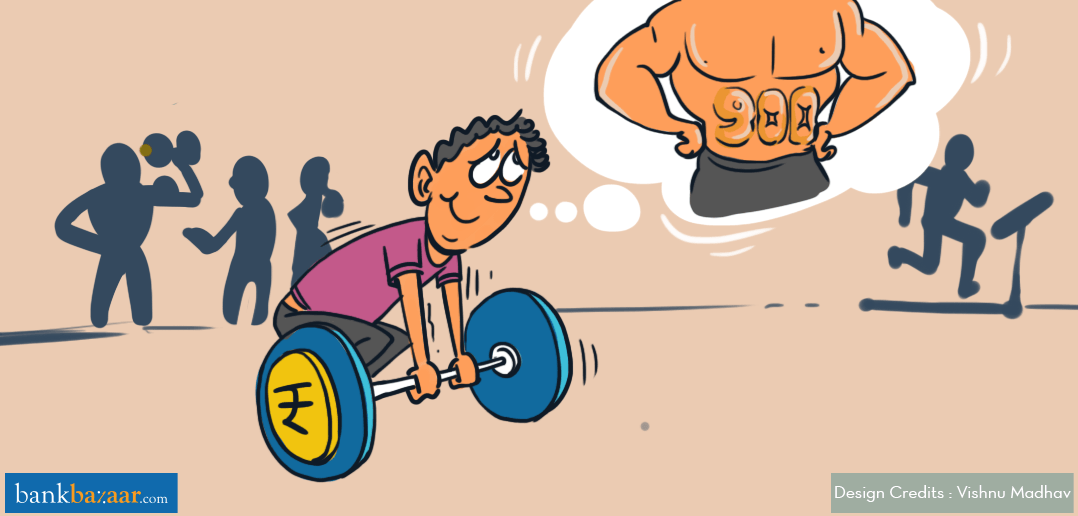

Is it even possible to hit a Credit Score of 900? Well, we’ve compiled a list of pointers you could follow to check it out for yourself!

What does it take to get the perfect Credit Score? Is it even possible? If you’re someone who wishes to crank up your credit game, you should aim to get your Credit Score up to its best possible state. For starters, you can see where you stand now – check your Credit Score! It’s free!

Hang on! What’s the use of having a good Credit Score?

The better your Credit Score, the better your chances of getting approvals from lenders. Also, banks provide better terms and offers to customers whose Credit Score reflects a solid assurance. Now, you can only imagine how cool it would be to prance around with the perfect Credit Score – you’ll sail past applications like a boss, whether it’s a Personal Loan, Car Loan, Credit Card or any other product.

Gotcha! So how do I get there?

While there’s nothing quite like a perfect Credit Score, a score anywhere near the top range is still great. So it’s not a bad idea to aim for the sky! That said, if you’re determined to master your credit game, you may want to go through the following list of pointers we’ve made just for you!

- Get your credit report

Before you plan Mission 900, you need to first see where you stand at the moment. Thanks to BankBazaar.com, you can get your FREE Experian Credit Score is less than 3 minutes! What’s more? You’ll also get a thorough report that’s sure to give you great insights into what has impacted your score and in what way. At this stage, you’ll have done a good reality check and formulated your starting point.

- Maintain various credit accounts

Your Credit Score requires you to have active credit accounts. It’s best you jazz up your credit portfolio with a good variety of accounts ranging from Credit Cards, Car Loans, Personal Loans and more.

- Oh, and maintain them well while you’re at it

Now, it’s not enough to just get a few loans on-board, you need to ensure that each bill or EMI is paid on time and as per the rules in connection with the related credit account. As you may already know, any deferred payment can really hurt your Credit Score; you don’t want that, especially when you’re on Mission 900, do you?

Additional Reading: How Late Payments Can Leave You Credit-Sore!

- Be realistic with your credit decisions

This point applies to general financial well-being as it does to your Credit Score. Don’t bite off more than you can chew (also applies to your diet, ha!)! Let’s better illustrate this with an example.

Let’s say you earn a monthly salary of Rs, 30,000. Now, let’s assume your monthly living expenses cost up to Rs. 15,000. What’s your remainder? Rs. 15,000. Now, it would make little sense to go in for a loan under an EMI plan where Rs. 13,000 gets deducted every month – don’t you agree? This is what we mean when we say ‘be realistic’ with your credit transactions.

Similarly, don’t go swiping your Credit Card like there’s no tomorrow. You may land up with a bill that you can’t deal with. As we mentioned earlier, every deferred payment will slow your ascent towards the 900 summit.

- Expect your journey to be a gradual one

It’s a little unrealistic to expect your Credit Score to shoot from a 700 to 900 overnight, so don’t be disheartened if you don’t see stellar growth in your score in a matter of few days. Your Credit Score will surely grow as long as you’re responsible, so the best thing to do is regularly check your Credit Score and enjoy every increase in that number you see.

- Keep a watch on your credit reports

Make time every now and then to keep a tab on your credit report. This will help you identify mistakes early and take appropriate measures to get them rectified on your report. Besides, it makes sense to track your progress as you’ll get great insights into what’s helping your score and what’s not, so that can aid you in prioritising your credit accounts.

- Do not max out your credit limits

Another crucial tip you must keep in mind is to stay well below your credit limit; turns out this plays a big role in impacting your Credit Score. Experts advise keeping your balance to around 30% of your credit limit or even below that!

We understand that it’s very tempting to utilise your credit limit when you need to make a big purchase. In such cases, you can ensure you clear your debt in the fastest way, without allowing it to gather more interest than a celebrity scandal.

- Set up bill reminders if it helps

If you’re the kind who has the memory of a goldfish, you could program and set reminders to save yourself from missing due dates and being subject to late fees and other penalties.

So, folks, just follow these basic but important practices, and you may stand a chance of hitting the big number. Don’t worry if you don’t though, because anywhere in the top bracket is still great.

Today, Credit Scores are more relevant than ever. Not only are they linked to interest rates on credit but also determine whether you’re worth lending to. With a good Credit Score on your side, you’re sure to save big because you’ll get favourable interest rates, and because of your responsible credit and payment practices, you won’t have to spend on any penalties.

The other takeaway from this whole mission is that you’ll learn so much through the journey, you’ll know your credit report like the back of your hand.

By the way, get your FREE Experian credit report is less than three minutes. It’s a snap!

Great article!

Hi Chunchu Kumar,

Glad you liked it. Have a nice day!

Cheers,

Team BankBazaar