The general elections are here and every other person is asking you to sell your equity investments? Here’s why you shouldn’t.

Of course, the outcome of the General Elections 2019 will affect all your equity investments, including your Mutual Funds, because they are market linked. However, that doesn’t mean you need to sell your stocks or stop your Systematic Investment Plans (SIP). In fact, this is the time you should hold on to them to get great returns in the long run, especially if you started investing only a couple of years back. Here’s the reason.

The History

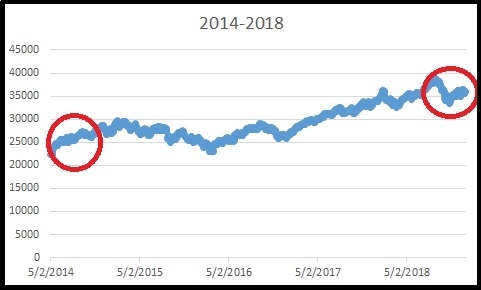

Usually, the equity markets become volatile 6 months before the elections and start to rally once the government is set. The below Sensex charts will give you an idea.

*Source: BankBazaar Research

Additional Reading: Best Equity Mutual Funds To Buy In 2019

The elections were in April 2009 and by May, the markets had started rallying and continued until June-July 2013. That’s when they were volatile as the next election was in 2014.

*Source: BankBazaar Research

Similarly, the elections were in April 2014 and by May, the markets had started rallying. They went up until November 2018 when they turned volatile.

Not only that, if you take the time between Dec 2008 and Nov 2009, the equity markets gave a return of 55%. During the 2004 elections, this return was 17%.

Data shows that the equity markets moved up during elections in 1998, 2009 and 2014. In 2009, the market zoomed up after the election results were announced. So, the markets actually give you returns during the elections. Want good profits? It’s better not to sell your stocks during the elections.

What about Mutual Funds?

The Funds Funda

People are urging you to sell your funds? Don’t! Sticking to your investment will provide you with great returns many years later. This example will tell you why.

Let us suppose you invested in Aditya Birla Frontline Equity Fund in 2002. Since the elections were coming up in 2004, you decided to sell your funds in November 2003 well before the elections. The NAV as on Feb 3, 2002 was Rs. 9.3 and Rs. 15.79 on Nov 8, 2003 when you sold it. You got a return of 69.2%. You are really happy! What if you had held the investment till April 2008? The NAV of the fund was Rs. 61.6 and your returns would have been an astounding 560%!

Source: The NAVs are from the AMC’s website.

Additional Reading: ICICI Prudential Long Term Equity Fund

What about 2009 elections? If you had invested in Feb 2007 and sold your fund in Nov 2008 just before the elections, you would have incurred a loss of 21.2%! However, if you had stuck to the investment until April 2014, you would have got 120%. If you are interested, this fund is available on BankBazaar.com.

Even though history might repeat itself and the markets might shot upwards, caution has to be exercised by certain investors. Based on the risk profile and/or goals horizon, here’s what you should do.

Group 1

Risk profile: Risk averse

Goals Horizon: 2-3 years away

What to do: If you are risk averse, it’s better to book profits if you think the markets will turn volatile. However, note that booking short term profits will result in higher taxation and lower returns in the long run. If your goals are coming up, you should gradually reduce equity exposure. Start by booking profits.

Group 2

Risk profile: Low risk

Goals Horizon: 15-20 years away

What to do: Stick to your investments. Even though the short term might be uncertain, if you have invested in the best stocks and funds, you will get great returns when it is time to use the money for your goals.

Additional Reading: Equity Investor? Don’t Follow The Herd!

Group 3

Risk profile: Moderately aggressive

Goals Horizon: More than 8-10 years away

What to do: Since you have a good risk appetite for equity investments, don’t sell them or stop your SIPs. You can invest more during market downturns.

Group 4

Risk profile: Very aggressive

Goals Horizon: Mix of short, medium and long-term goals

What to do: Invest at every market downturn. Since you love equity investments, your patience will pay off in the long run. However, for short term goals, ensure that you have minimum investments in equity.

The conclusion: Don’t sell those equity investments or stop your SIP. If you are long term investor, these events shouldn’t matter. In fact these might provide the much needed boost to your portfolio. Yet to start investing in Mutual Funds? Go ahead and explore the variety on BankBazaar.com.

Hey this post is great and definitely something that readers will love to read. Need for more such posts with stats and practical analysis which convinces a reader about what the writer wants to convey.

Hi Arjita,

We’re glad to know you found our article useful. Thank you for your feedback. We’ll definitely keep it in mind while working on our future blogs. Keep reading our blogs for more insights into the world of personal finance.

Cheers,

Team BankBazar