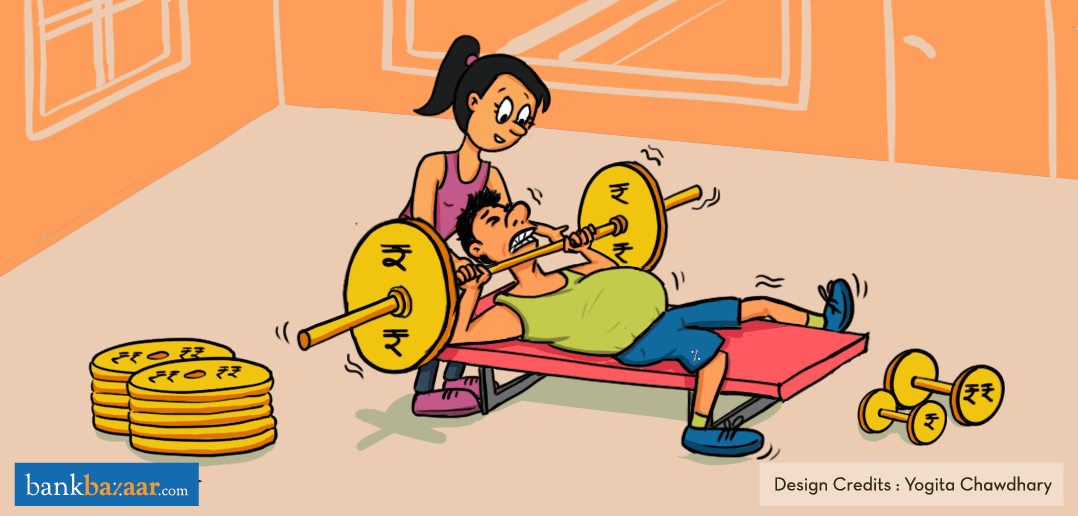

Want your finances to look their absolute best? Here are some sure-shot exercises that will give your money the workout it needs. Read on!

Just think about it; what would your financial situation look like if you were asked to imagine it to be a person? As with our fitness goals, we all want our finances to look fit and fine too, right? This article’s going to help you achieve just that!

What does a gym trainer do? He or she formulates a workout schedule that will give you results. Similarly, you can think of us as your finance gym trainers. Depending on what category your finances fit into, you can follow the prescribed exercises – they’re worth the end result.

Here are our categories of finance fitness; you could identify with the one that closely relates to your scenario.

The Couch Potato

Your finances belong to this category if they’ve just been lying around in your bank account without purpose. Typical characteristics of a “couch potato” financial situation are zero investments and no credit planning due to primarily one thing – procrastination and laziness.

Recommended exercises:

- Check your Credit Score every month so that you can figure out where you stand in the eyes of lenders and plan your credit applications wisely in the future. Don’t have a credit history? Time to build one – get a Credit Card.

- Don’t just let your money stagnate in your account; invest it in fruitful pockets such as Mutual Funds or Fixed Deposits – this way you’ll start creating wealth.

Additional Reading: How Women Can Save For Career Breaks

“I-work-out-only-to-burn-my-holiday-weight”

It wouldn’t be a surprise if many of us identified with this category. This scenario comes to life when an individual pretty much knows the right moves to make, but only makes them when he or she feels things have gone slightly out of hand. This situation can be best described as the knee-jerk financial reaction. Here is an example:

“Oops… I’ve missed an EMI payment on my Personal Loan. Now I’m going to make sure I don’t miss the next few!” – and then this promise fades away with time until there’s another slip-up.

Recommended exercises:

- Read your credit report regularly and verify your payment history

- Be disaster-ready, i.e, don’t wait for a slip-up to employ good financial habits

Additional Reading: Money Management Tips That Will Change Your Life

“YOLO bro, I go with the flow”

While living in the present surely has its upside, aspects such as finance may need some foresight. Think of it this way; a good financial plan can ensure that you can live your YOLO life without stress in the future. Just like fitness, finance also needs planning and dedication to help you maintain a certain quality of life.

Recommended exercises:

- Extend what you’re already doing to manage finances on a daily basis to a weekly basis, then to a monthly basis and so on

- Save consistently so that you aren’t short of cash the next time your YOLO urge kicks in. Makes sense, right?

Additional Reading: 7 Must-Have Money Management Apps To Track Your Finances

“My Finances Are So Fit They Have 6-Pack Abs”

If this line fits your current scenario, you’re doing just fine! Continue to flex your financial muscles just like this – consistency is key. Also, feel free to drop some exercises for people who belong to the above categories so they can help their finances look fighting fit!