If you’re wondering how to link your Aadhaar Card to file your IT return, then, here is a step-by-step guide to help you out.

In line with the government’s vision of a digital India, many services have been going online. Whether it’s applying for a loan, or buying an investment product, or simply a plate of momos – everything can be done online. And to ensure that these transactions are governed, and that every citizen can be identified, the Government of India introduced the Aadhaar Card.

Additional Reading: The Aadhaar Ecosystem And IT

An Aadhaar Card has a 12-digit unique verification number that is very much like a social security number that you may have heard of being used in western countries. This card is issued to citizens of our country and has proved to be a very valuable card to have. Your Aadhaar Card serves as a valid ID proof when availing various services/benefits, including investing in Mutual Funds.

Additional Reading: 10 Benefits Of Investing In Mutual Funds

As of now, the deadline to link Aadhaar to services has been extended indefinitely, except if you want to avail of sate-run welfare schemes and Government subsidies. Nevertheless, some of the services your Aadhaar can be linked to are your bank account, PAN Card, and LPG connection. It is also useful when applying for a driver’s license, and to file your Income Tax Return.

In this article, we will take you through the process of linking your Aadhaar Card to file your IT return.

Additional Reading: Linking Aadhar With PAN Card Compulsory To File Income Tax Returns, Says Supreme Court

From 1st July, 2017, the government has made it mandatory to quote your Aadhaar number while applying for a PAN Card or while filing your income tax return. And if this hasn’t been linked at the earliest, you may fall under the scrutiny of the Income Tax department for supressing income!

Additional Reading: FAQs About E-Filing Your Income Tax Returns

The process to link your Aadhaar to file your IT return is rather simple. All you need is to log into the e-filing website of the Income Tax Department and follow the instructions on the screen.

Step-by-step Guide To Link Aadhaar To PAN

Step 1

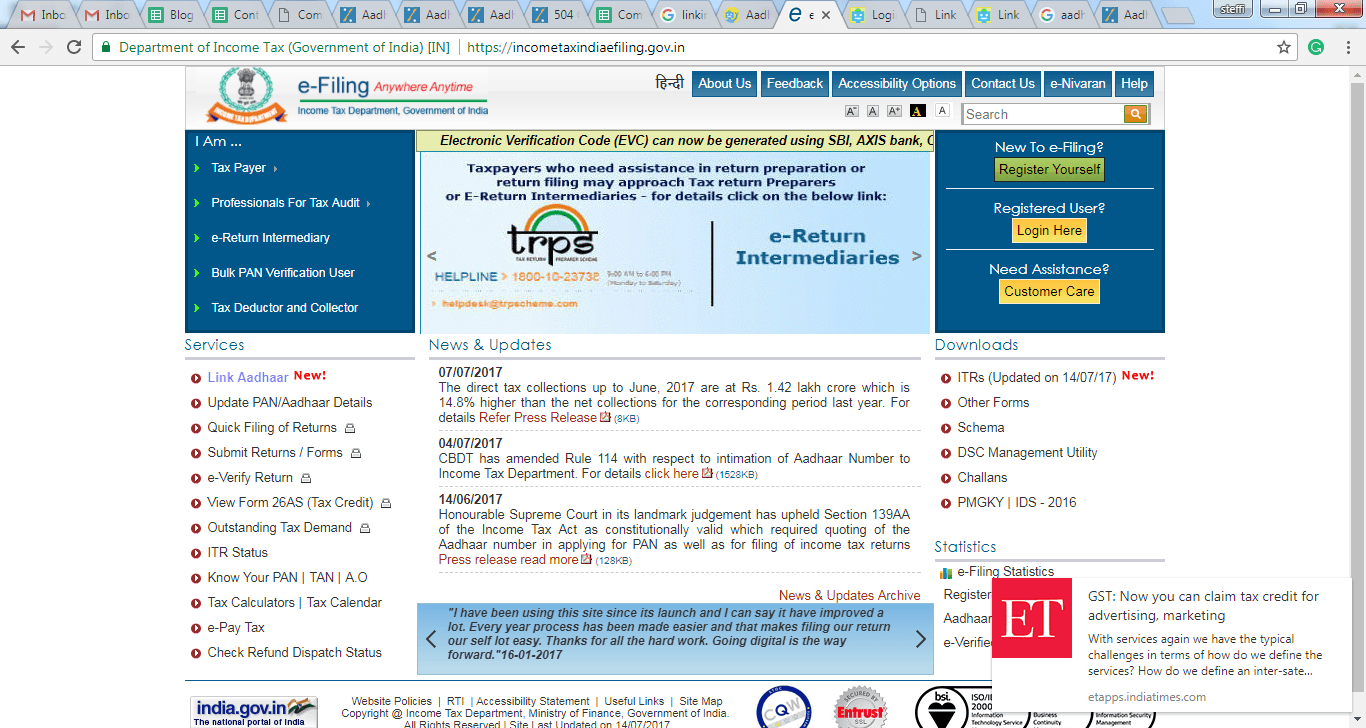

Log into the Income Tax e-filing website (https://incometaxindiaefiling.gov.in/). You will arrive at this page.

