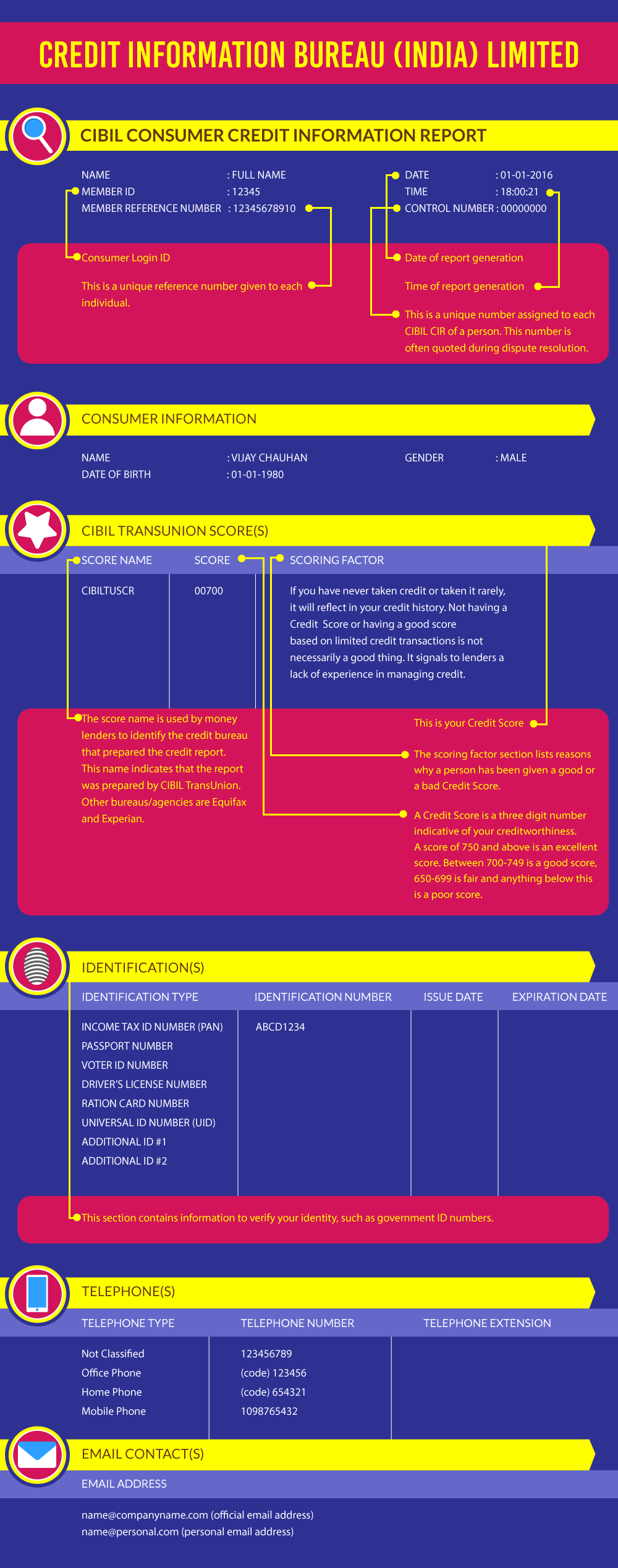

It’s common knowledge that a CIBIL Score is an important consideration when getting a Loan or a Credit Card. But where do you check your CIBIL score? This score is mentioned in your Credit Information Report (CIR) furnished by the CIBIL authorities. Your CIR is a detailed document of your credit accounts and gives lenders insight into your money management behaviour.

To this end, understanding the various components of your Credit Information Report can be a handy trick. Check out our chronological guide to understanding a CIR.

(Click on image to enlarge)

