There is nothing more annoying than finding gate-crashers at your party. In the world of personal finance, a monetary crisis is the most feared gate crasher as it can not only ruin your plans but also make you desperate for money. Under such situations, a panic stricken person turns to Personal Loans to bail them out of financial trouble.

But getting your Personal Loan approved is not that simple as banks look at multiple factors before sanctioning the loan. One of the biggest factors that can make or break your Personal Loan plea is your income. While people who earn well have less trouble getting their Personal Loan application approved, those with lower incomes not only generally have limited options but may also find it a little difficult to get a Personal Loan approved. We, at BankBazaar, are here to help you out by listing down the best Personal Loan options for people who earn less than Rs. 20,000 per month.

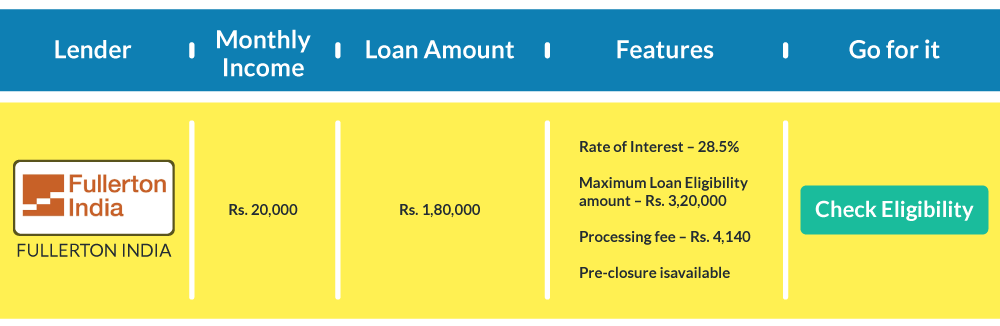

Let’s take a look at Personal Loan offers available under various age / income combinations:

Let’s assume that the borrower is 23 years old; let’s check out what his or her Personal Loan options are.

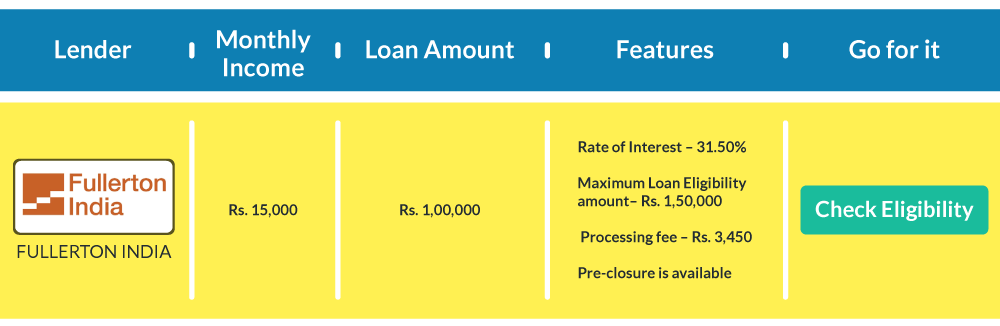

For a salary range of Rs. 15,000 to Rs. 20,000 per month:

