Looking for an ELSS fund to save taxes? This fund from IDFC with decent returns in the long term can help you.

IDFC Tax Advantage Fund is an Equity Linked Savings Scheme (ELSS) that aims to generate long-term capital growth from a diversified equity portfolio. You can Invest up to Rs. 1.5 lakhs and save up to Rs. 45,000 in taxes as permitted under the Income Tax Act, 1961 (This is for FY2018-19 based on highest income tax slab and Indian resident person below the age of 60. Tax savings may vary as per applicable tax slab. Tax treatment is subject to change in tax laws treatment).

What are the benefits?

The fund offers two benefits

-

- An investment option for tax Saving under Section 80C

- Investments in equities that could generate good returns in the long run

How good is the fund?

- The Fund is rated 4 stars by MorningStar (April 2018)

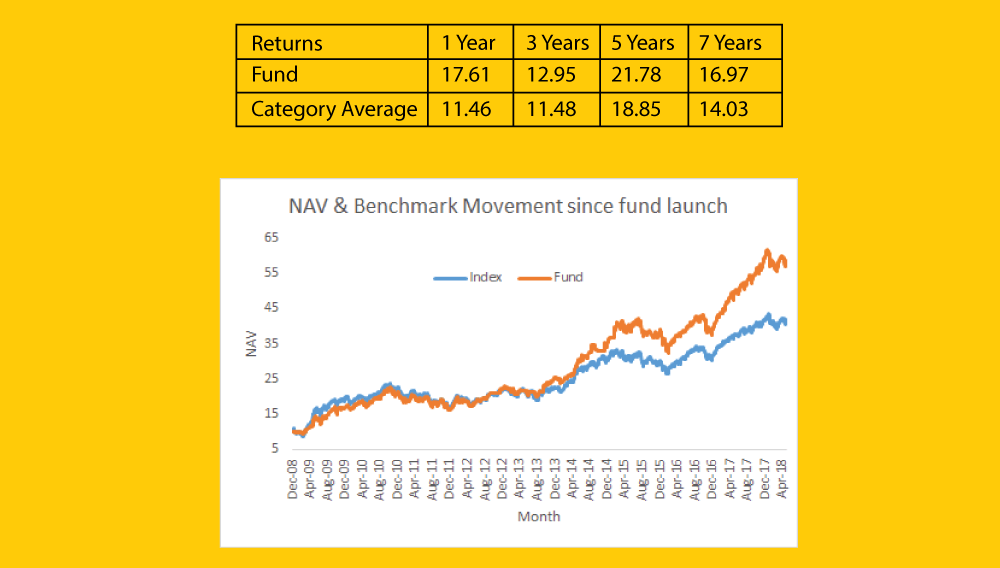

- The fund returns have exceeded the category average return across all tenures

- The fund’s returns have beaten that of the benchmark index (BSE 200)

Fund highlights

- Rs. 10,000 invested when the fund was launched will be worth Rs. 58,182 as on 31 May 2018

- The fund was launched on 26 December 2008 and manages an AUM of Rs. 1429 crore (April 2018)

- The top 3 preferred sectors for the fund are banks, software and auto ancillaries. They account for close to 30% of the portfolio (April 2018)

Looking for more investment options? You’ll find plenty on BankBazaar.

Copyright reserved © 2026 A & A Dukaan Financial Services Pvt. Ltd. All rights reserved.