Remember cheques? They aren’t as popular as they used to be, but they still play an important part in our financial dealings. Here’s all you need to know about cheques.

After the digital makeover of the banking system, non-traditional methods have taken precedence over old-school banking ways. The current COVID-19 pandemic has furthered the importance of digital banking too. It’s safe to say that the use of internet banking, Credit Cards, Debit Cards and digital wallets are at an all-time high.

However, it’s important not to forget the basics. Even today, a cheque, as old school as it may seem, plays an important part in our financial transactions. With that in mind, we’ve compiled a comprehensive list of frequently asked questions to resolve all your basic cheque-related queries. If you haven’t encountered them already, you’re bound to do so at some point. Ready to ‘check’ out what we have in store? Read on!

What is a cheque?

Let’s start with the basics. A cheque is basically a written order from a customer to a bank that states that a specified amount of money is to be transferred from the customer’s account to another account (or given as cash over the counter) as per the details mentioned in the leaf.

How do I write a cheque correctly?

Writing a cheque may seem like a fairly easy task but there are some obvious things that are likely to be overlooked. Follow this step-by-step guide to avoid making mistakes while writing out your next cheque.

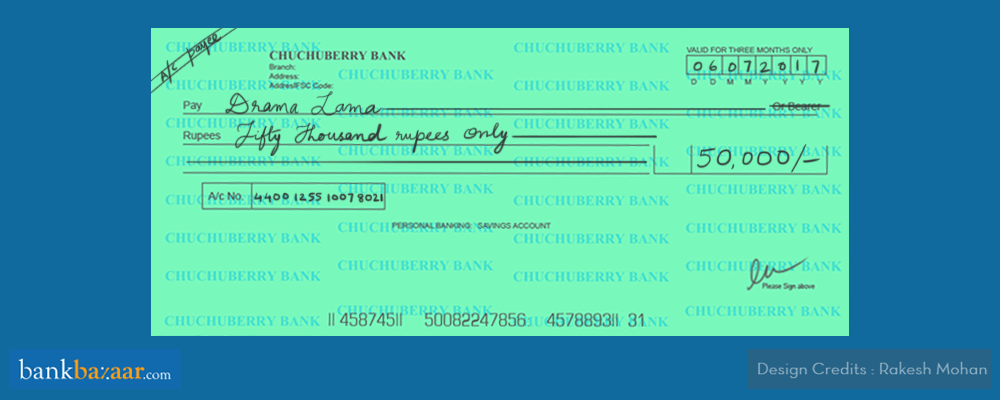

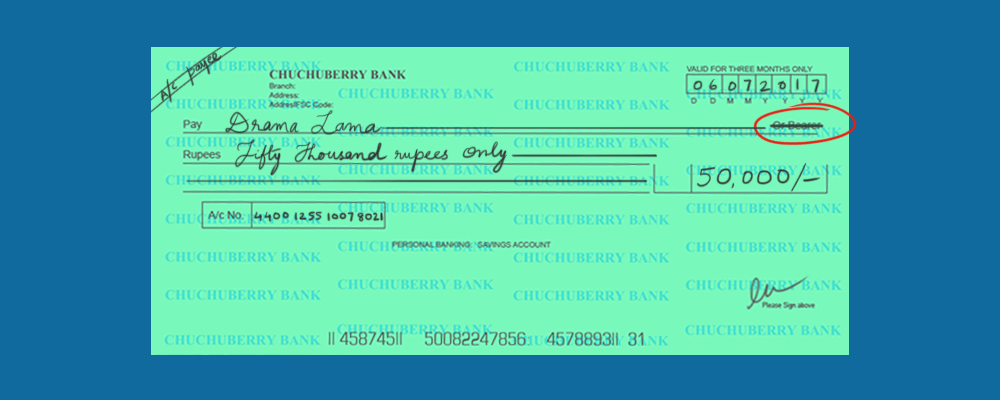

Step1: Start by ‘crossing’ the cheque – draw two parallel lines at the top left corner of the cheque.

Step 2: Write the date on the top right side of the leaf and the name of the entity that you wish to pay.

