Are you looking for the house of your dreams? What’s stopping you from actually getting it? Oh! We get it. It’s the financial part, right? If the fact that you aren’t getting paid all that much is hampering your quest for the right abode, worry not. We have it all covered. Yes, you read that right.

Additional Reading: Why You Should Get A Home Loan Now

If you think that being able to buy one’s dream house is a privilege only people with high incomes can enjoy, you’re wrong. At BankBazaar, there’s something for everyone. No need to stress too much about your Home Loan because we’re going to give you the details of a few offers we’ve got lined up for you. But first, let’s start with the basics.

Before applying for a Home Loan (or any other loan), you must know everything about the prerequisites. The documents required, for instance. Here’s a list of everything you need:

- Identity proof: Any Government ID proof like driving license, PAN card or voter’s ID

- Address proof: Utility bills (landline, electricity etc.), passport or Aadhaar card

- Loan application and photographs of the applicant (s)

- Income proof: Salary slips for last three months

- The property documents

Got all these in place? Great! Let’s move on.

No matter which low-income category you belong to, we have various Home Loan offers based on your salary package.

Let’s assume that the borrower is 26 years of age. Here are different Home Loan offers they can opt for (based on their salary package, of course):

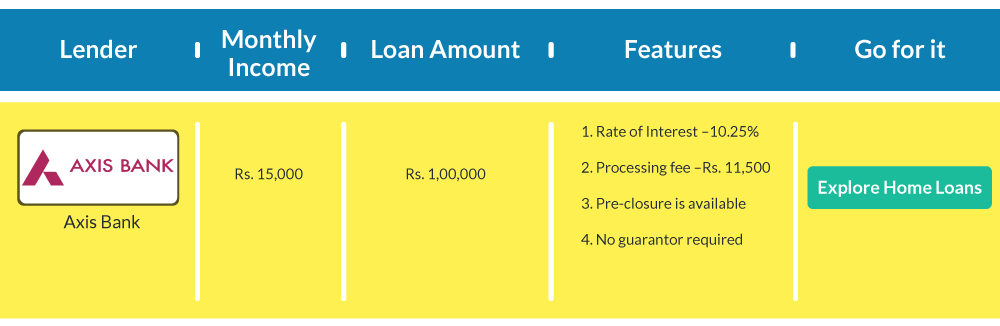

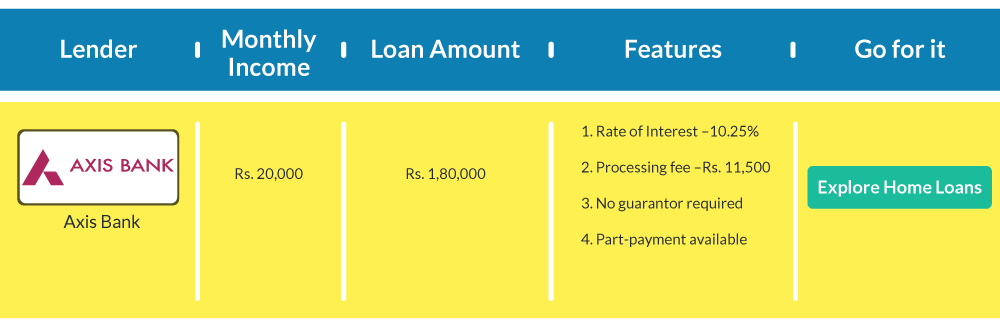

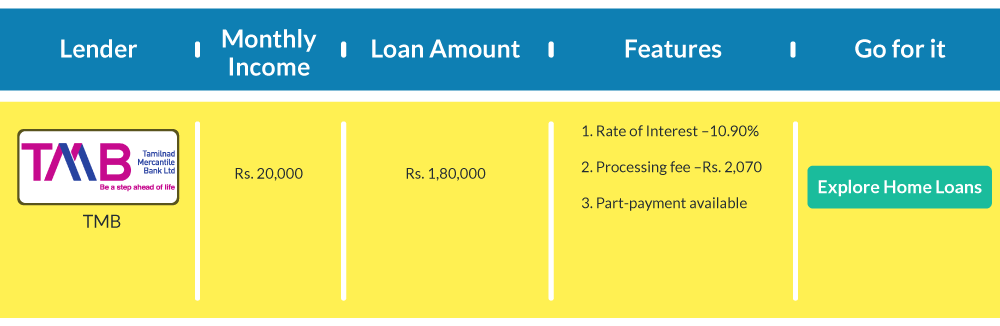

For a salary range of Rs. 15,000 to Rs. 20,000 per month:

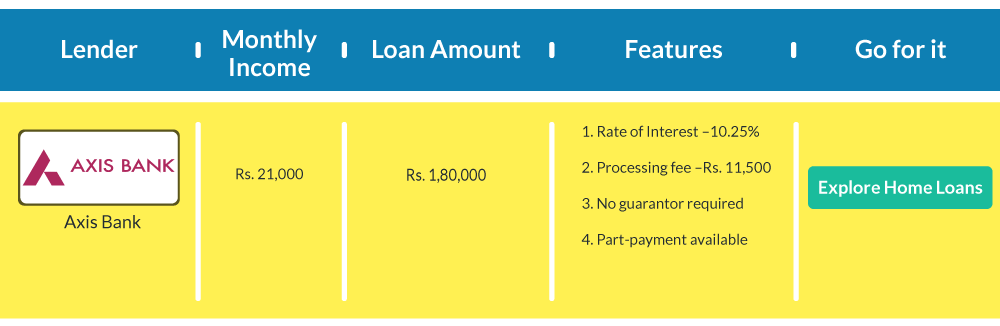

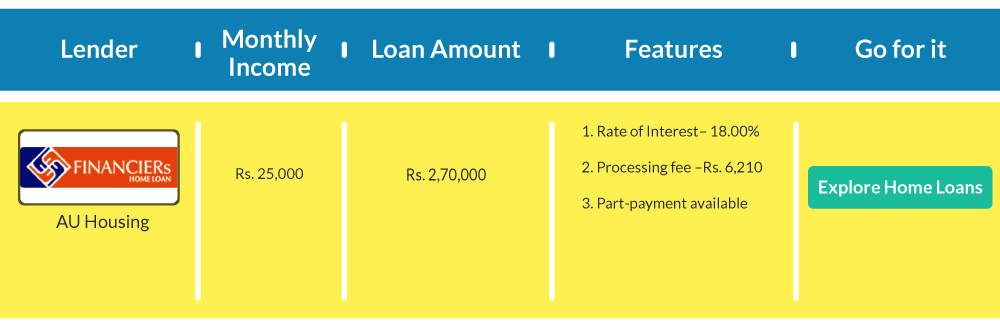

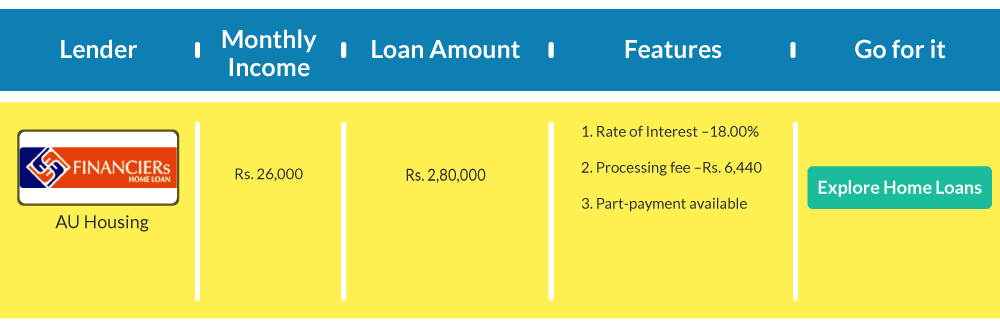

For a salary range of Rs. 21,000 to Rs. 25,000 per month:

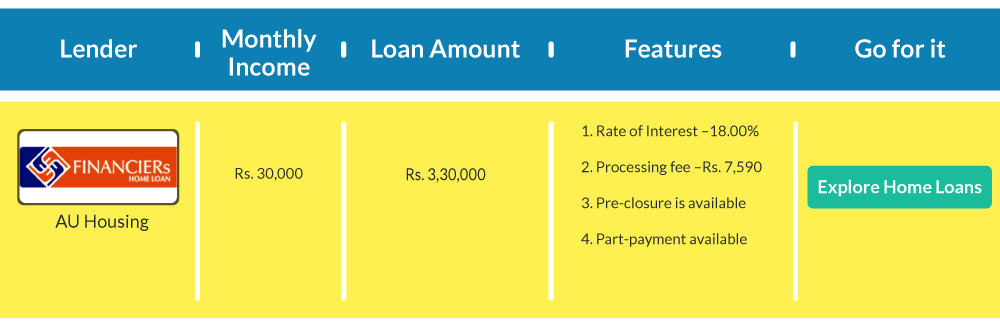

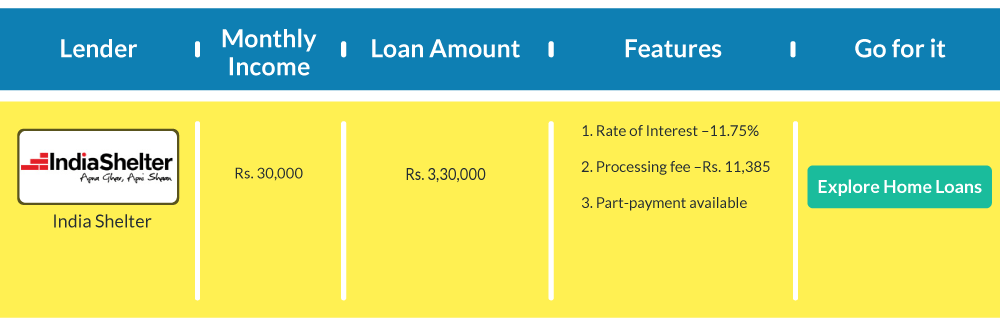

For a salary range of Rs. 26,000 to Rs. 30,000 per month:

See! You have a lot of options to choose from. Don’t let a low salary package wreck your dreams of buying your own house. Explore these loans, check the conditions, see which offer suits you the best, and apply! As simple as that. What are you waiting for?

See! You have a lot of options to choose from. Don’t let a low salary package wreck your dreams of buying your own house. Explore these loans, check the conditions, see which offer suits you the best, and apply! As simple as that. What are you waiting for?