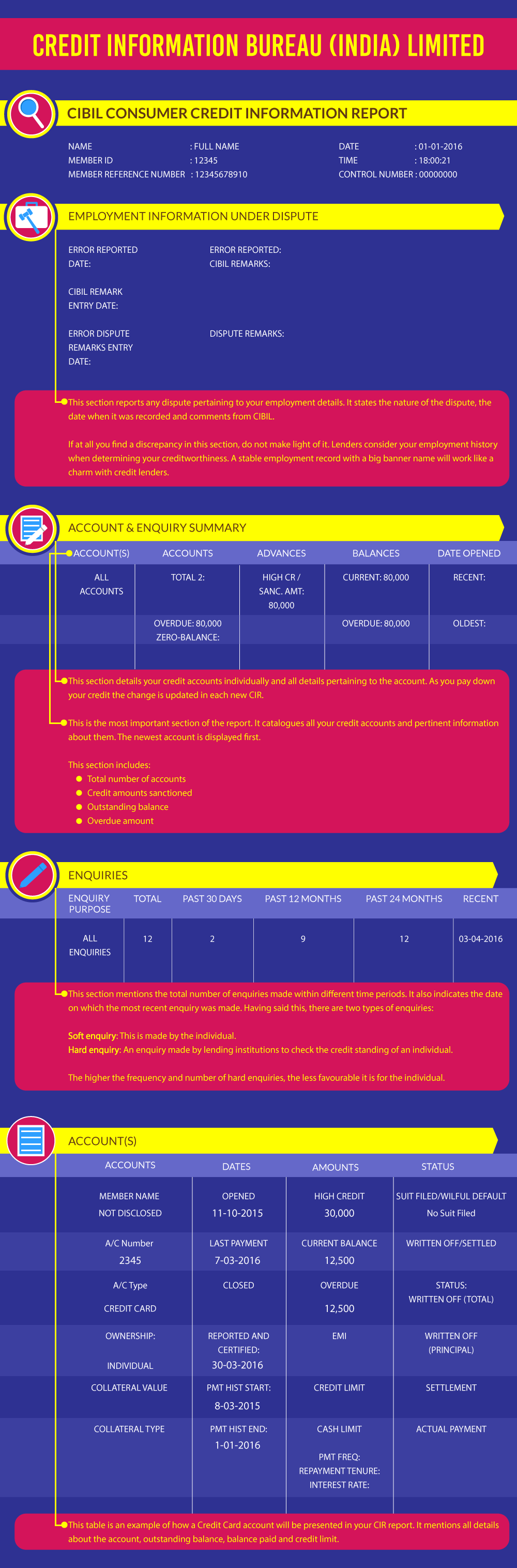

(Click on image to enlarge)

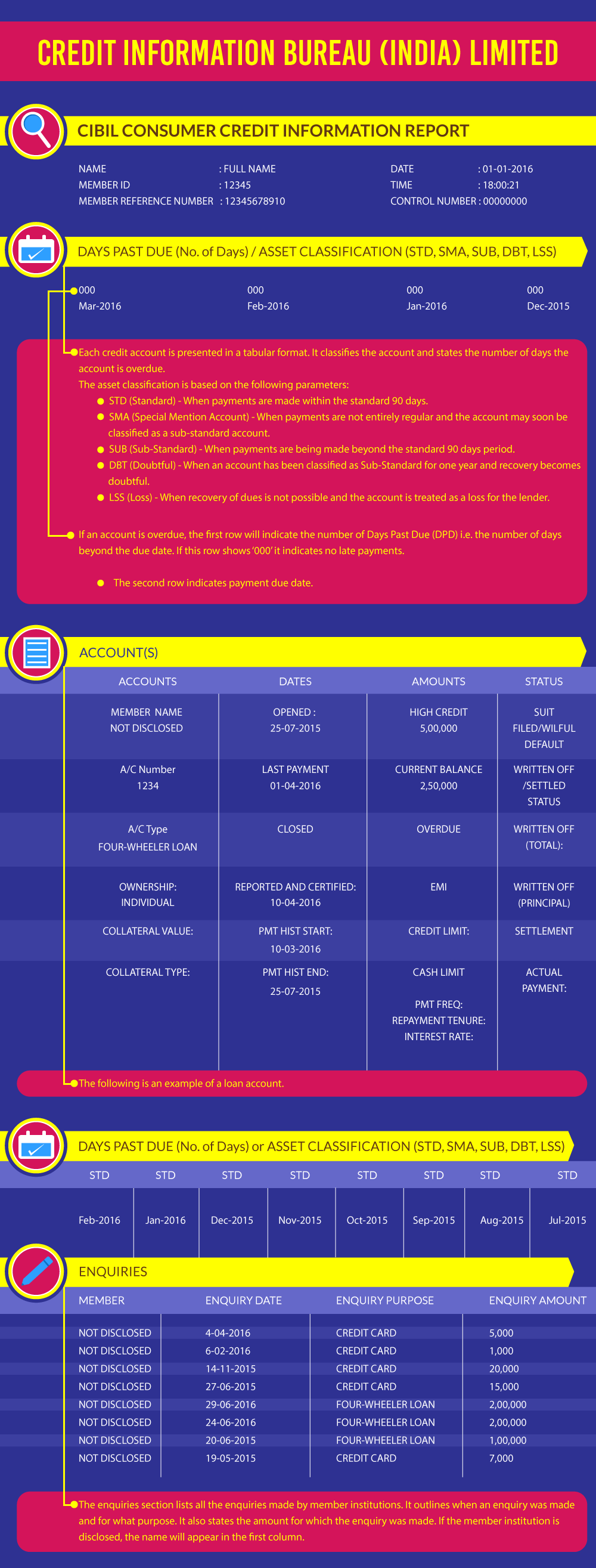

(Click on image to enlarge)

(Click on image to enlarge) Design Credits: Rakesh Mohan

Reviewing your credit report at regular intervals (thrice a year is recommended) will keep you abreast of your own credit behaviour. It will allow you to rectify errors and help you maintain a good Credit Score.

A good report will help you get credit at favourable rates of interest and on favourable terms.