Debt has become one of the most dreaded words in recent times. One consequence of the deepest recession since the depression is the build-up of public debt.

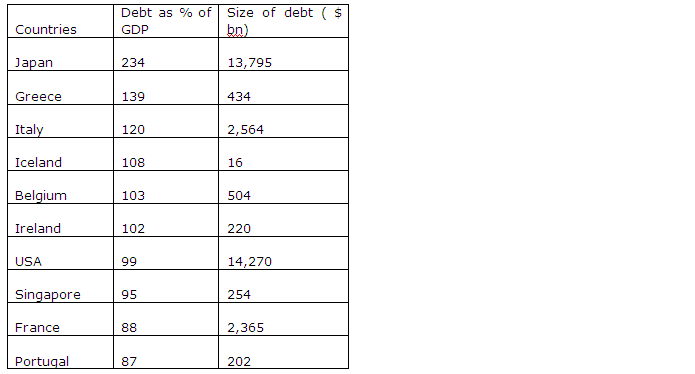

10 `most in debt’ developed countries

National debt to the size of the economy (GDP) is one of the most important economic indicators in assessing the current and future health of the economy. The national debt consists of loans borrowed directly by the government plus any debt of the government corporations which have been guaranteed by the government.

These figures are calculated on an exchange rate basis, i.e., not in purchasing power parity (PPP) terms.

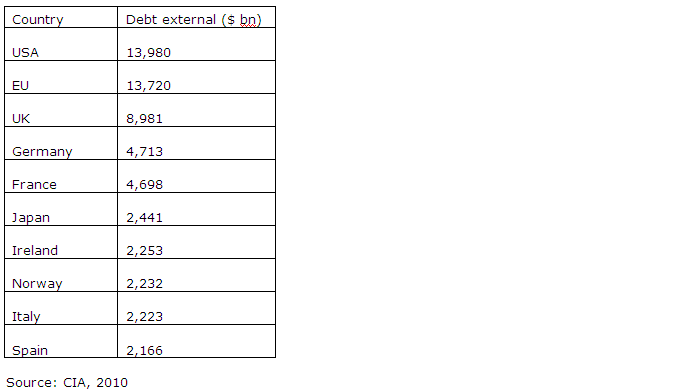

Public debt is the most relevant data for discussions of government default and debt ceilings. It is different from external debt, which instead reflects the foreign currency liabilities of both the private and public sector. External debt is that part of the total debt in a country that is owed to creditors outside the country. The debtors can be the government, corporations or private households. The debt includes money owed to private commercial banks, other governments, or international financial institutions such as the IMF and World Bank (Source: Wikipedia)

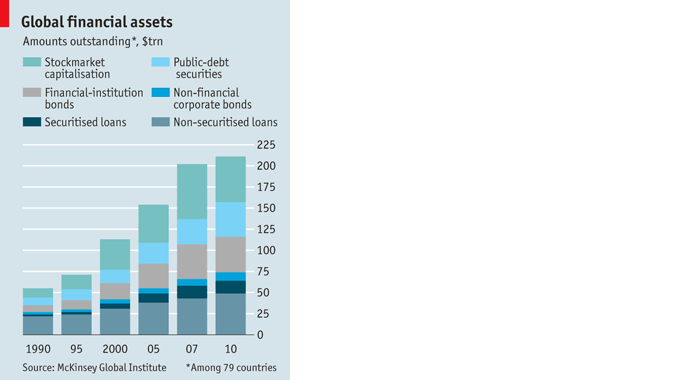

As per McKinsey the global debt increased by 3% to $158 trillion, reaching 266% of GDP in 2010.

The recent credit bubble burst has led to an enormous burden of debt. Today, countries are pondering as to how to prevent similar crisis in future and how to reduce the debt. The US national debt is 4,700 times larger than it was in 1913 when the central bank was created. With higher inflation and lower employment generation, the country is facing double dip recession.

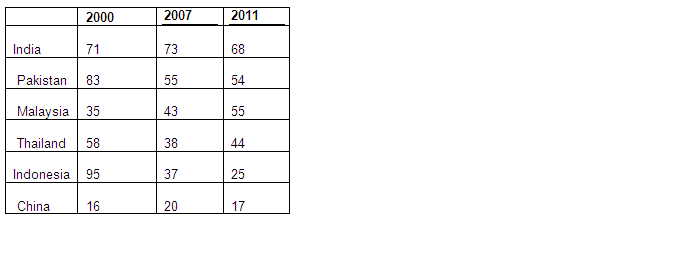

Lets us see where India stands: While India does not feature high on the list of most indebted countries in the world, it is ranked 1st in Asia. Though the debt ratio has declined from 71% to 68% in 2011, it is still high compared to its Asian peers.

General government gross debt ( % of GDP)

Source International Monetary Fund, World Economic Outlook Database, April 2011

Source International Monetary Fund, World Economic Outlook Database, April 2011

The amount of India’s outstanding debt burden is expected to increase by 10.7% to Rs 43.5 lakh crore by March 2012 on account of high levels of market borrowing. Outstanding debt liability of the government would rise from Rs 39.3 lakh crore at the end of the current fiscal. The main reason for rising debt is higher crude prices. At present almost 80% of crude oil demand is met through imports.

Also the problem of fiscal deficit continues to worry the government. It has estimated target of 4.7% for the fiscal year 2011-12 which looks as a significant challenge. India’s fiscal deficit in April-June quadrupled on-year to Rs 1.62 trillion from Rs 401.96 billion in the same period last year, as per the latest government data. The buildup of public debt as a result of large and rising fiscal deficits is not a good sign.

Rising inflation and higher interest rates coupled with global slowdown have caused worries. On account of the moderation in industrial output, the government also lowered its GDP growth projection for 2011-12 to 8.6% from the earlier estimate of about 9%.

While the government is taking steps to tighten the expenditure, corruption and politics (for eg : it is advisable to reduce the fuel subsidy, however it is not done on account of political pressure.) are hampering the measures.

While India has strong growth prospects, care has to be take to restrict debt levels as in times of slowdown, interest payments becomes a problem. Also debt increases the interest burden in the budget and restricts the government to take measures as seen in case of Fed. Hence the need of the day is proper fiscal prudence and governance. Currently S&P has given India a rating of BBB-, the lowest investment grade. In order to improve the grade, care needs to be taken to reduce or constrain the growth of debt.

good information!!