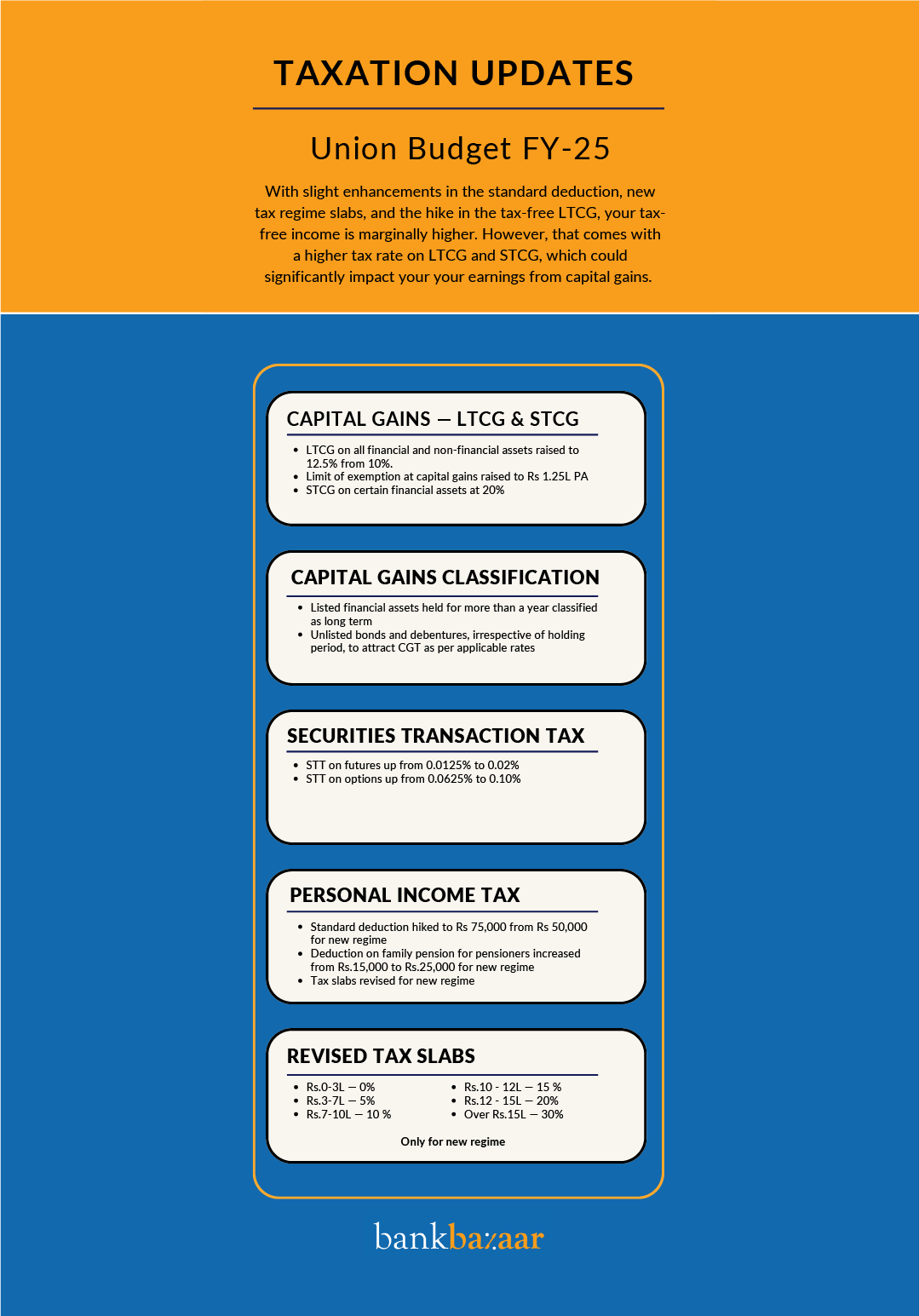

Here’s a quick round-up of key taxation changes in the Union Budget 2024-25 that may impact your earnings this year.

Note: Below changes will be effective for all assets sold post 23rd July 2024.

LISTED ASSETS

| ASSET | STCG Before | STCG Now | Holding Period | Holding Period Changed? | LTCG Before | LTCG Now |

| Stocks# | 15% | 20% | 12 months | No | 10% | 12.5% |

| Equity MFs# | 15% | 20% | 12 months | No | 10% | 12.5% |

| Debt and Non-Equity MFs | Slab Rate | Slab Rate | NA | Yes | Slab Rate | Slab Rate |

| Listed Bonds | Slab Rate | 20% | 12 months | No | 10% | 12.5% |

| REITs/InVITs | 15% | 20% | 12 months* | Yes | 10% | 12.5% |

| Equity FoFs* | Slab Rate | 20% | NA | Yes | Slab Rate | 12.% |

| Gold/Silver ETF | Slab Rate | 20% | 12 months | Yes | Slab Rate* | 12.5% |

| Overseas FoFs | Slab Rate | Slab Rate | 24 months | Yes | Slab Rate | 12.5% |

| Gold Funds | Slab Rate | Slab Rate | 12 months | Yes | Slab Rate | 12.5% |

#Annual LTCG exempt amount hiked from ₹1 lakh to ₹1.25 lakhs for stocks and equity MFs

UNLISTED ASSETS

| ASSET | STCG Before | STCG Now | Holding Period | Holding Period Changed? | LTCG Before | LTCG Now |

| Physical Real Estate | Slab Rate | Slab Rate | 24 months | No | 20%** | 12.5% |

| Unlisted Bonds | Slab Rate | Slab Rate | 24 months | Yes | Slab Rate | Slab Rate |

| Physical Gold | Slab Rate | Slab Rate | 24 months | Yes | 20%** | 12.5% |

| Unlisted Stocks | Slab Rate | Slab Rate | 24 months | No | 20%** | 12.5% |

| Foreign equities/debt | Slab Rate | Slab Rate | 24 months | No | 20%** | 12.5% |

*Apart from those investing 90% in equity ETFs | **Including indexation | Those investing in funds with at least 65% equity

Copyright reserved © 2026 A & A Dukaan Financial Services Pvt. Ltd. All rights reserved.