Steps to file your income tax online using your bank account. It’s simple, easy and convenient.

The Internet has made things easy and lazy, but its true potential was unleashed when the Government decided to adopt it for official work (we like to think so). It is such a relief to be able to file tax returns as well as submit your ITR-V (that’s your Income Tax Return Verification Form) online via your bank account – it has made the process a whole lot simpler.

E-filing of tax returns is one of the options for direct taxpayers in India. So how do you go about it?

Details required before logging onto the site

The first thing you need is a net banking facility and the provision to make e-payments. If you are a first-time user, i.e. if you have never e-filed your return before, you will need to create an account on the Income Tax Department’s website – www.incometaxindiaefiling.gov.in. Keep your PAN Card nearby as you will need it to create a username and password.

The website will extract some of your details from your PAN Card, while you must enter other personal details yourself. Be careful when you mention your email address. This is important as all communication pertaining to e-filing will happen via the email address you provide. Once you have registered, an email will be sent to your registered mail confirming the activation of your account. With this done, you are ready to file your income return online. You must now choose the appropriate ITR form.

Steps to file your Income Tax Return (ITR) online using net banking:

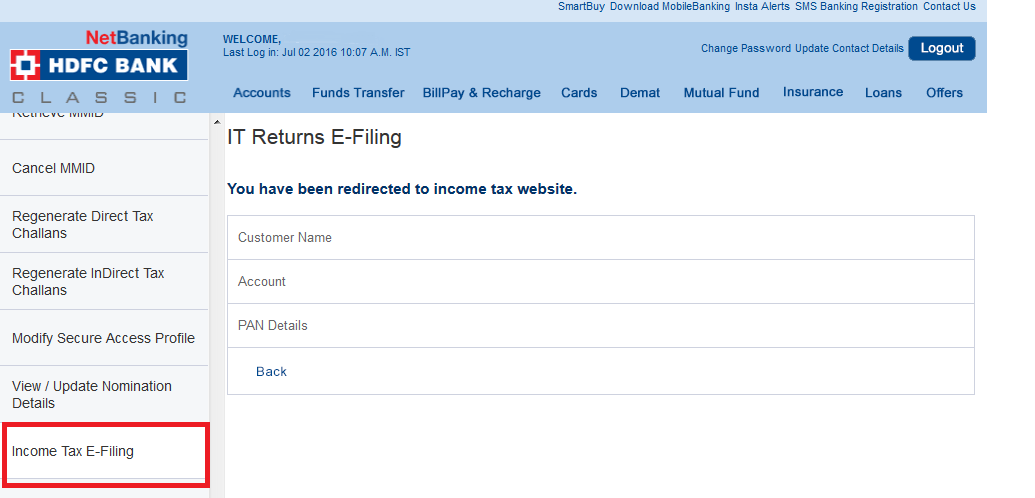

- Sign into your net banking account and navigate to the income tax e-filing tab. If you are unable to locate it, check whether your bank offers this facility. Clicking on the e-filing tab will take you to the Income Tax Department’s website. (The same site on which you created an account).

- Create your profile. Get your login details.

- Thanks to your PAN number, most of your income details will already be available.

- Get your Form 26AS which will have the details of taxes that you have already paid. This includes the TDS deducted by your employer.

- Now click on the option ‘Submit Returns/Forms’.

- Next, select the relevant Income Tax Return Form and the assessment year. (You also have the option to download this form, fill it up and upload the filled form to the site.)

- Fill in your details carefully and click on submit. You can refer to your Form 16 and Form 26AS for the details. You need to furnish your bank details to receive a refund, if eligible.

- It’s not over. After you click on ‘submit’ an acknowledgement is displayed. This is your ITR-V form.

