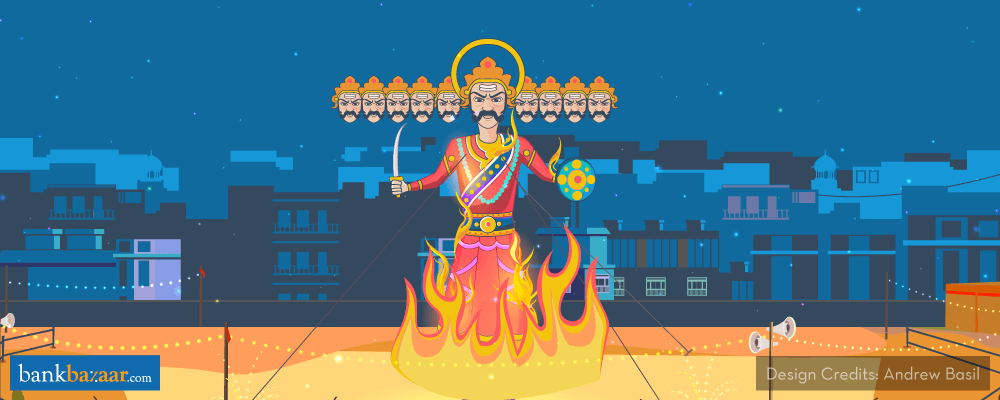

With Dussehra, Indians celebrate the victory of good over evil. It’s also a time for self-reflection: to identify our own vices and to work towards self-improvement. In our money management habits too, we may have some bad habits. Left unchecked over time, they can limit our ability to live prosperously.

In the spirit of Dussehra that marks the deca-headed Ravana, we’ve identified 10 bad habits to reflect upon and to correct.

Late Bill Payments

We have purchased so many subscriptions and services, and each comes with its own billing due date. Let’s admit it—it’s not physically possible to keep track of so many bills every month. Being late with the payment means having to pay penalties, which drain our hard-earned money. To avoid wasting money this way, automate your bill payments. You can programme your net banking, Debit Card, or Credit Card to pay your bills automatically every month. This saves you the hassle of tracking and paying your bills manually and having to pay penalties.

Late Loan Repayments

It is a folly to think there are no consequences to repaying your loans late. Your credit repayment history is diligently shared by lenders and recorded by credit bureaus such as CIBIL. Whatever be the reasons for your late repayments—whether they are genuine, or you’re simply being careless—they will reflect on your credit history. This will reduce your Credit Score and make it difficult for you to take new loans and Credit Cards. Always repay your debts on time. If you find yourself in a genuine difficulty, work with your lender to make the repayment terms more amenable.

Making Minimum Credit Card Payments

Credit Cards offer the minimum payment option which allows you to escape late payment penalties. This option should be exercised only when you absolutely need to. Credit Card debt is one of the most expensive forms of debt you’ll ever take. The lesser you take this debt, the better. Always repay your credit card balance in full and on time every month.

Splurging First, Saving Later

It’s a folly to try and save what’s left at the end of the month. This is an impediment to saving and investing. You must turn your methods on their head: save first, and then spend from what’s left. This would help you plan savings and investments better, and help reduce wasteful expenditure.

Not Checking Family’s Life Insurance Needs

Many Indians have the habit of purchasing Life Insurance at the end of the financial year, simply to save taxes. Once taxes have been saved, the policy may be discarded. Not enough pause to think how much money their families would need if they were to suddenly pass away. The ideal Insurance coverage should protect your family for the long-term and be able to cover such needs as replacing your income, providing for the surviving spouse, funding the children’s needs such as education and healthcare, and so on. If you have dependents, take time to carefully understand your life cover needs.

Not Planning Taxes

Tax payments should be actively planned and not be left for the final days of the financial year when you are compelled to make poorly-thought investment choices. In fact, active tax planning is one the ways you can create wealth more efficiently. By understanding your tax liabilities and investing in tax-efficient instruments such as PPF and equity Mutual Funds, you can lower your tax incidence and get better returns from your investments.

Not Buying Health Insurance

A medical emergency could befall anyone at any point. Hospitalisation costs keep going up over time. The treatment for a critical illness such as cancer could cost your family lakhs of rupees. To protect your wealth from being depleted and your life plans derailed by a sudden hospitalisation, buy a Health Insurance—especially when you’re young. Make sure all members of your family have adequate cover.

Not Having A Budget

A budget helps you identify key areas of money management—priority expenses such as rent and utilities, discretionary spending such as eating out, allocations for savings and investments such as your SIPs, and avoidable expenses such as subscribing to one too many video streaming services. A money management plan and a periodic look at your bank and card statements would help you understand where your money is going, and whether you can find some avenues to increase savings.

Not Saving For Retirement

You are your own debtor. Imagine your 60-year-old self who is retired and without a regular source of income. You owe it to your future self to save and invest today so that you’re comfortable in old age. Not enough young Indians pay attention to retirement planning, leaving this matter for very late in their lives. This can be avoided. Simply start investing through a SIP with a few thousand rupees, and create a multi-crore rupee corpus for your retirement.

Not Having An Emergency Fund

An emergency could come unannounced at any point in your life. It could be a job loss, damage to property, loss of life and limb. Your best response to life’s vagaries is to be prepared. Put away at least three to six months of your current monthly income in a safe and liquid instrument such as a fixed deposit. It would keep you going through your emergency.

BankBazaar is a leading online marketplace in India that helps consumers compare and apply for Credit Cards, Personal Loans, Home Loans, Car Loans and insurance.