Travelling abroad can be a ton of fun, but it also comes with its fair share of conundrums. Chief among those is whether it’s a good idea to withdraw cash in a foreign country using your Debit Card or Credit Card.

While it’s always preferable to carry enough money on a trip, sometimes you may find yourself in certain situations that require you to cough up extra funds to cover some of your costs and expenses.

Additional Reading: How To Plan Your Finances For An International Trip

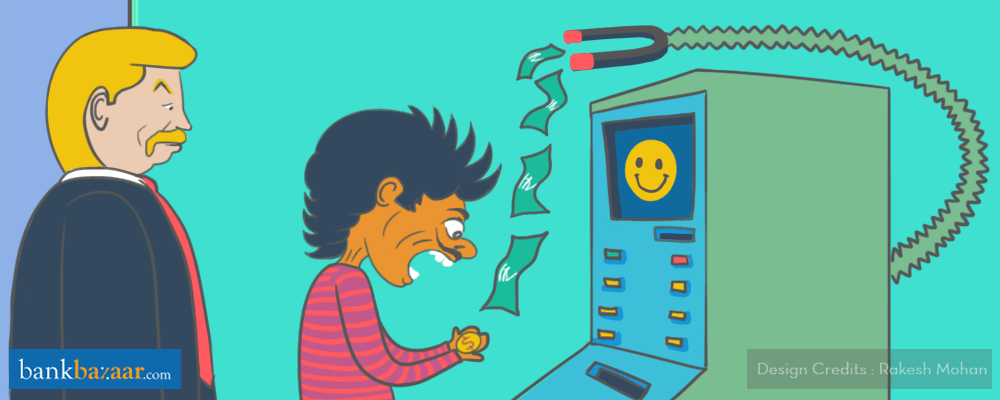

Now, you shouldn’t even be in a situation where you need to withdraw money from an ATM abroad, unless you’re faced with an absolute emergency. This is because it is common knowledge that withdrawing money from international ATMs comes with extra charges, which are usually a percentage of the amount you withdraw.

Of course, these fees vary depending on who you bank with, but generally speaking, it really isn’t a very good idea to keep pulling out cash while travelling overseas, because you could end up losing a fair amount of money in unnecessary fees.

Additional Reading: 9 Fees You Could Save On Travel

However, if you’re really in need of money abroad, and are looking to make a withdrawal, most Debit and Credit Cards offer you the facility of doing just that. In general, making withdrawals, especially with your Credit Card, is an expensive affair as the fees and interest charges you incur can be quite high.

Additional Reading: Using Your Credit Card Overseas? Understand Your Charges!

Let’s take a look at the charges levied by a few banks for cash withdrawals at ATMs abroad:

- A fee of Rs. 25 plus taxes will be levied on each balance enquiry you make at an international ATM.

- A fee of Rs. 125 plus taxes will be levied on each cash withdrawal transaction you make at an international ATM.

- Should you use your Debit Card to make transactions in foreign currency, a currency conversion mark-up of 3.5% will apply.

- A fee of Rs. 25 plus taxes will be levied on each balance enquiry you make at an international ATM.

- A fee of Rs. 125 plus taxes will be levied on each cash withdrawal transaction you make at an international ATM.

- Should you use your Debit Card to make transactions in foreign currency, a currency conversion mark-up of 3.5% will apply as per the VISA/Mastercard exchange rate prevalent at the time of the transaction.

- Any transactions declined at an international ATM due to insufficient funds will attract a fee of Rs. 25 plus taxes.

- Using your Citigold Debit Card at international Citibank ATMs or for purchases will not attract any foreign transaction fees or charges.

- Using your HSBC Debit Card at non-HSBC ATMs abroad will attract a fee of Rs. 120 per withdrawal and a fee of Rs. 15 per balance enquiry.

- Using your HSBC Debit Card at HSBC ATMs abroad will attract a fee of Rs. 120 per withdrawal and a fee of Rs. 15 per balance enquiry. However, customers holding an HSBC Premier Debit Card will not be charged any fees.

- Should you use your Debit Card to make transactions in foreign currency, a currency conversion mark-up of 3.5% will apply as per the VISA/Mastercard exchange rate prevalent at the time of the transaction.

- Any transaction declined at an international ATM due to insufficient funds will attract a fee of Rs. 25 plus taxes.

Additional Reading: International Debit Cards – Compare And Apply

Small or large amounts? How much should you be withdrawing abroad?

If you’re in a position where making a withdrawal from an ATM becomes unavoidable, then it’s probably advisable to withdraw a fairly large amount instead of a smaller amount.

Since fees are levied as a percentage of the withdrawal amount, and are also levied on every withdrawal made, it may be in your best interest to make one large withdrawal instead of multiple smaller ones.

Most cards also come with a minimum charge, which is why it makes more sense to take out a larger amount rather than getting charged for every single small transaction you make.

Additional Reading: Know The Hidden Charges On Your Card

Using your Credit Card for purchases abroad VS withdrawing cash

Let’s say you’re short on cash and want to make some purchases while holidaying abroad. What would be the best way to go about it?

Paying with your Credit Card or using it to make a cash withdrawal from an ATM? Well, the answer should be pretty simple. Swipe your Credit Card.

There are a number of reasons why this is a more preferable option than withdrawing from an ATM:

- Credit Card cash withdrawals come with higher interest rates than purchases. This is because Credit Card withdrawals are actually loans handed out by Credit Card firms.

- While Credit Card purchases give you some breathing space to pay back the amount, withdrawals attract interest charges from the day you make the transaction, so you don’t have any breathing space to speak of.

- Most Credit Card cash withdrawals also attract fees and service charges.

- Using your Credit Card to make purchases will help you avail reward points or purchase protection, which you can’t benefit from if you pay by cash made via a cash withdrawal.

Additional Reading: Financing Your Vacation Using Your Credit Card – Good Or Bad?

Tips to avoid using your Credit Card to withdraw money

While this has more to do with good pre-trip planning and basic common sense, it’s always advisable to keep these few tips in mind to help you avoid ending up in a situation where you need to use your Credit Card to withdraw money.

- Budget your trip. Ensure that you are carrying enough foreign currency as well as a little bit extra to tide you over in case you find yourself short of funds.

- Take all possible expenses into consideration well in advance of your travel dates so you will have a fairly accurate idea of how much money to carry with you.

- Buy traveller’s cheques, which can also be used as an alternative to cash.

- Try acquiring a Credit Card that does not levy fees on withdrawals made abroad, just in case you DO find yourself in a situation where you need to withdraw money.

Additional Reading: Are Your Financially Ready To Travel Abroad?

Since different banks and card providers charge different amounts for withdrawals made abroad, it would certainly hold you in good stead to gather as much information as you can before you head overseas.

Stay informed at all times or you could be saddled with the extra burden of unnecessary fees and charges.

ATM didn’t dispens the cash but money was deducted from my account. it was happened yesterday 16th jan 2018. please contact me on +917226069064

Hi Suresh, We wouldn’t be able to help you resolve this issue. Kindly get in touch with your bank as soon as possible. You can find the customer care number on the back of your ATM card. Cheers, Team BankBazaar