Use UPI, NEFT, mobile banking & more to pay securely and effortlessly!

Your Payment Options:

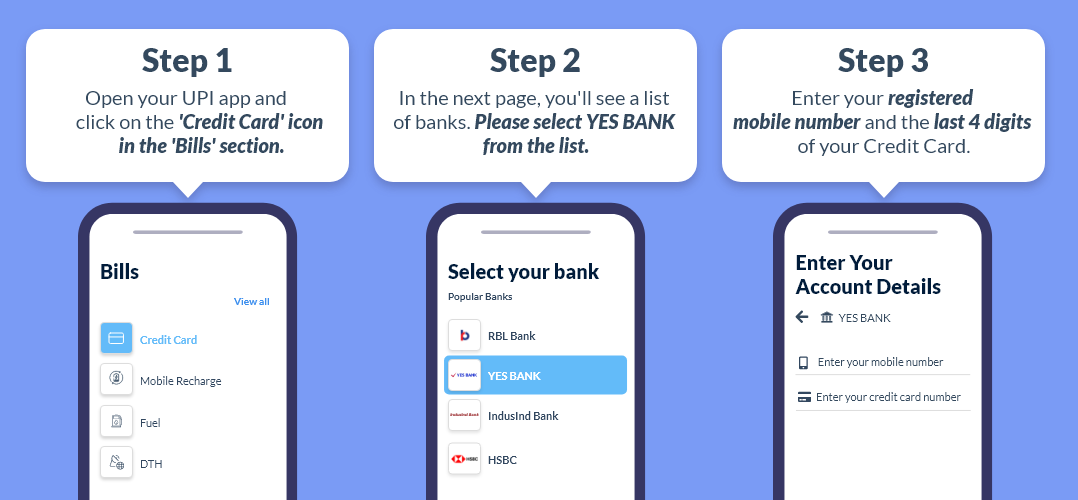

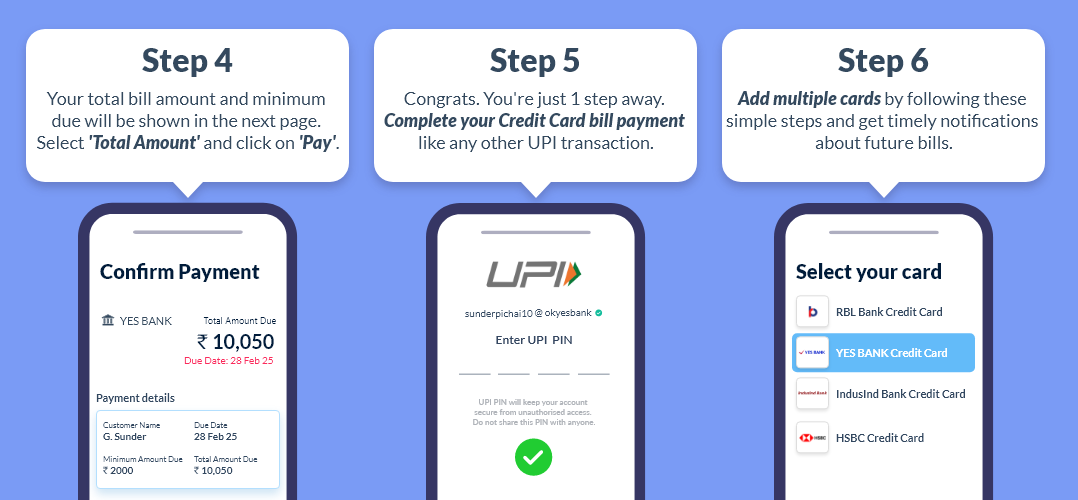

UPI

Need a video guide? Click below!

NEFT Transfer

For NEFT transfers, log into any bank account, add your YES BANK Credit Card bill as a payee/beneficiary and enter the following details to transfer funds.

- Payee name: Name as on your YES BANK Credit Card

- Payee account number: 16-digit Credit Card number

- Bank name: YES BANK

- IFSC code: YESB0CMSNOC

BillDesk Net Banking

Pay by using any bank’s Net Banking facility through BillDesk.

iris by YES BANK (Mobile App)

Download the YES BANK mobile app on your android/ iOS device and pay directly using your YES BANK savings account or even via an account from another bank.

Net Banking for Account Holders

If you have a YES BANK account, click here to log in, register your Credit Card, and make quick and secure online payments.

To see more bill payment options, click here.

Learn the Benefits of Paying Your Credit Card Bill on Time

Paying your Credit Card bill on time offers several advantages:

- Avoid Late Fees: Prompt payments help you avoid incurring late fees, which can significantly increase your overall Credit Card expenses.

- Maintain a Good Credit Score: Consistent on-time payments contribute positively to your Credit Score, which can impact your ability to obtain loans, Credit Cards offers, and other financial products in the future.

- Lower Interest Rates: A good Credit Score may lead to lower interest rates on your Credit Card and other loans.

- Avoid Interest Charges: Paying your bill in full each month prevents the accumulation of interest on your outstanding balance, saving you money.

- Increased Credit Limit: Timely payments may make you eligible for credit limit increases. Credit Card issuers may be more likely to raise your limit if they see that you manage your account well, which can enhance your purchasing power and improve your credit utilisation ratio.

- Peace of Mind: Paying your Credit Card bill in full and on time provides peace of mind, reducing your financial stress and anxiety. Without the worry of accumulating debt due to missed payments, you can focus on other aspects of your financial goals and things that really matter.

Get To Know Your Monthly Statement

Credit Card bills are typically generated at the end of each billing cycle. This cycle usually starts on the day you activated your card and runs for 30 or 31 days. For example, if your card was activated on April 1st, your billing cycle would end on April 30th or 31st. The below is what you can expect to see on your YES BANK Credit Card statement monthly:

- Minimum amount due

- Total outstanding amount due

- Due date for the payment

- Billing start date and end date

- Interest charges levied (if any)

- Accumulated reward points

- List of transactions done on your Credit Card, both debits and credits, along with the merchant’s name

- Transaction amount

- Transaction date

The Credit Card statement will be sent to your registered email address or postal address, depending on which mode of communication you have opted for. It is important to go through the Credit Card statement in detail and report to the bank if there are any fraudulent transactions or discrepancies in the statement in order to correct or resolve the issue.

YES BANK Support Options

- Customer Care (toll free): 1800 1200

- Credit Card Queries: 1800-103-1212/ 1800-103-6000