Additional Reading: What You Should Know About The New Income Tax Return Forms

How to submit your ITR-V

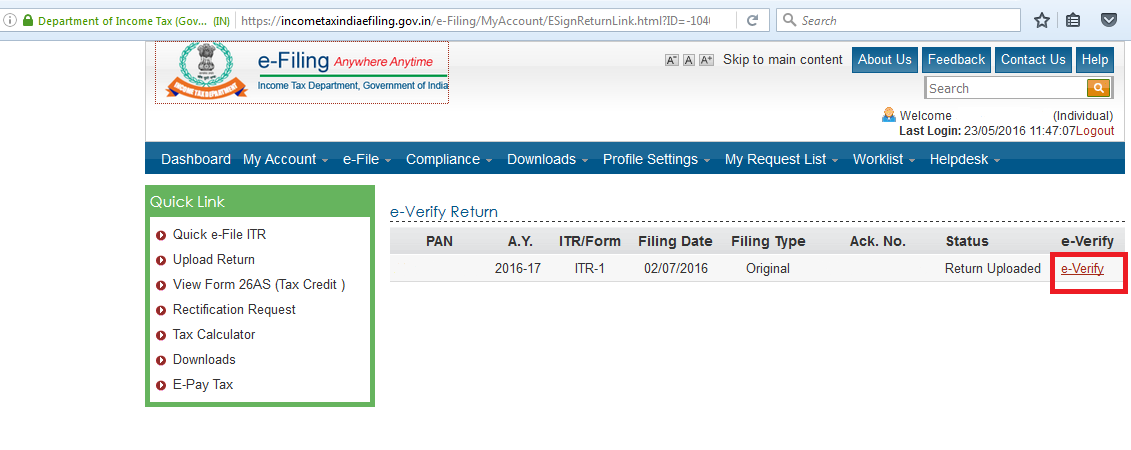

- In the menu options, click on ‘Dashboard’. You will see an option which reads View ‘Returns/Forms’.

- Clicking this option will show a list of all your returns and their status. Under the status tab, you will see – ‘Returns uploaded, pending for ITR-V/E-Verification’.

- Click on e-verify. It’s as simple as that.

- Clicking on e-verify will open a pop-up window. Click on continue to get an electronic verification code (EVC) which is linked to your PAN. This is your income tax return verified. Bingo!

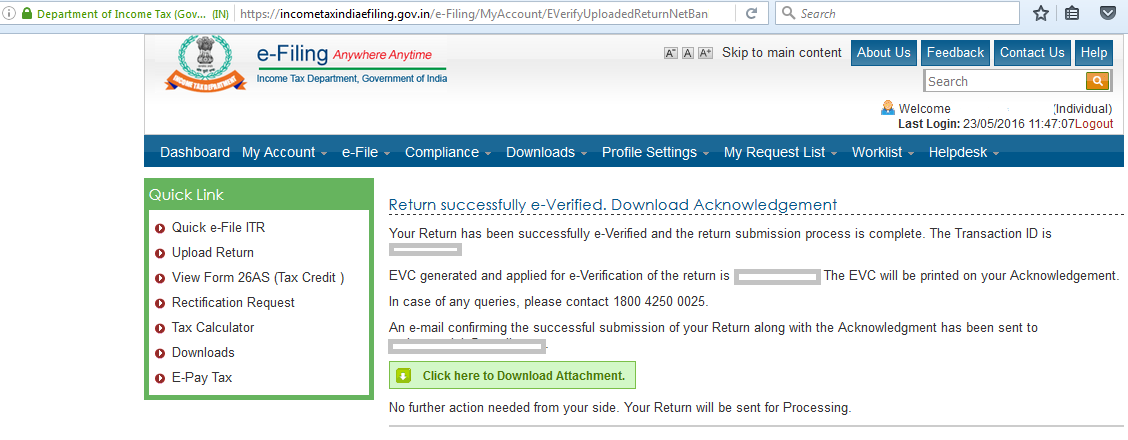

- You will also get a confirmation message on your screen stating the transaction ID and EVC code. You can download this for your reference.

You have successfully filed your return! Put your feet up and relax.

Benefits of e-filing over paper filing

Filing taxes over the internet is definitely faster and a more efficient process. Instead of relying on the reliable Indian Postal Service to do the to and fro of documents for you, you can upload and download your ITR form in minutes or even better, just fill in your details online. Also, a lot of work is automated. You upload your tax documents and they are processed right away. In another few minutes, you receive an acknowledgement for your transaction. The best part being you can file your taxes safely.

Additional Reading: What Happens If You Don’t File Your Income Tax Return?

Deadlines for filing returns

The last date to file your return is 31st July 2018 for individuals. For those who need to get their account books audited under the Income Tax Act, mainly businesses, the last day is 30th September 2018.

The #TaxFiling deadline may be some weeks away, but it’s never too late to gather your bank statements, proofs of investments and Form-16 in preparation for filing your returns!

— Adhil Shetty (@adhilshetty) June 27, 2018

Income Tax Slabs for FY 2017-18 (AY 2018-19)

| Income Tax Slab | Tax Rate |

|---|---|

| Income up to Rs. 2,50,000* | No Tax |

| Income from Rs. 2,50,000 – Rs. 5,00,000 | 5% |

| Income from Rs. 5,00,000 – 10,00,000 | 20% |

| Income more than Rs. 10,00,000 | 30% |

| Surcharge

10% of income tax, where total income is between Rs. 50 lakhs and Rs.1 crore. 15% of income tax, where total income exceeds Rs. 1 crore. |

|

| Cess: 3% on total of income tax + surcharge. | |

| * Income up to Rs. 2,50,000 is exempt from tax if you are over 60 years old. | |

So, go ahead and file your IT return. And don’t forget to get your ITR-V done.