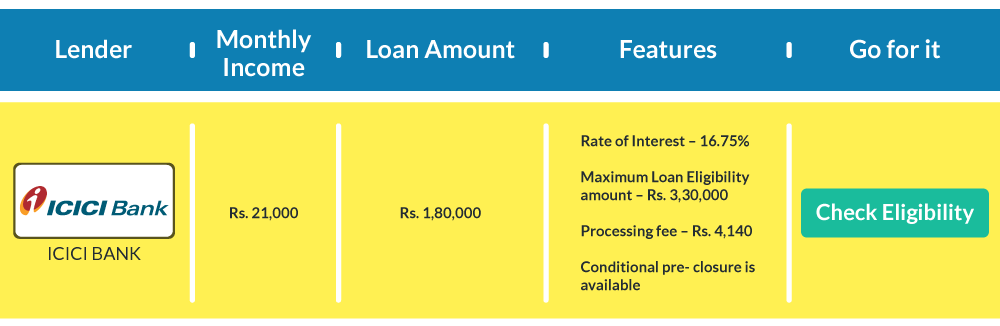

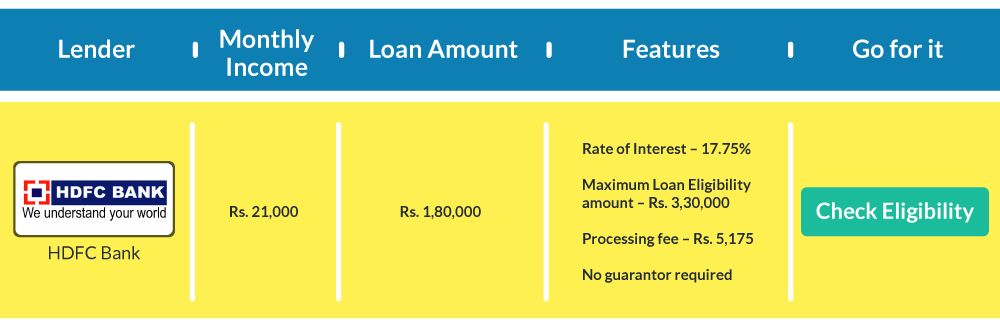

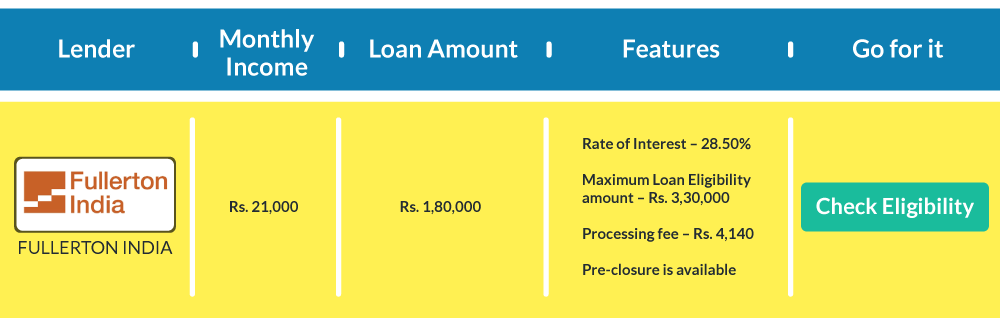

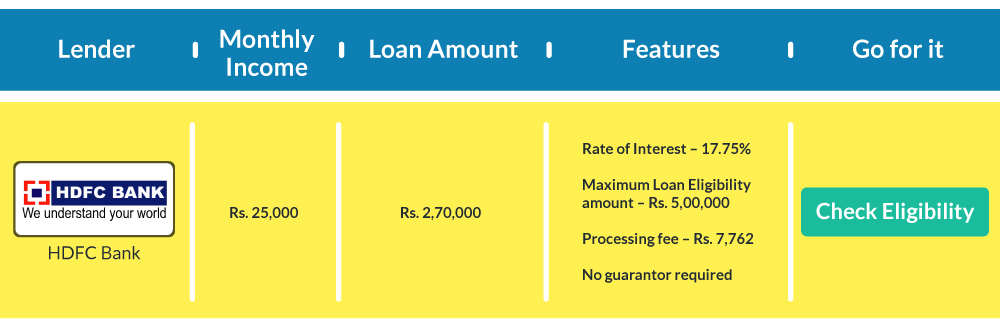

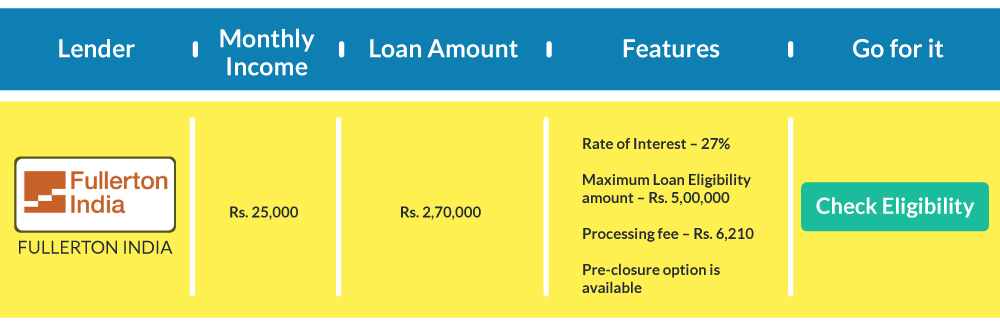