Step 3: Write the amount in words followed by ‘only’. It is important to write ‘only’ after the amount to prevent fraud. Fill in the amount in digits also and end it with the ‘/-’ symbol. Finally, sign in the empty space at the bottom of the leaf.

Here are a few important guidelines that you MUST follow while writing a cheque:

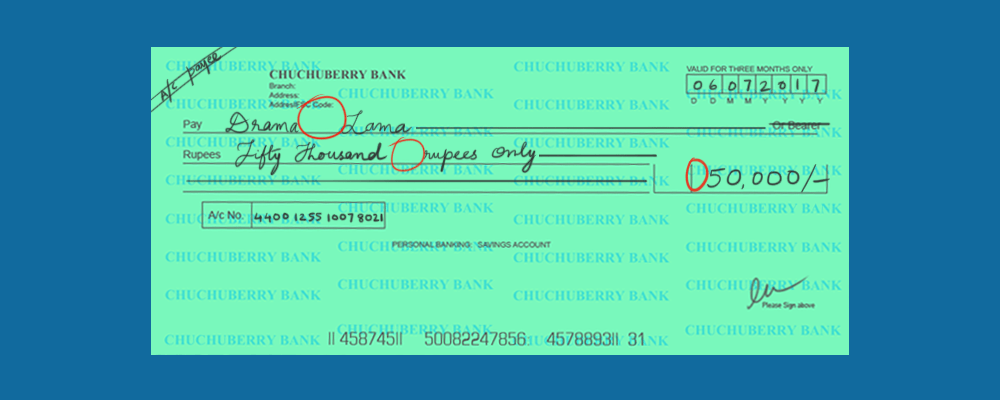

Do NOT leave spaces between words or numbers

When you write the payee’s name or cheque amount, make sure you don’t leave too much blank space between characters or at the end of the line. This will ensure that nobody misuses the cheque by adding a letter or number. Also, avoid overwriting as it introduces confusion that can lead to cancellation of the cheque.

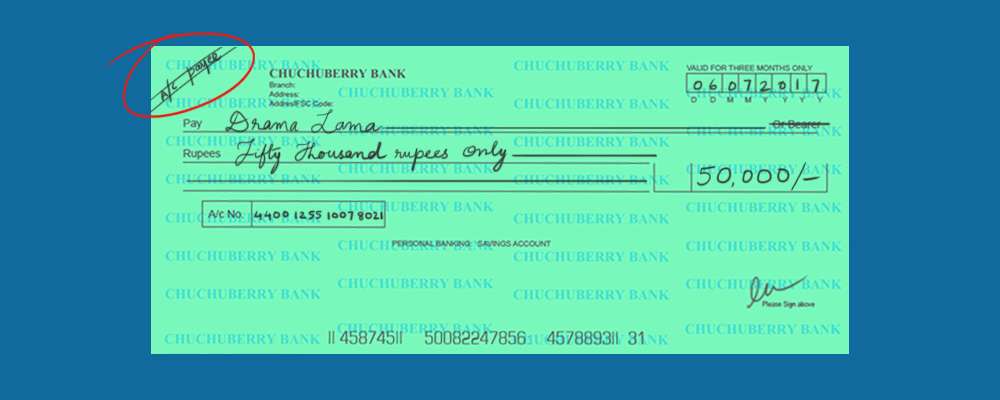

Always cross the cheque with the words “A/C Payee”

To ensure that your cheque payment goes to the right recipient, draw double-cross lines at the top-left corner of the cheque leaf and write ‘A/C Payee’ within these lines. This is done to make sure that your money gets credited to a bank account and is not handed over to someone as cash over the counter.

