The Reserve Bank of India in its latest monthly financial bulletin has revealed that loans against shares, advances and other securities have been on a constant upswing in the last couple of months. With the stocks markets entering into what many financial experts believe to be a long bull run, financial securities are being used as mortgage tool to avail retail loans. According to the latest RBI financial bulletin, loans against shares and advances have grown by almost 25 per cent compared to the same period last year. The sudden increase in loans against shares or the growing popularity of such loans have made the banking watchdog a little circumspect keeping a close look at the situation. Let us take a look at various aspects of loans against securities and the reasons behind its sudden growth in popularity.

Rising Popularity of Loan against Securities: With consumer spending on rise and retail loans getting expensive, a large number of people are exploring new ways to raise finances for their financial requirements. The bloom is the financial markets have also meant that people are more willing to opt for a loan against security with competitive interest rates, rather than opting for a traditional personal loan. According to the Reserve Bank of India’ latest monthly bulletin, advances to individuals against shares and bonds grew by 24.9 % compared to 9.2 % growth for personal loans. The high interest rates of personal loans and tough eligibility criteria are some of the reasons people seem to be opting for loan against securities instead.

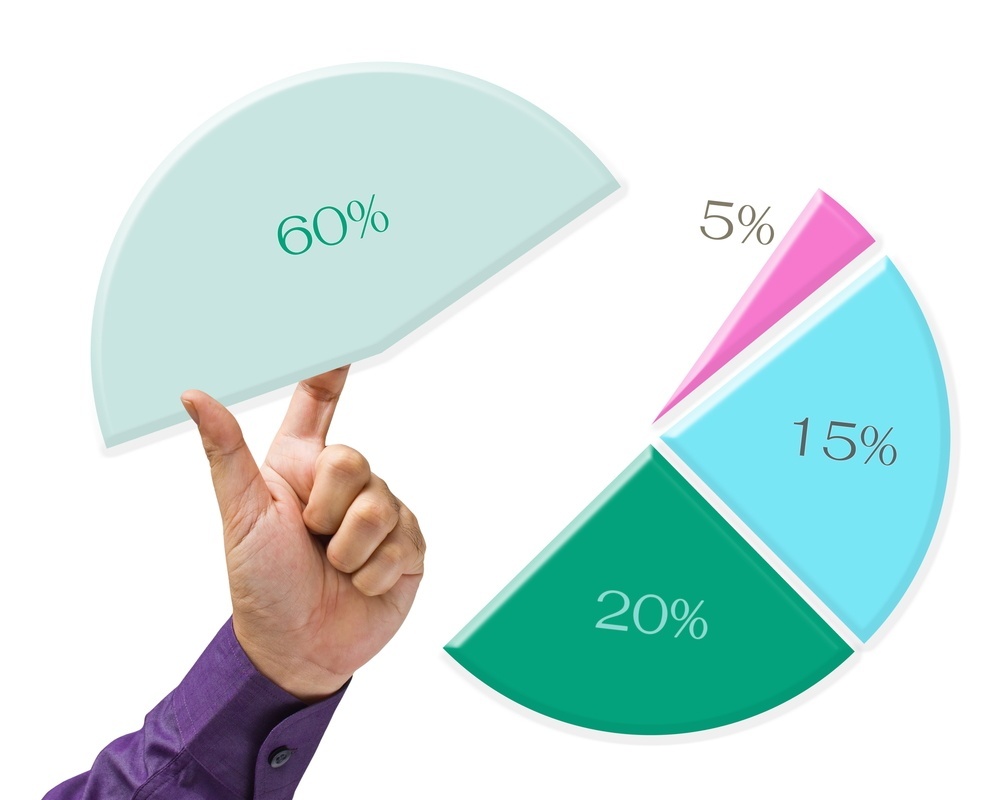

Just as loans are available against precious metal like Gold, loans are easily available against shares, advances and mutual funds under the loan against security providence. Loan against securities are available by both banks and non banking financial companies albeit with some clauses. Not all securities, shares and advances qualify for a loan. Most banks usually define the shares of the companies which can be pledged against the loan. Bank selects the securities according to their market value and offer 50 to 70% of the loan amount to the borrower.

