Blasted with advertisements for everything, ranging from an apartment, to a holiday to clothes, smart phones and other gadgets, how can anyone not be expected to be swayed? The purchasing power of individuals is increasing and so are the desire to own the best and the latest. Here’s a case of spending and beyond capacity.

Medha Narang, a software engineer bagged a job and moved to Mumbai. Within a few months, she was lured by offer of credit cards and applied for 2 of them and also went in for a personal loan. She went on a splurging spree and bought clothes, television, home appliances and a two-wheeler. At the end of the month when she received the statement for the cards, she realized that she was unable to pay the bill as well as the EMI for the personal loan.

Every month she just paid minimum amount due for her credit cards instead of the entire amount. The next couple of months she missed her loan EMI. She opted for a loan settlement from the bank to get out of the financial mess. A few years later, her application for a home loan got rejected.

Are cases like these quite common among many of us? Do we take our loans, bills and credit card payments and EMIs seriously? And how many are aware of the fact that all our action is watched and made note of? Who does that and how is it done are some of the important things that all of us ought to know.

What is CIBIL and how does it monitor your credit related activity?

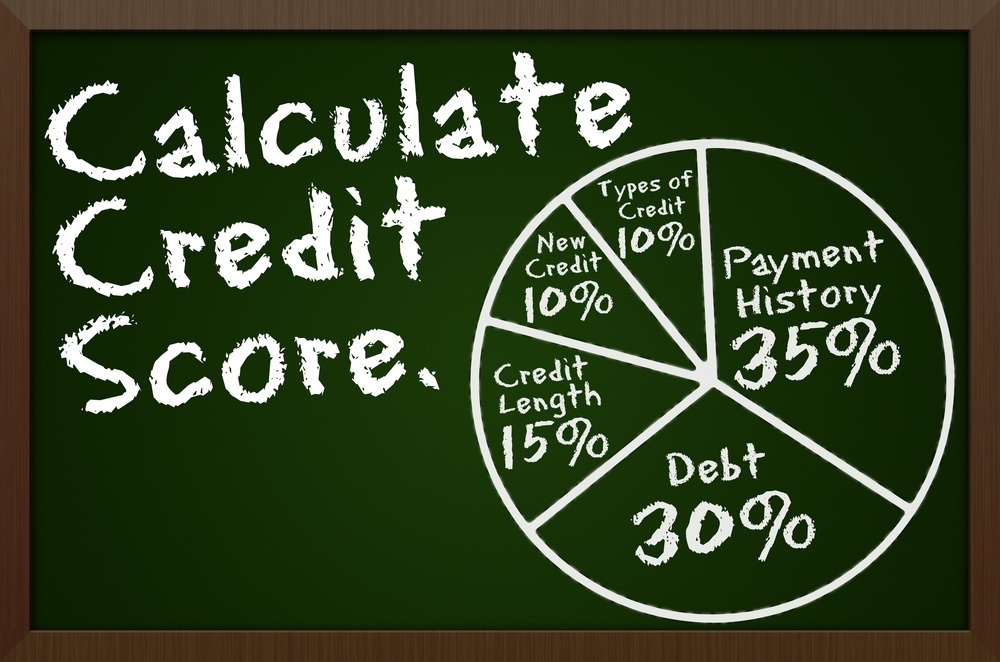

Credit Information Bureau (India) Limited or CIBIL is a Credit Information company that collects and maintains records of an individual’s payments pertaining to loans and credit cards. These records are submitted to CIBIL by banks and other lenders, on a monthly basis. This information is then used to create Credit Information Reports (CIR) and credit scores which are provided to lenders in order to help evaluate and approve loan applications.

The CIBIL TransUnion score

The Credit Information Bureau (India) Limited (CIBIL) TransUnion Score is a 3 digit numeric score given to rate your financial and credit health. It is in the range of 300-900 and is derived from your Credit Information Report. The score is an indication of the likelihood of your loan repayment to the lender. The higher the score, more the chance of securing a loan. 90% of the loans are sanctioned are to individuals with CIBIL score of 700 or more.

What takes your score down?

All of us do take loan for one or the other thing, like owning a house, land, vehicles, electronics or a personal loan for any of your needs. Who would like his/her loan application being rejected and in turn shatter your dreams of owning that coveted house or a car? We know that loans are sanctioned on the basis of your credit history and a low CIBIL score will not get you the loan. But what are those actions that take your score down. They are

- Default in payments/ late payments in the recent past.

- Amplified usage of credit limits ie., using your credit limit to the full each cycle.

- More number of unsecured loans like personal loans and credit cards to your name. This kind of credit is unsecured and many unsecured loans do not reflect well on your behavior.

- Credit hungry conduct. Increased number of applications for loans or credit cards will negatively affect your score. Or a recently sanctioned loan/card can also reduce your chances of new loan.

- Loan settlements. This is done when you are unable to pay your EMIs for your loan and when bank finds that it is not able to recover the money from you, it offers you a chance of settlement. In this case, instead of the entire amount, you pay only a mutually agreed amount.

In the example above, Medha not only missed her payments but also opted for a loan settlement and ended up getting her loan application rejected. But to err is human. Does that mean she can never get a loan or a credit card in her name? Working on improving your score is the only way out.

What takes your score up?

- Obtain your latest credit report and ensure that all transactions are updated. It may happen that there are some errors, get them rectified. If your credit score is low, work towards improving the score

- Ensure you make all your payments, whether, credit card payments or loan repayments on time. Set reminders or ECS mandate, so that you don’t miss out on payments.

- Restrict the number of credit cards or loans. Rather go in for secured loans like auto or home loans, this improves your score. Keep a mix of unsecured and secured loans.

- Use only a part of your credit limit on your credit card each month.

- Do not close credit cards that you don’t use. It is a way of signaling your loan provider that you are financially secures and do not need to use a credit card.

- Applying for each and every credit card or personal loan will also mean that you are looking for too much credit. Avoid doing so

- Lastly, make a conscientious decision before standing guarantee for your friends and family. Know their credit history earlier. If they default, your credit score will be impacted.

CIBIL maintains a log of defaults, as old as 8 years. Once you default or your debt is written off/settled, the agency reports it to CIBIL and it mars your Credit report. Working back into the good scores of CIBIL takes time, often as long as a year or two. Protracted financial discipline is the only way out. It always pays to keep your credit history clean, rather than spend time cleaning it!!