Didn’t receive your ITR refund yet? Don’t fret! Here’s a step-by-step guide to help you track the status of your refund online. Read on.

Once the tiresome process of filing of ITR is done, many taxpayers look forward to receiving the income tax refund which might be due. One can expect a tax refund when more tax is paid by a taxpayer (through TDS or advance tax) than his/her actual tax liability.

The refund is credited to your bank account once the tax return is processed and the claim is accepted by the Income Tax department. Here’s your step-by-step guide to tracking the status of your refund online.

Checking ITR refund status via Income Tax e-filing website

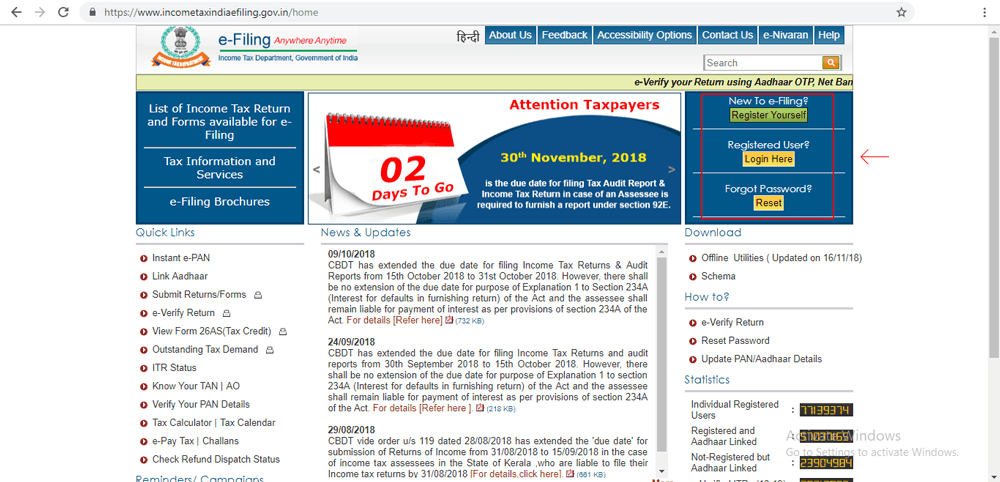

Step 1: Visit https://www.incometaxindiaefiling.gov.in

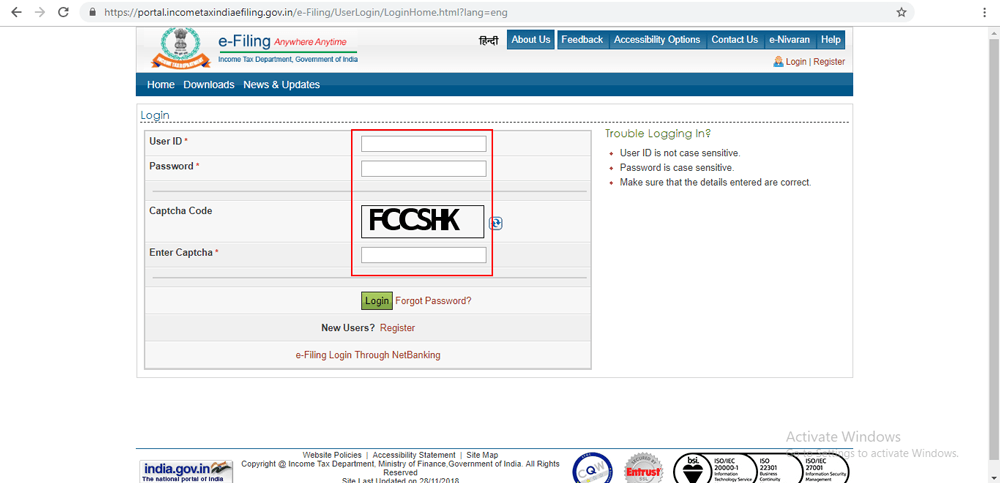

Step 2: Now, enter your user ID, password, and Captcha code.

