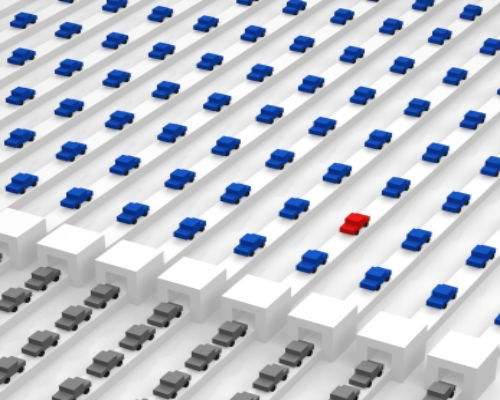

Had you invested in the Auto sector stocks last year, you could have earned a healthy return of more than 35%. While the long term growth prospects of this industry looks bright, surging inflation and input costs might act as an impediment in the short to medium term. So, if you are interested to invest in a couple of Auto industry stocks and worried at how the industry will be reacting to the forthcoming budget then this article is worth giving a read!!

Wish list for Auto Sector

- Inflation: Going by the current trends on inflation, there is a belief that the inflation is primarily caused by the supply side constraints and hence the Government should take up the responsibility to build infrastructure to mitigate the resource constraints. Currently the interest rates are very high and hence the demand for Automobiles has plummeted. Apart from this, rising input costs and fuel prices could impact the margins. Therefore if measures are taken by Government to curtail inflationary pressures it will have a positive impact on the Auto sector stocks.

- Access to Low Cost Capital: As Auto industry is a capital intensive sector access to low cost capital will help the industry to grow at a faster rate. Currently the interest rates are already high because of surging headline inflation and hence it is becoming extremely difficult for companies to raise low cost capital. Therefore the industry would look forward to signals from the finance minister on accessing cost-effective capital for the industry in the forthcoming budget. Also Government needs to look into the land acquisition reform, labor reforms, incentivizing R&D etc. All the measures will have a strong positive impact on the Auto Stocks.

- Transfer pricing provisions: The auto sector has been impacted greatly by the transfer pricing provisions in the past. One of the major impediments is the unavailability of relevant data for a fair comparison. Various contract manufacturers supplying to foreign entities bear low risk and are generally compensated over their manufacturing cost. In comparing those transactions, adjustments are required to account for the differences in risks. The Indian Transfer pricing regulations doesn’t provide any guidance on adjustments which affects the auto industry in substantiating the transfer pricing. Hence any steps taken by the Government in this union budget will be welcomed by the community.

- Taxation: On the taxation front, there are lots of expectations from the forthcoming budget. Major parts of the cost of the most auto components are the key raw material (Aluminum and Alloy Steel) costs and hence removal of the special additional duty and reduction of duties on key raw materials will have a positive impact on the Auto component manufacturers. Also the provision of inverted duty structure in Free trade agreement is affecting the competitiveness of Auto component manufacturers. As per the inverted duty structure the import duty on finished products will be lower than on parts and components used in manufacturing of the parts. Reducing the Minimum alternate tax and increasing the depreciation rate are other few expectations that the industry seeks in this year’s budget .Simplifying the Cenvat credit provision will also help in improving the cash flow.

Copyright reserved © 2026 A & A Dukaan Financial Services Pvt. Ltd. All rights reserved.