Everyone is talking about how RBI’s decision to link loan rates to external benchmarks is good. This article will give you a fresh perspective.

As you might have already read, the Reserve Bank of India (RBI) has said that all new floating-rate retail loans including Home Loan, Auto Loan and Personal Loan will be linked to external benchmarks from April 1, 2019. This includes floating-rate Micro and Small Enterprises (MSE) loans extended by banks. The new lending rate mechanism is based on recommendations of an internal study group chaired by RBI’s Janak Raj in October 2017.

The benchmarks will include any one of the following – RBI’s policy repo rate, 91 days Treasury bill, 182 days Treasury bill, or any other benchmark of the Financial Benchmarks India Private Ltd. These benchmarks are, of course, market-linked and will change more frequently than your Marginal Cost of Lending Rate (MCLR) that banks are using.

Additional Reading: Gold Loans Or Loan Against Property: Which One Works Better?

Your loan rate

Your loan rate will be the benchmark rate plus a spread. This spread over the benchmark rate will be decided wholly by the bank and will be set at the time you take the loan. RBI has said that this spread will have to remain unchanged through the life of the loan unless the borrower’s credit assessment undergoes a substantial change as mentioned in the loan contract.

Good or bad?

Now, the question is whether this is good for you, the borrower. Even though there is a lot of hype about how interest rates will now reflect market rates, the point is that interest rates have started increasing. Last year, when interest rates were being slashed by RBI, everyone was complaining about how interest rates weren’t getting transmitted fast enough. Now, interest rates are going to reflect market rates very quickly because they will be linked to these benchmarks. This means that you will be paying more in interest sooner rather than later.

Another point is that these benchmarks are market-linked. This means they are going to be highly volatile. The reset frequency of loans cannot be the same as that of these benchmarks. RBI has to allow a reset frequency that is different from the benchmark that has been chosen. Note that even a 3 or 6 months reset frequency can cause a big dent to your EMIs.

Additional Reading: Personal Loans That Give You Tax Benefits

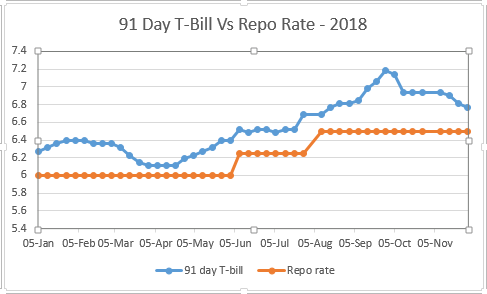

If we look at this year, the Treasury bill (T-bill) rates have been very volatile and have gone up very sharply. They have risen faster than the repo rate or even the MCLRs of banks. Here’s a comparison of the 91-day T-bill rates with the repo rate.

Source: RBI

Source: RBI

If you look at the chart you will understand that T-bill rates rise faster than the repo rate and are very volatile. In September 2018, T-bill rates went up to 7.2% while repo rates were at 6.25%. So, if the loan rate is linked to T-bill rate, you might be paying higher interest even before RBI actually hikes interest rates.

Let’s consider an example to understand this. Suppose your Home Loan rate was based on the T-bill rate and the spread decided by the bank is 1.7%, your loan rate will be 8.9%, which is much higher than the 8.5% that most banks are charging right now.

What should you do?

More clarity is required as to how the benchmark rate will be considered. Will it be an average of the rates during a period or the rate at the end of a particular period? It’s more likely to be an average of rates given the volatility of these benchmarks. But that period has to be long since loans are taken for long tenures and frequent changes in loan EMI or tenure will put a spanner in the works for the borrower.

If you are looking for a Home Loan, this might be the right time to go for that loan. Rates are only going looking to go up from here. Also, you can take advantage of the Pradhan Mantri Awas Yojana (PMAY) subsidy which has been extended till 31st March 2019. If you are an existing Home Loan borrower looking for better interest rates, it is best to wait until RBI clarifies how the new benchmark system will work.

Additional Reading: 5 Most Popular Home Loans

Another point is that this benchmark rate system is only if you are borrowing from banks. RBI hasn’t talked about rates set by Non-Banking Finance Companies (NBFCs) and Housing Finance Companies (HFCs). So, you will still need to compare rates across the board to get the best rate for your loans.

Want to compare rates and check your eligibility before you apply? Go right ahead!