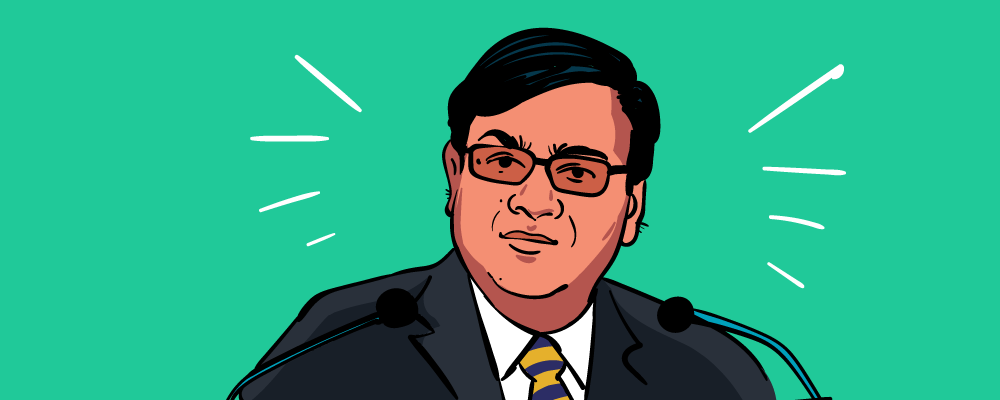

Everyone was waiting with bated breath. It was a huge responsibility and a well-qualified person was an absolute necessity, especially after the precedent had been set by Raghuram Rajan, the most loved Reserve Bank of India (RBI) Governor. Now, it has finally been decided who will take on the mantle of India’s central bank. And the winner is Urjit Patel, the Deputy Governor of the RBI. Urjit Patel, when he assumes office on 4th September 2016, will be the 24th RBI Governor of India.

Here’s all about our new RBI Guv.

A well-qualified successor

Urjit Patel has been the deputy RBI Governor since 11th January, 2013 and is armed with the choicest of degrees. He passed out of the London School of Economics with a Bachelor’s degree in Economics. He went on to do his Master of Philosophy at Oxford University. He completed his education with a Doctor of Philosophy in Economics from Yale University. Soon after this, in 1990, he joined the International Monetary Fund (IMF). He worked in various countries such as the United States, Bahamas, Myanmar, and India when he was at IMF.

In 1996, he was deputed by the IMF to work for the RBI. During his stint, he worked on improving the debt market in India, launched banking as well as pension fund reforms and also improved the foreign exchange market in the country. Patel has also served as an advisor at the Boston Consulting Group (BCG) where he handled energy and infrastructure. He has even worked at our erstwhile Reliance Industries Limited where he headed business development from 1997 to 2006.

Patel has been with the Government of India since 2000, working with Central and State Governments. He has handled the task force on Direct Taxes and also served at the Department of Economic Affairs (a part of the Ministry of Finance). He has been closely working with Rajan on RBI’s monetary policy formation. According to newspaper reports, he declined an offer with the BRICS Bank that was formed in Shanghai recently. It is said that the reason for declining was because he wanted to be with his mother.

Additional Reading: What Exactly Does the RBI Do?

Corporate Speak

Here is what eminent corporate personalities have said about our new RBI Governor.

Adhil Shetty, CEO, BankBazaar.com

“Urjit Patel is a highly qualified successor to an outstanding RBI governor like Raghuram Rajan. We can expect a strong leadership and a tight control on inflation in the coming months from the head of the committee that introduced some of the most significant monetary policy reforms since India opened up its economy in 1991, including a switch to inflation-targeting and adopting consumer prices as the new benchmark.

We believe that the appointment of the Deputy Governor as the new RBI governor is a strong statement on policy continuity by the government. The next three years are very crucial to actually reap the benefits of the monetary policy in place for the last couple of years. We can look to the new governor to ensure the long-term sustainability of the policies currently in place.”

Ajay Bodke, CEO & Chief Portfolio Manager – PMS, Prabhudas Lilladher

“Institutional Investors both domestic & foreign would welcome the Indian government’s appointment of RBI Deputy Governor, Dr. Urjit Patel, as successor to Dr. Raghuram Rajan. It signals a seamless continuity in the policies pursued by the RBI to conduct its monetary policy in an independent manner. One of the most seminal achievements of Dr. Rajan was the signing of monetary policy agreement between the government and RBI for “flexible inflation targeting” which was based on the report of the panel headed by Dr. Patel. Dr. Patel’s path-breaking report has helped India join the league of developed nations where adoption of flexible inflation targeting has helped anchor inflationary expectations and brought about a structural control over inflation. Markets would strongly cheer the appointment”.

Jay Shankar, Chief India Economist & Director, Religare Capital Markets

“His appointment would ensure continuity of RBI’s policy stance. He should be able to hit ground zero on day one, without needing a lead time to become familiar with policy-making process and procedures. Markets – equity and bond – should react positively on Monday.”

Nilesh Shah, Managing Director, Kotak Mahindra Asset Management Company

“Dr. Urjit Patel’s appointment provides continuity to the monetary policy making especially related to inflation targeting. It reassures both debt and equity market for continuity in policy making at the RBI. Market participants will be keenly looking forward to next credit policy to hear governor’s viewpoint on macroeconomic environment and agenda for the future.”

Chanda Kochhar, MD and CEO, ICICI Bank

“I congratulate Dr. Urjit Patel on his elevation as the RBI Governor. As the Deputy Governor of RBI, Dr. Urjit Patel has played a key role in developing the new monetary policy framework that has focused on reigning in inflation and has imparted stability to the currency. His appointment would ensure a smooth transition and continuity in monetary policy, as India puts in place major structural reforms to transition to a higher growth path. I wish him all the very best in his new role.”

Motilal Oswal, CMD, Motilal Oswal Financial Services

“By appointing Urjit Patel, the author of the monetary policy framework report, as RBI Governor, the government increases its credibility to maintain its fight against inflation. I wish him all the best”

We can expect great reforms and a reasonable interest rate regime from our new RBI Governor. Another fall in interest rates in the offing? Stay tuned and keep reading our blog to find out.