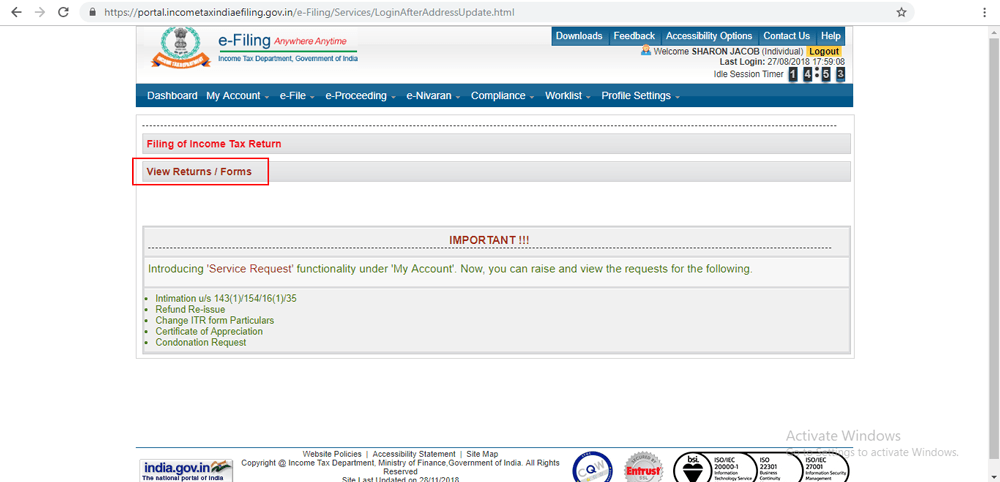

Step 3: Next, click ‘View Return And Forms’ on the display page.

Step 4: From the drop-down menu, select ‘Income Tax Returns’ and then the relevant assessment year.

Step 5: Once you click on submit, your refund status will be displayed on your screen.

Additional Reading: How To Correct Mistakes In Your Income Tax Return (ITR)

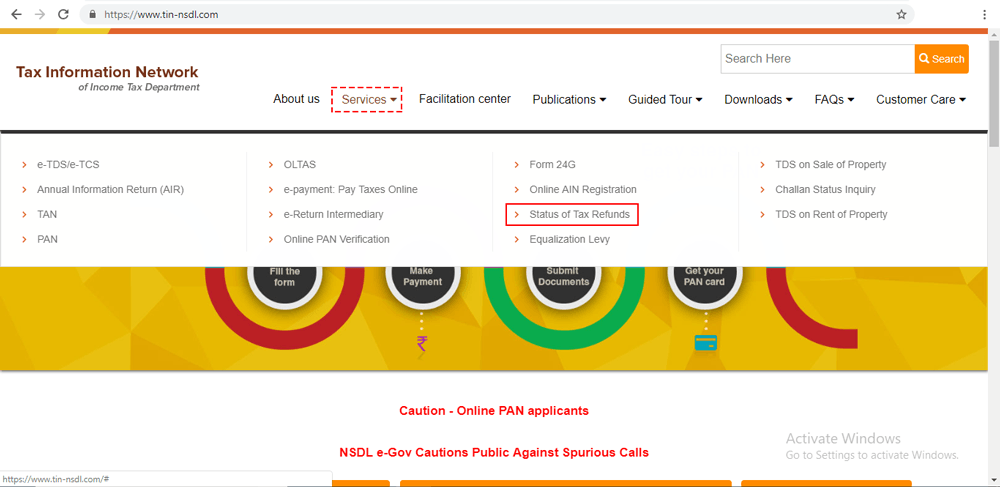

Checking ITR refund status via TIN NSDL website

You can also check the status through TIN (Tax Information Network) NSDL website. It is a repository of nationwide tax-related information that has been established by NSDL on behalf of the Income Tax department. You can follow the below steps:

Step 1: Visit https://www.tin-nsdl.com/. Go to the ‘Services’ section and select ‘Status Tax Refunds’. Now, on the left-hand side, click ‘Status of Income Tax Refunds’.

Step 2: Enter your details like your PAN, applicable assessment year and the Captcha code.

Step 3: Click the submit button. Your refund status will be shown on the screen.

There you go! In case you are looking for a loan or Credit Card, we have one-day approval offers exclusively for you. Do check them out!