To your left you will see an icon that reads “Link Aadhaar”. Simply click on it.

Step 2

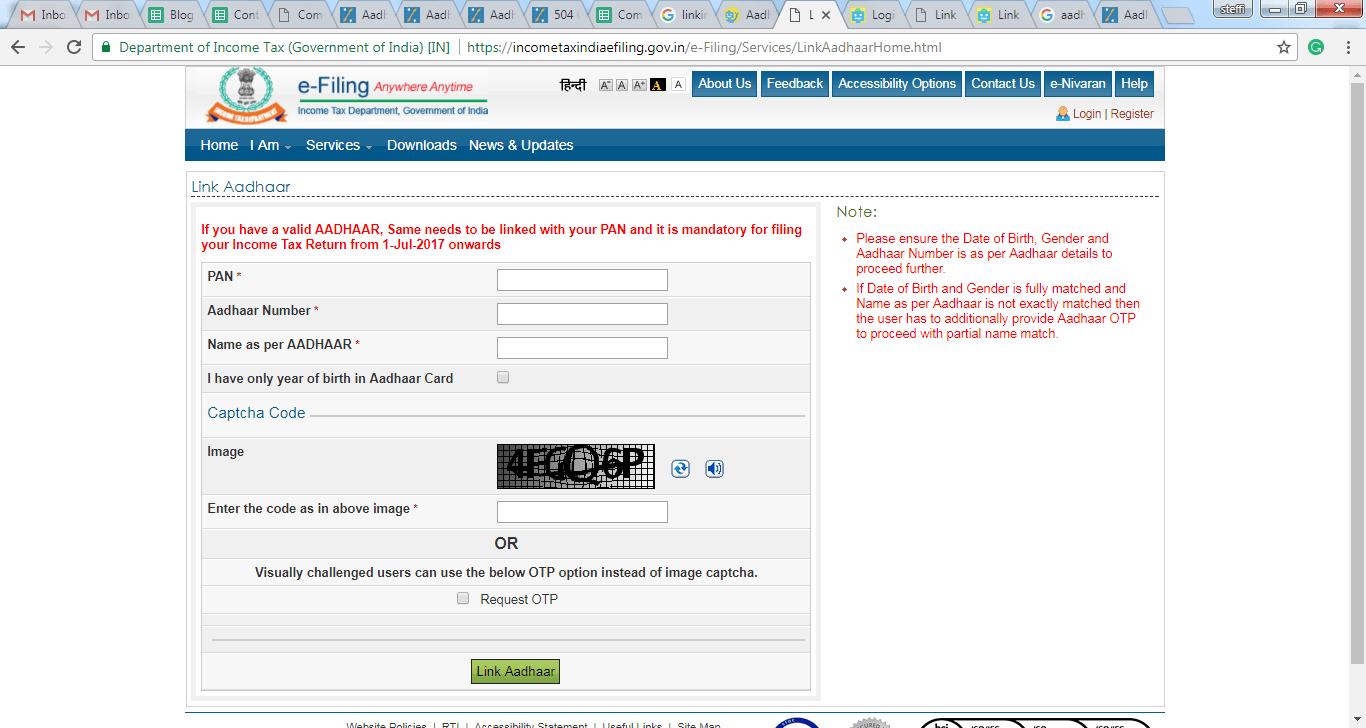

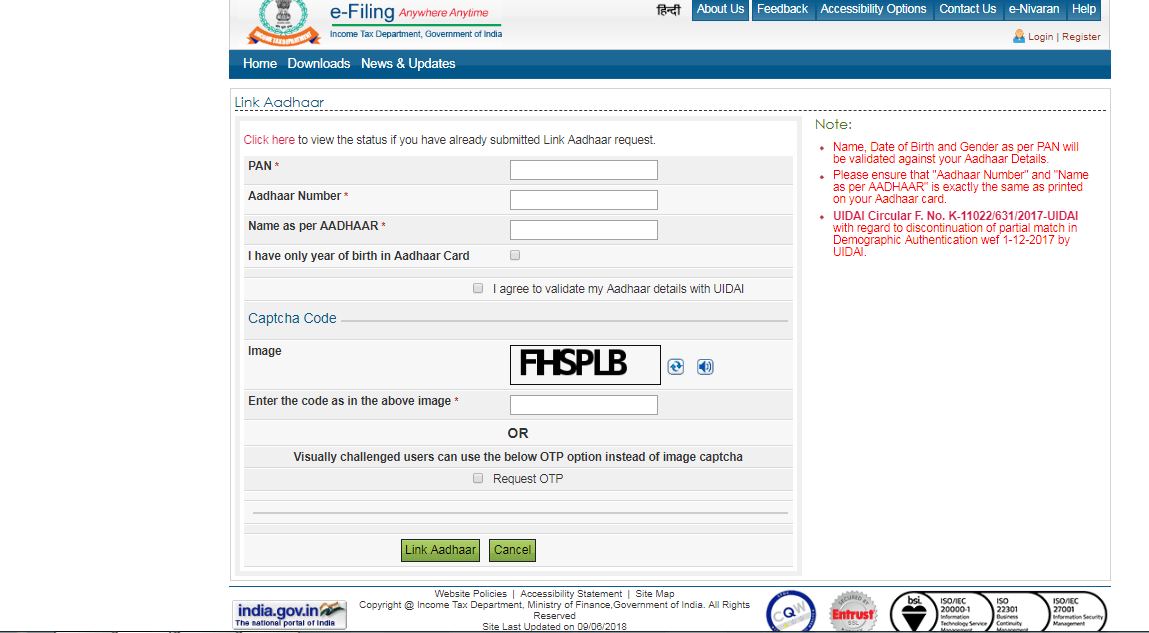

Once you click on it, you will be redirected to a new screen.

Now, start filling in your details, that is, your PAN, Aadhaar number and Name as it appears on your Aadhaar card. Fill in the Captcha code and then click on the”Link Aadhaar” button at the bottom of the page and you’re set!

Wasn’t this easy as pie?