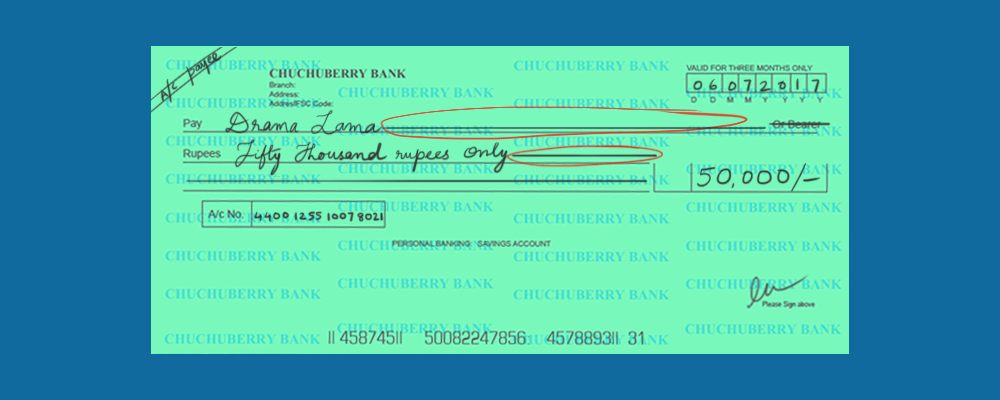

Add a line after the name and amount till the end

Pro tip: Always add a running line (————) at the end of the payee’s name as well as the cheque amount in words. This will rule out any possibility of cheque manipulation.

You must cancel the word “Bearer”

In the pay section, you’ll have space to enter the payee’s name. Towards the right corner of this section, you’ll see “Or Bearer” written on the cheque leaf – you’ll need to strike this off. If not stricken off, it implies that either the payee mentioned in the cheque leaf or anyone who bears the cheque can cash it as long as the A/C payee is present on the leaf.

How do I get a new cheque book?

Once you have exhausted all the cheque leaves in your cheque book, you can place a request for a fresh one by simply filling up a requisition slip (provided in your cheque book).

Fill up the slip and submit it at your respective bank branch or bank ATM. You can usually collect your new cheque book over the counter or have your bank mail it to your registered address.

PS: Since going out amidst the COVID-19 pandemic poses a health risk, it’s better to place a request online. You can use any of these below channels:

Internet Banking

Just log in to your net banking site with your credentials and select the cheque book link under the ‘Requests’ tab (user navigation may differ from bank to bank). Select the account for which you require a cheque book, enter the number of cheque leaves required along with the mode of delivery – that’s pretty much it!

Mobile App

Similarly, you can also use your bank’s Mobile App and place a request for a new cheque book.

Can you submit the request at the nearest ATM?

Yep, simply follow these steps:

Step 1: Insert your Debit Card.

Step 2: Enter your Debit Card Pin.

Step 3: Select an option to issue a new cheque book.

Step 4: Submit your request and you’re done!

FYI – you can also place a request for a new cheque book via your bank’s customer care number.

Will I be charged a fee for a new cheque book?

Each bank has a fixed number of cheque leaves for each cheque book. This number may differ from bank to bank. Once you’ve used up your existing cheque book, you’ll need to place a request for an additional cheque book – your bank will charge you for the new book – the cost too may vary from bank to bank.

How do I transfer money between two of my own accounts via cheque?

To do this, you just need to write a crossed cheque in your own name from the account where you wish to transfer money from and deposit the cheque in the account that is to be credited.

For instance, let’s say you want to transfer funds from your HDFC Bank account to your ICICI Bank account. In this case, you can write a cheque from your HDFC Bank cheque book (in your name) and present the same to the teller at your ICICI Bank branch or a cheque dropbox in an ICICI ATM for depositing in your ICICI Bank account. You would need to attach a cheque deposit slip (provided at the bank or ATM) to your cheque with all the details duly filled.

Psst… don’t forget to mention your ICICI bank account number on the back of the cheque (another best practice)

Can I withdraw money from my bank via cheque?

You can withdraw money from your bank account by simply writing a cheque to self.

To write a self-cheque, you’ll need to write ‘SELF’ in the ‘PAY’ section of your cheque leaf.

Note: Do not strike out the word ‘Bearer’ at the end in this case and do not write ‘A/C Payee’ within double lines at the corner of the cheque.

Next, fill in the other sections as per the steps mentioned above in this article & encash it at the bank counter.

Note: You might have to sign on the opposite side of the cheque in front of the bank authority before you can get the cash; this is done to verify if the account holder and the one who signs the cheque is the same individual.

P.S: You can’t just use any bank’s cheque to withdraw cash from another bank.

Can I correct or overwrite a mistake in my cheque?