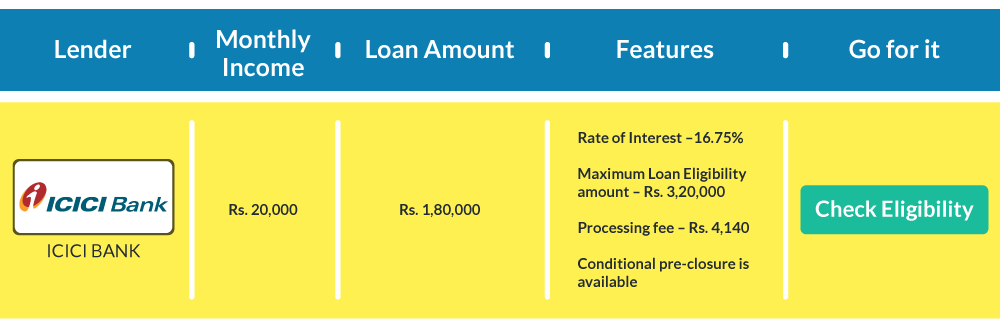

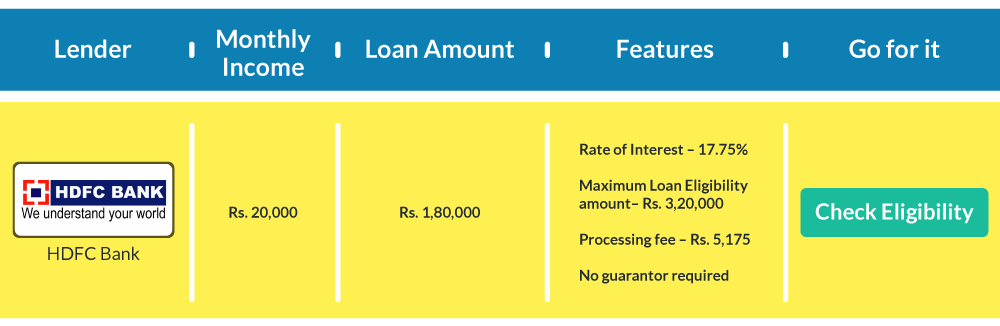

For a salary range of Rs. 21,000 to Rs. 25,000 per month:

For a salary range of Rs. 21,000 to Rs. 25,000 per month:

