Wedding on the cards? House renovation on your mind? Planning to start a new business or need some financial help to enhance the current one? Need money to clear off small debts? Well, we are sure you have considered applying for a Personal Loan. Personal Loans certainly come to one’s rescue during a financial emergency. However, make sure you double check the factors mentioned below before zeroing in on a loan one. Here’s your checklist!

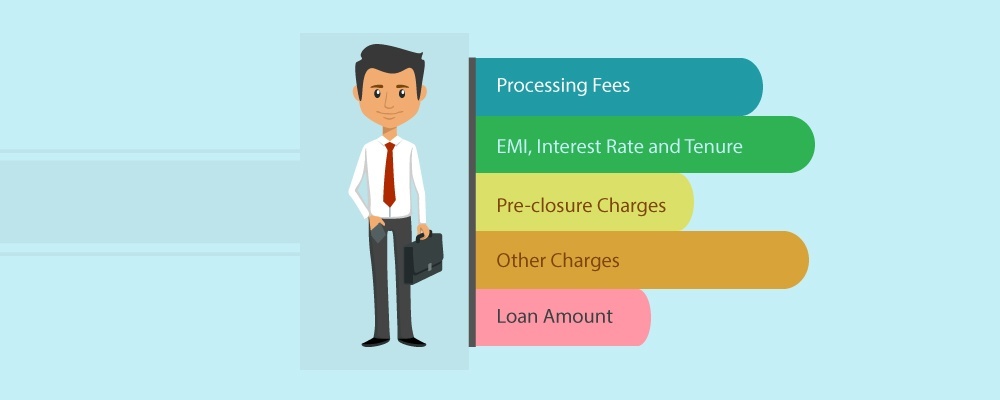

Processing Fees

Most banks charge a processing fee for a Personal Loan. Banks usually charge a processing fee of 2-3% on the loan amount. This is debited from the loan amount before it’s credited to your account. Compare the processing fee of different banks. Some banks deduct a lower percentage of the loan amount towards the processing fee if you have an account with that bank.

EMI, Interest Rate, and Tenure

Make sure you check the amount of the monthly instalment due, interest rate and the tenure of the Personal Loan. If you can afford a higher EMI, go for it, instead of opting for a longer tenure. Nobody likes paying too much money towards interest, right? Choose the EMI amount very carefully, as it will affect your all other monthly expenses too! Based on these factors, you can choose a loan that suits your budget.

Pre-closure Charges

Do you plan to prepay your Personal Loan before its tenure? If yes, then it’s a must to check the pre-closure charges. If you were unaware of pre-closure, we must tell you that Personal Loans can be prepaid before their tenure, but not all banks allow this, and some charge a penalty. Check the penalty charges before deciding on your loan. Prepayment charges levied by the bank can be in the range of 2-5% of the outstanding amount. Also, some banks allow prepayment with a penalty only after you’ve completed a part of the tenure, which can be six months to one year.

Other Charges

Yes, there are other charges involved too. What charges, you ask? Well, if you fail to pay your EMI on the given date, you will be charged a late payment fee. If you have given post-dated cheques for the monthly payment, and your cheque isn’t honoured, you will have to pay a cheque bouncing penalty as well. These costs differ based on the bank. It would be wise if you checked all these charges beforehand, even if you don’t on missing an EMI.

Loan Amount

While checking all the above-mentioned factors is important, it’s equally important to choose the right loan amount. So, what’s the right loan amount? It’s the amount that you need to deal with the financial emergency. Don’t go overboard while choosing the loan amount only because you can opt to take a higher amount. Remember that higher the loan amount, the higher the EMIs and longer the tenure.

Now that you know all about Personal Loans, what are you waiting for? We have plenty of offers for you at BankBazaar!

Thank you so much for mentioning how you should take the time to choose the amount you need and not go overboard when choosing a loan. It is important to remember that taking the time to understand this can help you avoid getting into debt you can not repay. My brother was talking about how he needed to get a loan for his jewelry, so I’ll share your page with him.

Hi Marcus Coons,

Thanks for stopping by. We’re glad we could be of help to you and your family.

Have a nice day!

Cheers,

Team BankBazaar

It helped when you mentioned how you need to consider your monthly payments and lat fee costs when choosing the best loan for you. I understand that doing some research and understand what options are in your area can help you get the financial help you need. We are planning on getting a loan so we can take a short trip out of the country, so I’m glad I found your post.

Hi Marc, We’re glad we could be of help. Keep reading our blog for more insights into the world of finance. Cheers, Team BankBazaar.

Thanks for the advice about considering what extra charges you will incur with a loan. It would be good to consider this because it would affect how fast you can pay it back. I’m trying to get a personal loan, so I’ll have to consider what charges there may be.

Hi Hannah, Here’s an article on the fees and charges that come with a Personal Loan – What are the charges & fees on personal loans?. Cheers, Team BankBazaar

Thank you for sharing the useful post with us.

Hi Wisebuy Investment Group,

We’re glad you found our article useful! Keep reading our blog for more insights into the world of finance.

Cheers,

Team BankBazaar

>>Pre-closure Charges

Team BankBazaar, are there still banks that charge additional fees for early loan repayment or is this a free service in all large financial institutions?

Hi Marina, most banks would charge for pre-closure. Please check with each bank individually before taking the loan.

Cheers,

Team BankBazaar