If you’re worried that your ELSS SIP may be impacted because of a switch in your job, read on.

If you’re tired of slogging away at your job and getting paid peanuts for it, a job switch can hold the answer to your work woes. Not only does a job switch present an opportunity for career advancement and diversifying your skill set, the rise in income will help you step up your investments in Mutual Funds, Fixed Deposits etc. over the years.

Many investors who are just starting out on their investment journey are often riddled with confusion about what happens to their investments especially if they’ve been investing through SIPs when they switch jobs. Well, to put it as straightforward as possible – nothing!

Unless the cool new-office vibe makes you totally forget about heavy stuff like finances and investments and you stop making timely payments on your SIPs, your investments will go on per usual. Aside from this, some investors may even be confused as to which employer they should submit their investment proofs to – their previous employer or their new one? This article should help you put all your concerns to rest.

Additional Reading: A Step-By-Step Guide To Making Your First P2P Investment

Who Should You Submit Your Investment Proofs To If You Switch Jobs?

As per tax rules, you should make investment declarations to both your employers – your previous as well as your current. For instance, if you switch jobs at the end of four months from the start of a financial year, you would’ve submitted your SIP investment proofs for that duration to your previous employer.

Likewise, you will need to submit the same investment proofs to your new employer by including this information in Form 12B that you may have to submit to the latter at the time of joining.

Additional Reading: Aditya Birla Sun Life Tax Relief 96

What Is Form 12B?

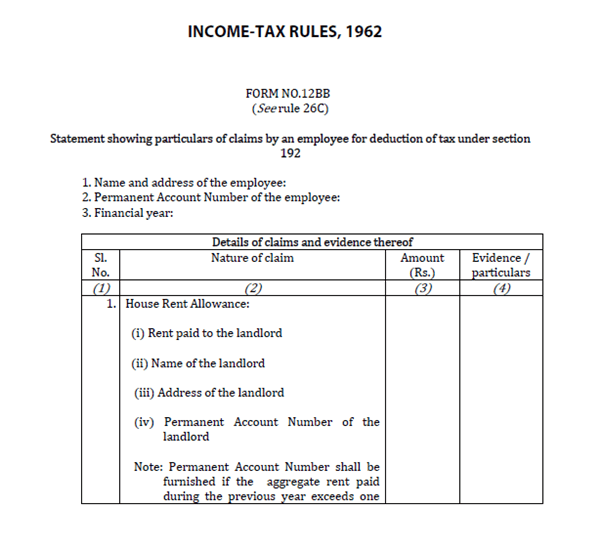

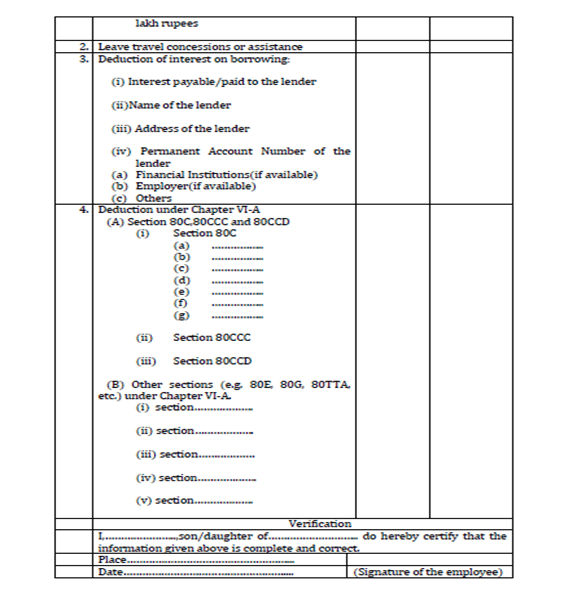

Form 12B is usually handed out by employers to new joiners when they join in the middle of the financial year so that they can include previous income details as well as any tax-saving deductions and exemptions that they may have claimed from that income.

The new employer has to compile this information so that the employee does not claim the same tax benefits twice in a financial year. This will also ensure that appropriate taxes are deducted at source by the new employer after factoring in the previous employment income and total eligible deductions for the financial year.

Additional Reading: Tax-Saving Options Beyond Section 80C

Submit Proofs Of Your Balance/New Investments To New Employer:

After joining your new job, if you continue with your ELSS SIP investments, you must submit the SIP investment proofs for the remaining months to your new employer. You may go ahead and do this even if you’ve submitted proofs for the previous four months to your ex-employer and have also submitted your Form 12B with the new employer. For claiming deductions for any new investments that you have not mentioned earlier in your Form 12B or which were not supported by proofs, you will need to submit the details accruing from such investments to your new employer before the financial year ends.

What Should You Do If You’ve Forgotten To Submit Tax-Saving Proofs To Your Previous Employer?

To start with, prepare to get a much less ‘in-hand’ salary. If you’ve given a declaration of your upcoming investments via ELSS SIP to your previous employer at the start of the financial year but have forgotten to submit proofs against them, then your previous employer will not offer you the tax deduction benefit for these tax-saving investments while calculating TDS from your salary income.

However, if you forget to declare your SIP investments and submit proofs against them to either your previous or current employer, you can still claim tax deductions against them at the time of filing your tax return (ITR) and claim a refund. This would result in a full refund in the tax return in case full tax has been deducted at source. Here’s what a sample Form 12B will look like:

Salary In Lieu Of Notice Period:

If you’re changing companies before the expiry of your notice period in the previous company, you may have to cough up a month’s salary as payment in lieu of the notice period from your own pocket. You will not be allowed to claim any deduction or exemption for such repayment. If your new employer compensates you for this, it will be credited to your account as a part of your new salary which will also attract a TDS deduction.

Additional Reading: Why You Shouldn’t Rush Out Of ELSS After The Lock-In Period Is Over

If You Have Worked For 5 Years In Your Previous Company:

If you’ve completed a continuous period of half a decade in your previous company, you would be entitled to the following:

Gratuity: You are entitled to gratuity if you’ve worked for a continuous period of at least five years. For non-government employees, the maximum tax exemption is the least of: (i) actual gratuity received; (ii) Rs. 10 lakhs; (iii) 15 days salary for each completed year of service or part thereof. The Rs. 10 lakh ceiling is a lifetime exemption.

Transfer of EPF: Withdrawal against your EPF is not taxable if you’ve rendered five years of continuous service. While switching jobs, it’s best to transfer your EPF to your new employer. All you have to do is verify your Universal Account Number (UAN). Such a transfer is not taxable and is considered as continuity of service.

Hence, switching jobs will have no impact on your investments as long as you keep them going. Hit the button below to explore the world of personal finance.