Does the very thought of applying for loans, insurance and credit cards create a huge dark cloud over your head? Do you feel demotivated upon reading the first few lines of financial jargon that seems to make sense only to lawyers and astrophysicists? Do you want to access the incredibly lucrative world of investments and be able to manage your personal finances? Then the BankBazaar app for mobile devices is definitely for you!

The app not only gives you the best of information, but also aids you in your application procedure for a range of financial products on offer in India.

Key features of the app

- All available information is researched, collected, collated and presented with minimal confusing financial jargon by a dedicated team of financial content experts.

- Content is presented in a manner that’s accessible and understandable by everyone – clearly outlining the fine print and potential pitfalls of different financial products, in addition to their benefits.

- All content is India-specific, and written for you – the employed chaser of the Indian dream – who works and contributes taxes to the development of a better India.

- Comparison tables and charts that neatly outline the key features, benefits and disadvantages – under clearly defined headings and parameters – to help you choose better.

- Calculators for everything from EMIs to interest rates to make your life easier.

- Eligibility checks for many financial products – all you need to do is enter your details and the app will do the rest.

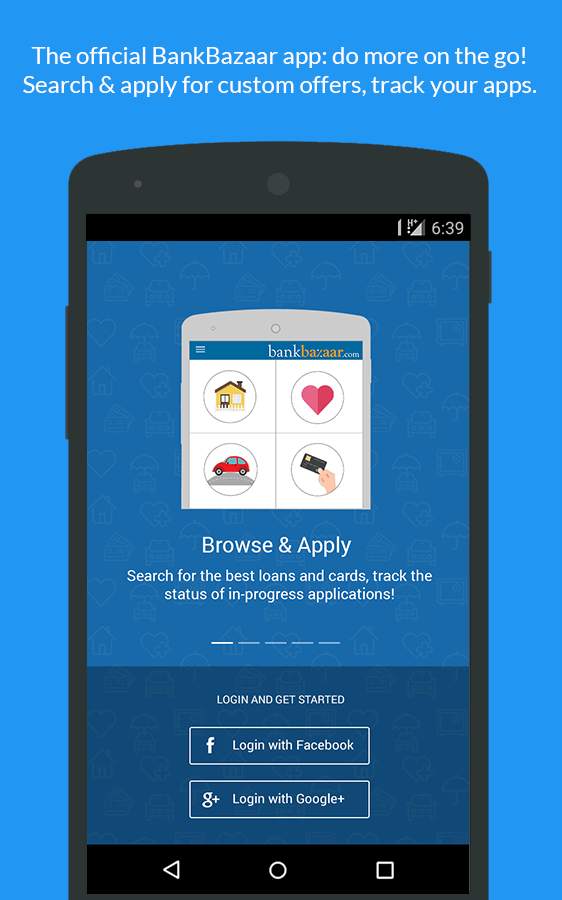

- You can apply for credit cards, loans, insurance, fixed deposits, etc. directly through the app itself.

What information is available on this app?

The app contains all the information you need to consider – like interest rates, rewards programs, fees and charges, application procedures and claim procedures, variants and offers, advantages and disadvantages and even FAQs (as applicable) – for the following financial products. The content even includes possible pitfalls in fine print that most people ignore and later wish they hadn’t.

Credit Cards – Information and all parameters are presented in a way that won’t give you a headache, with an impartial attitude towards all banks – giving you the power to make a well informed decision.

Loans – information provided in a manner that gives you knowledge without nudging you towards any provider in particular. The information is at your disposal, upon your request. You can pursue personal loans, home loans, car loans and education loans, and even apply for the same through the app.

Fixed Deposits – details for all deposits on offer by various institutions in India have been made available. You can compare the potential benefit and disadvantages of different deposits in a matter of minutes.

What else can I do with this app?

In addition to finding the best possible credit cards, loans, insurance products and fixed deposits – specifically tuned and tweaked per your requirements, the app also has the following features:

News – a constantly updating newsfeed that is fuelled by an expert in-house content team, taking the latest and most relevant financial information from the net and advising you on how to use new legislations, products, promotions and offers to your financial advantage.

Money Talk – is a part of the app, where you can ask your pertinent finance-related questions to other BankBazaar app users and our in-house experts. You could also use this as a forum to write about your personal experience with a particular financial product from a particular company, or for a custom comparison between specific products. All your questions can be answered by utilizing the collective power of on-the-ground customers like yourself.

Support – is a section designed to address any grievances or consider any requests that you, the customer, may have about the app and BankBazaar. Simply ask a question and a representative will get back to you ASAP.

Resources – the app can give you your IFSC code and MICR code as fast as your internet connection will allow – just by entering your bank branch details.

Application Tracker – this feature allows you to track the status of any application for credit cards, loans, insurance or fixed deposits that you have initiated through BankBazaar. Have multiple applications for various products? No problem, as there is another feature that lists out all your applications for your perusal.

Notifications – containing details of promotions, offers and deals on financial products specifically for your needs as a BankBazaar customer.

Providing you with the vital information you need in structured parameters and comparison tables, this app is truly the tool to be used for financial freedom. Find the right places to invest your hard earned money, the right insurance plans and the right cards to supplement your lifestyle without being trapped in debt.

Maybe an air-miles card from Bank A has the credit limit and reward system you’re looking for, but the interest rates on the petrol-saver card from Bank B is more suited to your needs. You could lose weeks of your life attempting to make sense of the mess of information available online. The BankBazaar Android app collects, collates and presents this information to you on a silver platter, and all you need to do is work your thumbs.

So get with the times and secure your finances. Download the ultimate personal finance planning app now!