Well, if you don’t have an Aadhaar Card yet, you can apply for one right now.

Additional Reading: How To Correct Your Aadhaar Card Details

How to Check If Aadhaar-PAN Have Been Linked

If you have already linked your Aadhaar and PAN then you might want to check whether it has been done. The process to do the same is quite simple:

Step 1

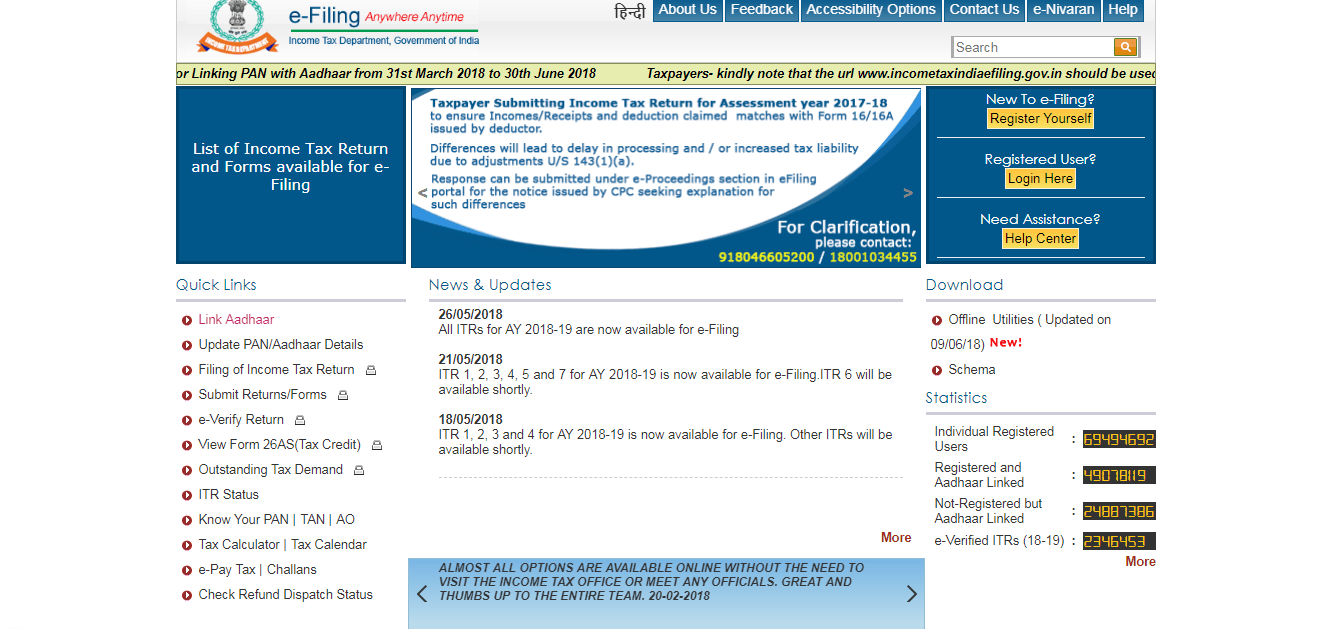

Log into the Income Tax e-filing website (https://incometaxindiaefiling.gov.in/). You will arrive at this page.