Additional Reading: Small Schemes For Low Income Groups

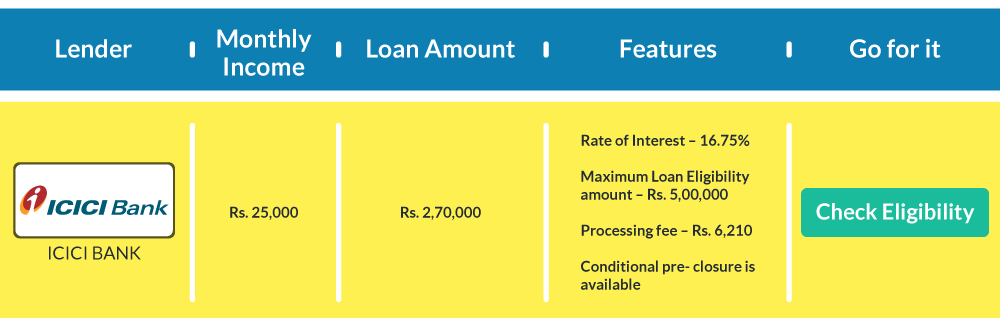

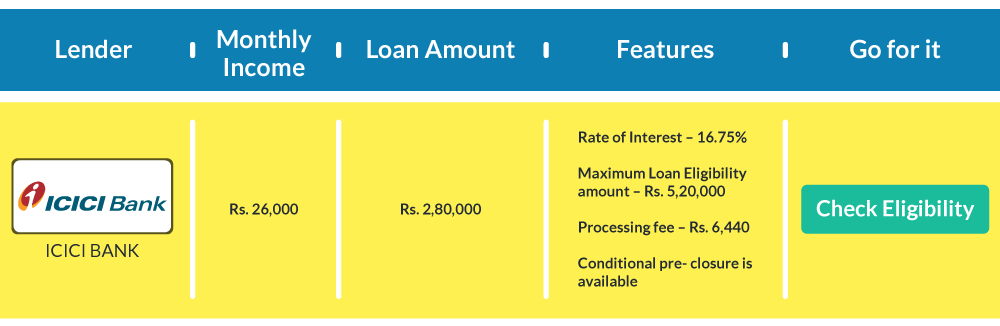

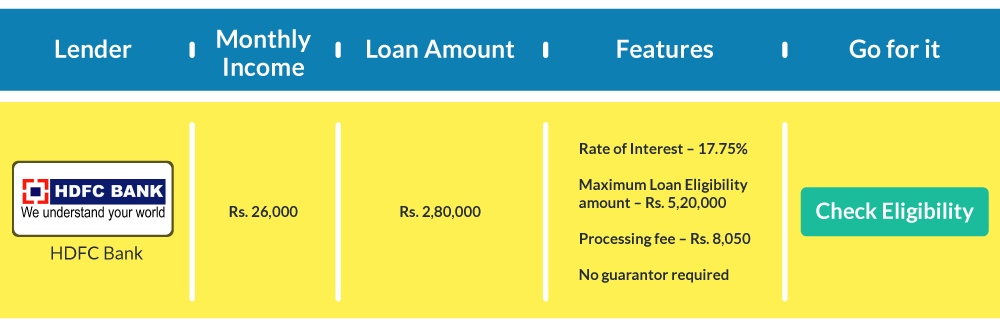

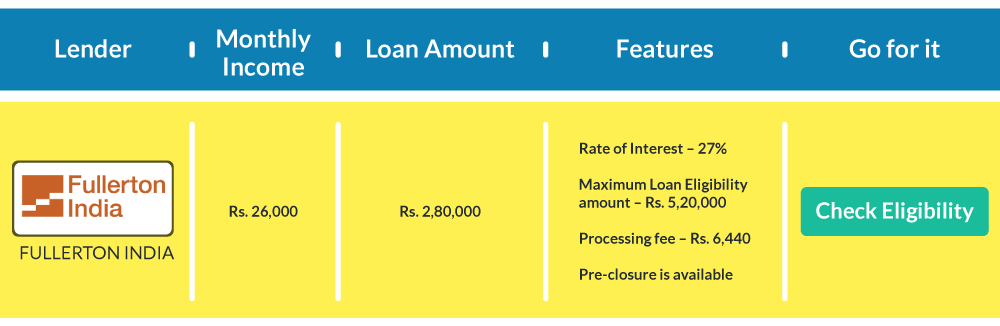

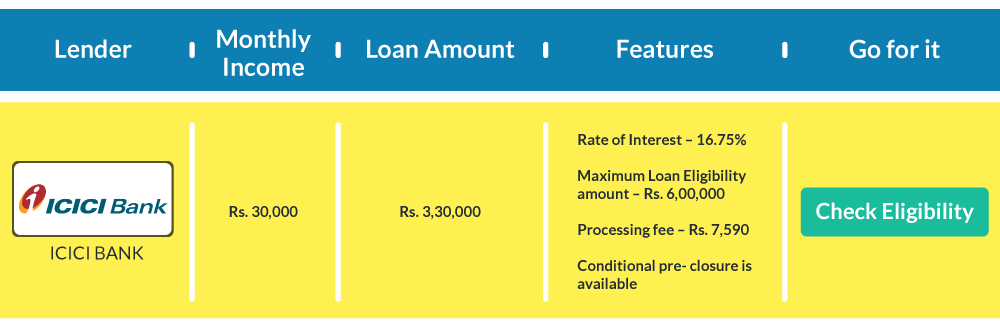

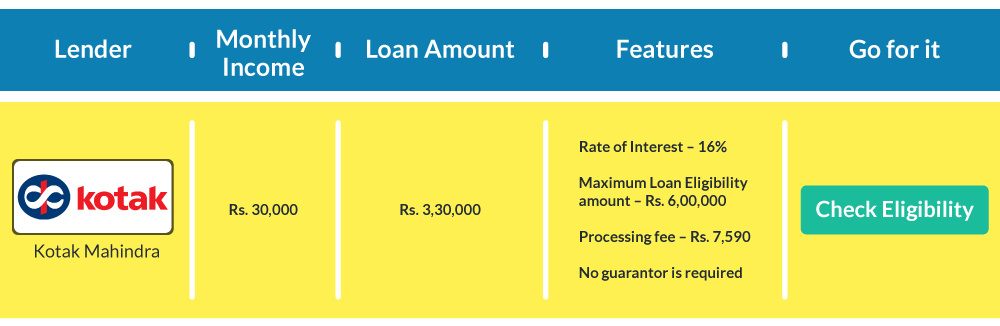

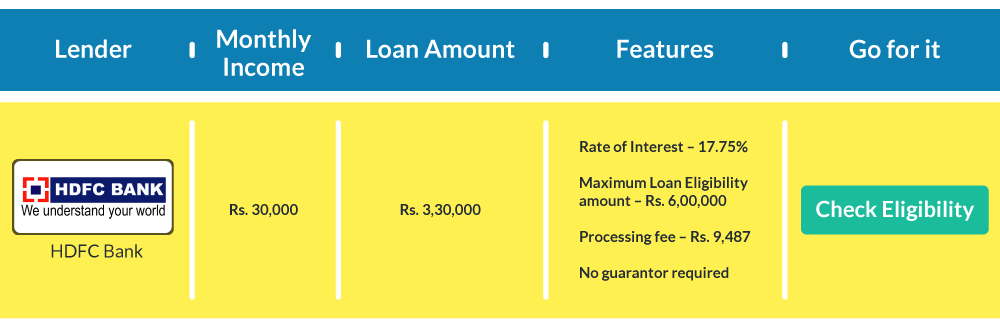

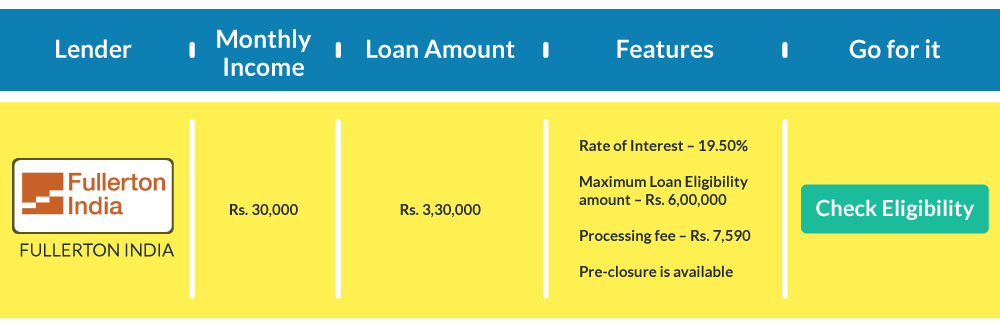

For a salary range of Rs. 26,000 to Rs. 30,000 per month:

Additional Reading: A Higher Income Alone Won’t Solve Your Money Problems

Now that you know that you still have options when it comes to Personal Loans, you can approach one of the above-mentioned banks to get your Personal Loan approved. Want to check your eligibility before you apply? Just hit that button below.