFC Bank | 8.15% |

| Infosys | 3.95% |

| Axis Bank | 3.82% |

| State Bank of India | 3.23% |

The closing AUM as on 31 Jan 2019 is Rs. 4675 Crore. Investments in the fund will be locked in for three years. Want to compare more funds? Click the button.