Step 2

Click ‘Link Aadhaar’ under the ‘Quick Links’ tab on the left hand side of the screen. You will get the following page. At the top of the form you will see a line ‘Click here to view…’

Step 3

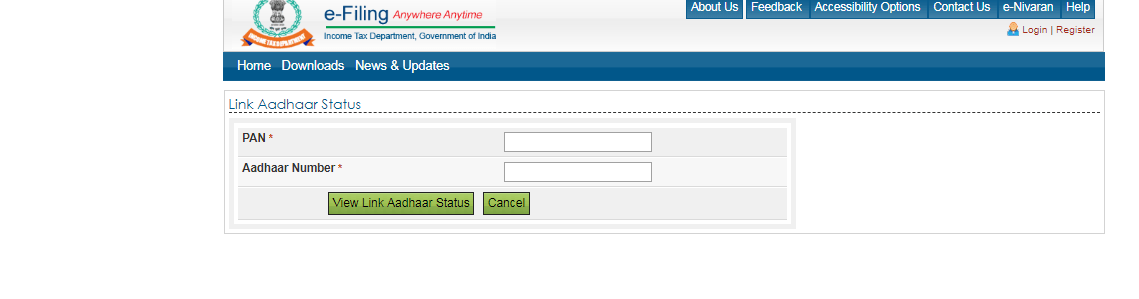

You will get to the following page. Here enter your Aadhaar number and PAN and click ‘View Link Aadhaar Status’

Step 4

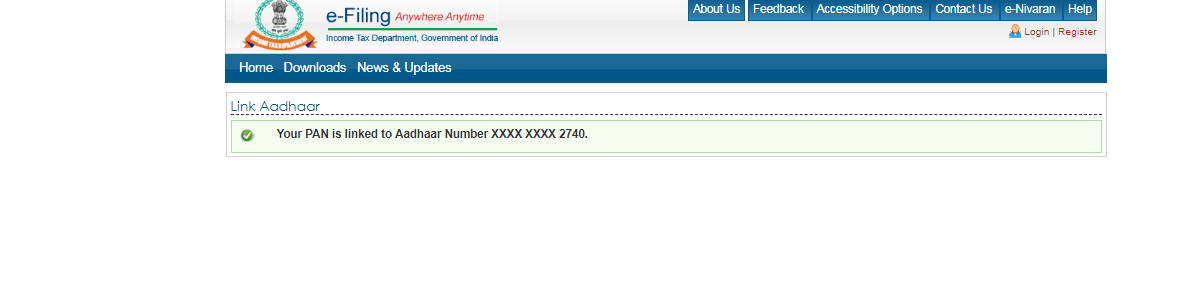

You will get the status of your Aadhaar-PAN linking on the next page.

You can also check your Aadhaar-PAN linking via SMS. It’s as easy as sending an SMS to 567678 or 56161 in the following format

UIDPAN <12 digit Aadhaar number> <10 digit Permanent Account Number>

If Aadhaar and PAN are linked, you’ll get a message conforming the same on your phone.

Why is it important to link PAN with Aadhaar

People are being encouraged to link their PAN and Aadhaar for the following reasons:

Helps prevent tax evasion

Linking PAN with Aadhaar helps government curb corruption and cases of tax evasion. Since Aadhaar is linked to everyone’s bank accounts, it helps the government keep a tab on all taxable transactions. Linking Aadhaar with PAN allows the I-T department to verify whether all taxable transactions by an individual or entity were duly accounted for when filing returns.

In case of tax evasion, the government can track the bank account(s) of the evader and seize them.

Clampdown on multiple PAN cards

A common way to evade tax is to have multiple PANs. Individuals can distribute their transactions on multiple PANs thus reducing their taxable income. Since only a single PAN can be linked to a single Aadhaar it greatly reduces the possibility of a person using multiple PAN cards.

With Aadhaar-PAN linking, the government will be able to track the account details of the PAN card holder and know if a person has multiple PAN cards.

Up to speed on linking your Aadhaar and PAN? How about putting your Aadhaar to good use and investing in Mutual Funds? It’s so easy, you can do it on your mobile phone in just a few minutes.