Advantages of Loan against Shares: Once an individual borrower pledges his or her shares with the bank, the bank issues a current account for managing the loan. One of the biggest advantages of loan against securities is the fact that the borrower is charged interest only on the amount withdrawn from the account and for the span of time the fund is utilized. With the rise in the security market, the pledged securities get increased in value with each passing day as the share price increases in the market. This means a higher Loan to value ratio is available for the borrower for the same security making it an advantageous mortgage option compared to a personal loan with increasing interest rates.

Curbs on NBFCs offering loans against shares: In a proactive decision to curb any untoward incidence the Reserve Bank of India (RBI) has asked non banking financial companies with assets of more than Rs. 100 Crore to maintain a loan to value ratio of 50%. As a result lenders would be allowed to accept shares of only group 1 securities while offering loans against securities for more than Rs. 5 Lakhs. The Reserve bank of India has clear guidelines for shares and securities that qualify under Group 1 securities. All shares that have been bought or sold of the exchange on at least 80% of the trading days with a price decline of less than 1% qualify for mortgage with NBFCs.

Banks Offering Loans against Shares: Public sector banks and private banks offer loan against shares and debentures depending on their in-house risk factors for the shares to be mortgaged and the repayment history of the client. Some of the popular banks offering loans against shares are as follows:

| Bank | Scheme | Loan Amount | Processing Fee | Interest Rate |

| SBI | Loan Against Shares | You can avail of loans up to Rs 20.00 lakhs against your shares/debentures. | Nil | Equity Plus Scheme: 6.50% above Base Rate, currently 16.50% p.a.Loan against Shares & Debentures: 6.50% above Base Rate, currently 16.50% p.a.Loan to employees to subscribe for ESOPs:6.50% above Base Rate, currently 16.50% p.a. |

| Bank of Baroda | Advance Against the security of Relief Bonds/Government Bonds | Loan: Rs.3000/-Overdraft: Rs.20,000/- | Rs.100 flat plus out of pocket expenses and actual conveyance charges. | Against NSC/KVPLoan: Base Rate + 3.50% or 0.50% over NSC / KVP rate, whichever is higherOverdraft: Base Rate + 4.00% or 0.750% over NSC / KVP rate, whichever is higher

Life Insurance Policy / Relief Bonds Loan: Base Rate + 3.50% Overdraft: Base Rate + 4.00% |

| HDFC Bank | Loan Against Securities: Any shares from any Depository (NSDL or CDSL) and any Depository Participant across the country. | 65% of the total portfolio valueMutual Funds (Equity, Debt, FMPs) up to 50% of NAV (Net Asset Value). | Up to 1% of the Loan/Sanctioned credit limit. Minimum Rs. 2000/- (Non refundable) | 12-12.5 % |

| ICICI Bank | Loan Against Securities | Drawing power up to 50% of the value of the shares, 50% lending on the NAV for Mutual Funds. Minimum loan amount is Rs.50000. Maximum loan amount is Rs. 20 lakh. | CALAS Cases: Rs. 3500 plus applicable service tax. CARLB Cases : 0.25% of the loan amount subject to a minimum of Rs. 5000 plus applicable service tax | 13.25 % |

YOU MAY ALSO WANT TO: Check out the EMI for your Personal Loan – Personal Loan EMI Calculator

Thanks for the informative post 🙂

I have gone through your post and I totally agree with your point “ One of the biggest advantages of loan against securities is the fact that the borrower is charged interest only on the amount withdrawn from the account” In fact, I took the loan against security from Bajaj Finserv and I got so many benefits like :-

Higher Loan Amount to Cover your Needs

Quick Online Approval

Exclusive Customer Support

No Additional Charges

Online Account Management

Pre-approved Deals

Hi Seema,

We’re glad we could be of help. Keep reading our blog for more insights into the world of finance.

Cheers,

Team BankBazaar

Great article on the increasing trend of increasing loans against shares. Loans against shares work much in the same way as personal loans, in the sense that you can use the loan amount for pretty much anything. Of course, most lenders caution against speculative endeavors, and many bar you from this (speculative purposes could be something like using the money you got a loan against your shares, to buy more shares). Add to this the fact that the interest rate on a loan against shares will be lower than what you would get on a personal loan, and this starts to sound like a pretty good deal. Thanks for sharing.

Hi Jay Mehta,

That is correct. Have a nice day!

Cheers,

Team BankBazaar