If you have made a mistake while writing a cheque, you can strike the mistake out, write the correct information and place your signature next to the correction (in the same colour ink/ using the same pen). However, we recommend that you tear up and discard the cheque with the mistake in it and write a fresh one as the bank could reject your cheque if it contains corrections and overwrites. Overwriting, strikeouts and so forth may strike a banker as being suspicious.

How do I stop a cheque payment?

If you’re in a situation where you need to stop your cheque payment, you can use netbanking to do just that.

Just log in to your internet banking with your ID and password. You should find a “Stop Cheque Payment” option from your user menu. Click on that and then enter your cheque number and provide a valid reason as to why you need to stop your payment. Finally, click on ‘Submit’.

Alternatively, you can also make use of the bank’s phone banking services to seek help with this task.

What if my cheques are lost in transit or during the clearing process?

If cheques are lost in transit or in the clearing process, the bank should immediately inform you so that you can ask the drawer to issue a stop-payment order. This is done to make sure that the cheques issued by you aren’t dishonoured due to non-credit of the amount of the lost cheques.

In such cases, the bank will also reimburse the related expenses for obtaining duplicate instruments + interest charged for delays.

Additional Reading: Cheque – The Fallen Hero Of The Banking World

If my cheque book is lost/stolen, what should I do?

In case your cheque book is misplaced or lost, what you need to do is immediately file an FIR at your nearest police station. (You can do this online too).

The next step is to contact your bank and place a request to stop all payments by cheque. To enable this, you’ll need your cheque number, the exact amount, and the person you made the check out to; this information is essential in order to issue a stop cheque-based payment.

Should I bother to maintain a list of payments made via cheques in the space provided in the cheque book?

Maintaining a record of all your important financial transactions in the record slip (which comes with your cheque book) can be handy, especially when you want to cross-verify transactions with your bank.

What’s the validity of a cheque?

A cheque is valid only for three months from the date of issue. This is why your cheque date is a very important element. Any cheque that is presented for collection three months after the date of issue will be marked as an ‘out-of-date cheque’. If you’re writing a post-dated cheque, make sure you enter the date only after which it can be encashed.

What is a cancelled cheque?

As the name suggests, a cancelled cheque is any cheque that has a label ‘cancelled’ across it. It is a common know-your-customer (KYC) document used to verify bank account details like account number, account holder’s name, MICR and IFSC and name and address of the bank branch.

Here’s a quick video that will give you a quick lowdown on all the important things that you need to know about a cancelled cheque:

Use of Cancelled Cheques

What does dishonour of cheque mean? When does a cheque get dishonoured?

Dishonour of a cheque is a situation where the bank refuses to pay the amount of the cheque to the payee.

When you make a payment via a cheque to any individual, institution, firm, etc., the bank sends the cheque for clearance and, once it is cleared, it honours the cheque and releases the payment to the concerned person.

Additional Reading: Everyone’s Going The Digital Way

Please note that the bank may not approve your cheque in some situations as below:

- If there aren’t enough funds in your account

- If there is a difference between the amount mentioned in words and figures

- If the cheque date is beyond three months

In any of the above cases, the concerned party will not receive the money and, additionally, you may have to pay cheque-bounce charges to the bank. So now you know why it’s important to cross-check your details before submitting it!

What happens when a cheque bounces? Am I liable to pay any charges?

If your cheque bounces either due to a mismatch in the signature, insufficient funds, or any other reason, both you (the defaulter) and the payee will be charged by the respective banks.

In cases where your bounced cheque is against the repayment of a loan, you’ll have to bear the cost of late-payment charges (which may be anywhere between Rs 300 to Rs 700) as well as a penalty fee.

What’s more? A bounced cheque can also impact your Credit Score. Clearly, there are enough reasons to make sure you make your cheque payments properly!

Additional Reading: The Legal Consequences Of Bounced Cheques

What is a payable-at-par cheque?

Payable-at-par cheques refer to those cheques that can be encashed at any bank branch across the country without any additional charge.

For instance, say you have a bank account in Delhi and have to make some payments in Bengaluru on your visit to the city. Here’s what you do – make the payment through a payable-at-par cheque at a bank branch in Bengaluru.

