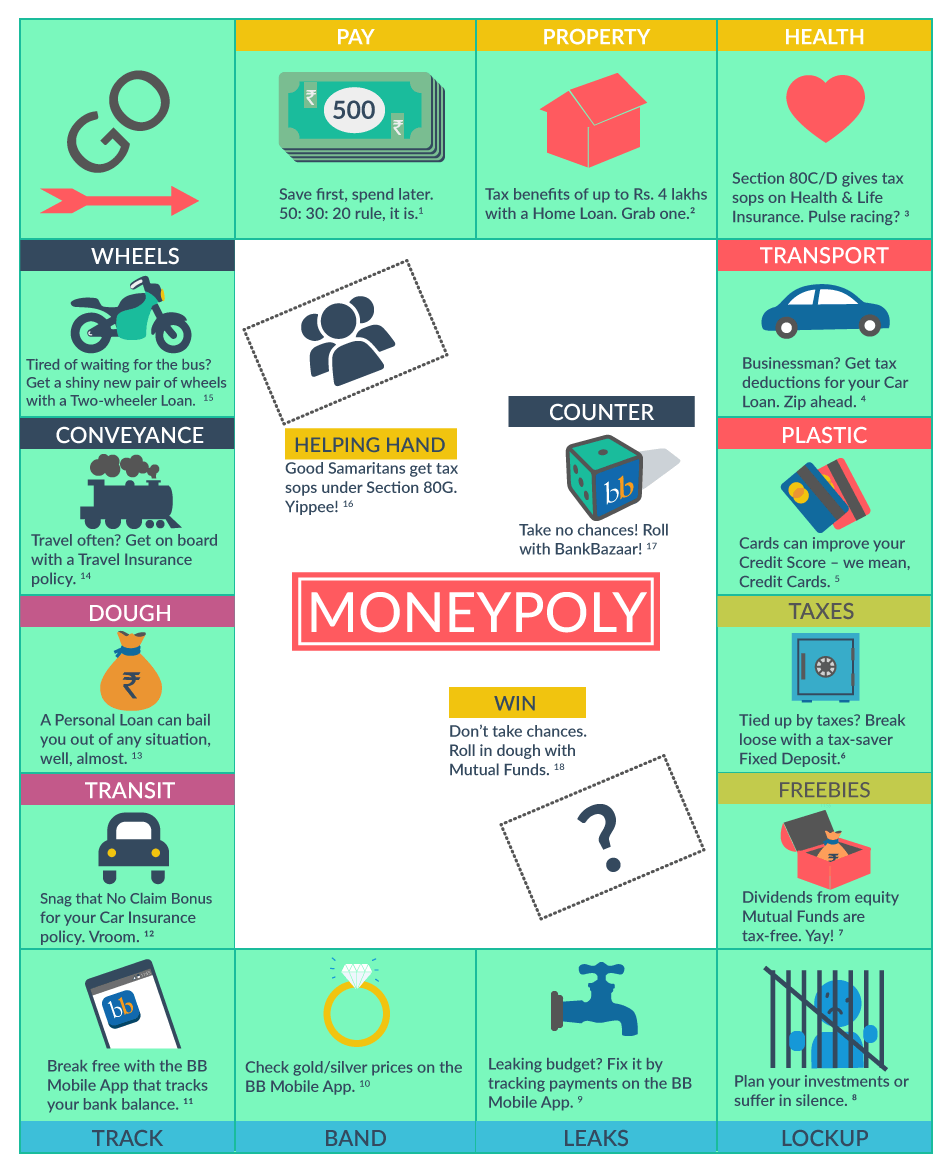

- BankBazaar has the best products in the finance marketplace and accurate information that will help you make the right choices. With us, you can rest assured.

- The 50:30:20 rule states that 50% of your pay should go towards your fixed expenses, 30% should be used for discretionary spending and 20% is saved. Go in reverse to ensure you save every month.

- If you opt for a Home Loan as a co-borrower, then the maximum total tax deduction for interest paid on the Home Loan can go as high as Rs. 4 lakhs under section 80C of the Income Tax Act.

- Health and Life Insurance premiums paid for self, spouse, dependent children or parents, qualifies for a tax deduction under section 80D/80C of the Income Tax Act. Maximum benefits? Over Rs. 2 lakhs.

- If you are self-employed, you can claim the interest paid on your Car Loan as a tax deduction.

- Did you know, a Credit Card can improve your Credit Score in no time? Just pay your bills on time and keep those balances low to see your score zoom ahead. Simple!

- Under section 80C of the Income Tax Act, investments of up to Rs. 1.5 lakh in a tax-saver Fixed Deposit can be claimed as tax deduction. Yay!

- As per Indian tax laws, any dividend received on units of equity Mutual Funds is tax-free, irrespective of whether you are a resident or a non-resident Indian. Don’t wait, invest now!

- Want to reach your financial goals quickly? Plan your investments in advance to avoid any financial perils.

- The BankBazaar Mobile App allows you to view a personalised summary of your combined bank balances across multiple savings accounts. Awesome, isn’t it?

- Thinking of investing in gold/silver this summer? Check gold/silver rates for free on the BankBazaar Mobile App.

- Use the BankBazaar Mobile App to view a real-time snapshot of your transaction history across multiple bank accounts.

- No Claim Bonus (NCB) is a benefit given to those who don’t make claims on their Car Insurance policy in the preceding year. Grab discounts on this year’s insurance premium!

- A Personal Loan can rescue you in no time in situations like a medical emergency. Use it sensibly to reap the right benefits.

- Whether you are traveling for business or pleasure, a Travel Insurance policy can save you from losses due to cancelled flights, lost baggage and many other unforeseen events.

- Tired of waiting for the bus? Get a shiny new pair of wheels with a Two-wheeler Loan.

- You contributions made to certain relief funds and charitable institutions can be claimed as tax deduction under Section 80G of the Income Tax Act. Being a benefactor pays and how.

- BankBazaar helps you access the right financial products and provides you with accurate information that will help you make the right choices when it comes to your finances. We’ve got your back!

- Tired of receiving meagre returns on your bank deposits? Investing in Mutual Funds could help you generate higher returns and beat inflation. A win-win!

The information provided here are for illustrative purposes only. Please contact your financial adviser before making any financial decision.

Copyright reserved © 2026 A & A Dukaan Financial Services Pvt. Ltd. All rights reserved.