This type of cheque is treated like a local cheque and, hence, works as a substitute for demand drafts and, at the same time, saves cost.

What is a cheque deposit slip? How do I fill one?

In recent times, a lot of banks have done away with cheque deposit slips – a paper slip attached to cheques which serves as proof of deposit at the end of the day. These days, more ATMs have an electronic cheque reading facility during the time of deposit. However, if your bank is still kicking it old school, here’s how to handle a cheque deposit slip.

As you enter a bank, you’ll usually see deposit and withdrawal slips stacked on a table from where you can pick one up or request one at the counter.

A deposit slip has two parts – bank copy and customer copy. Both will need to be filled correctly. Fill in the details on the slip such as name of the bank branch, the day and date on which you are depositing your cheque, the type of account into which the cheque is being deposited (usually savings), the account number to which the deposit is to be made, mobile number, email ID and the amount of deposit.

You’ll also need to fill in the cheque number and the name and details of the bank on which the cheque is drawn. The cheque number is a six-digit number at the bottom of the cheque (within quotation marks). Also, remember to sign the deposit slip.

Attach the deposit slip (bank copy) to your cheque with a paperclip and hand it over at the counter (or drop it into the cheque deposit box at the ATM). Be careful not to damage your cheque while doing this. Retain the customer copy part of the deposit slip with you for your future reference. It is proof of your deposit and will be helpful in case any issue arises in future.

NEW RULE: Positive Pay System (effective from Jan 1st, 2021)

The RBI is all set to introduce a Positive Pay system for cheque payments of Rs. 50,000 and above. Read on to know how this system works.

1. Once the payer issues the cheque, he/she will then have to share cheque details such as the cheque number, date, payee name, account number, cheque amount, etc., with the bank along with photos of the front & back faces of the cheque leaf.

2. The bank will then match or reconfirm the details on the cheque with the info provided by the payer. The payment will be processed only when these details successfully match.

3. Any discrepancies in details will be flagged for further action from the banks involved in the transaction.

The objective of this move is to eliminate chances of cheque fraud and tampering. While this facility is currently set to be at the discretion of the account holder, banks may make it mandatory for cheque payments of Rs. 5,00,000 and above in the future.

There you go, folks; we hope we’ve answered all your queries relating to cheques in general.

If you’re looking to embrace the digital wave in the world of personal finance, now’s your chance to get instant access to loans and Credit Cards at the click of a button. What are you waiting for? Go right ahead – you may be pre-approved for some festive offers!

Quite informative. There are always so many questions around usage of a cheque, a piece like this one can be very helpful.

Hi Shipra Sorout,

Appreciate your feedback. Have a nice day!

Cheers,

Team BankBazaar

Extremely helpful and informative!!

Hi Lakshaya bakshi,

Glad we could be of help. Have a nice day!

Cheers,

Team BankBazaar

Very Useful, Helpful, and Valuable Information, I really enjoyed it and learned a lot.

Hi Vijay Sharma,

We’re glad you liked this article. Have a nice day!

Cheers,

Team BankBazaar

Can you plz tell me how to make cheque for transfer from my one bank account to my another bank account? Example means I need to transfer money in my HDFC account to my another account in ICICI. Plz help

Hi Kula Shekar,

You will have to simply write a cheque in your name (as in your ICICI account) with the amount you need to transfer on your HDFC cheque leaf and drop it in your ICICI cheque deposit box.

Cheers,

Team BankBazaar

I want to reactivate my ppf account and for that i have to pay the fine and amount for every year. how should i fill the cheque for fine and for depositing in ppf account

Hi Manohar,

To reactivate a dormant PPF account, you have to visit the bank branch or post office where your account is held, and submit a written request. For each financial year that your account has been dormant, a penalty of Rs. 50 is levied, which must be paid to initiate the reactivation process. You also have to pay the minimum deposit amount of Rs. 500 for each year your account has been inactive. Once the verification process is carried out, your PPF account will be reactivated.

Cheers,

Team BankBazaar

How many cheques can we issue in one single day ?

Hi Shalini,

While there is no cap on the number of cheques you can issue in a day, you can only issue cheques of up to a maximum limit of Rs. 10 lakhs.

Cheers,

Team BankBazaar