Investments such as Mutual Funds are not always Greek and Latin if you take the trouble to understand them. With the right blend of information and guidance, anyone can make successful investments. It really isn’t a Herculean task.

However, if you delve into investing without some level of caution, it is very likely that you will make a few mistakes that could derail your finances.

If you fancy going the distance with investments on your own, we can help by telling you a few common investing mistakes that Do-It-Yourself investors are likely to make. Read on and get smart about investing on your own.

Additional Reading: Investment Options For Everyone

Investing without considering fees and additional charges

Many novice investors feel that the activity of buying and selling equities is rather satisfying. To see your money growing, especially when the going is good, gives investors a motivational boost. But to ensure success, investors must keep an eye on the transaction fees involved in trading certain stocks. For instance, investors would do well to choose equities that have a low or nil Expense Ratio. Such additional fees eat into the overall returns you stand to get from your equity investments.

Additional Reading: What’s An Expense Ratio?

The fear of losing money

There is always a fear when it comes to investing that you run the risk of losing money when markets dip. However, smart investing strategies can limit your exposure to market volatility. The fear of losing money is especially strong because you are investing your own hard-earned money. We understand. But there are ways to beat fluctuations in the markets and stay ahead of the game.

Psst… Try investing in Mutual Funds through Systematic Investment Plans. By going the SIP way, you can be sure that with small periodic investments over time, your money is protected from the unpredictability of the markets. You can start investing in Systematic Investment Plans with as little as Rs. 500 per month. Who says you need a large sum of money to begin investments? Not at all.

Additional Reading: Decoding Mutual

How Much Should You Invest?

Finding your feet when you begin making investments can take a certain amount of time. There’s no hurry. You should attempt to assess your risk profile. What’s that? Well, a risk profile tells you how much risk you are comfortable with when you make investments. You must also decide how much to invest. Settle on a figure that you are comfortable with, after taking into count all your expenses and financial commitments on a monthly basis. After all, investments are made to grow your money. It will be counterproductive if you find yourself strapped for finances at any point during the month, because of your commitment to making investments.

An easy way to decide how much to invest is to plan your financial milestones. Set yourself some achievable goals. Why are you investing? Is it to buy a house, plan for the down payment on the Home Loan? Also, based on your investment horizon, you should consider the right investment products. If you are investing for your retirement, you may want to choose safe, low-risk Debt Funds. If your goals are less than 3 years away, choose to invest in Short Term Debt Funds. For the long term, Equity Mutual Funds are your best bet.

Remember, you can benefit more by remaining invested for the long term. Don’t sweat the frequent fluctuations in the markets. These will stabilise over the long term.

Additional Reading: Introduction To Equity Mutual Funds

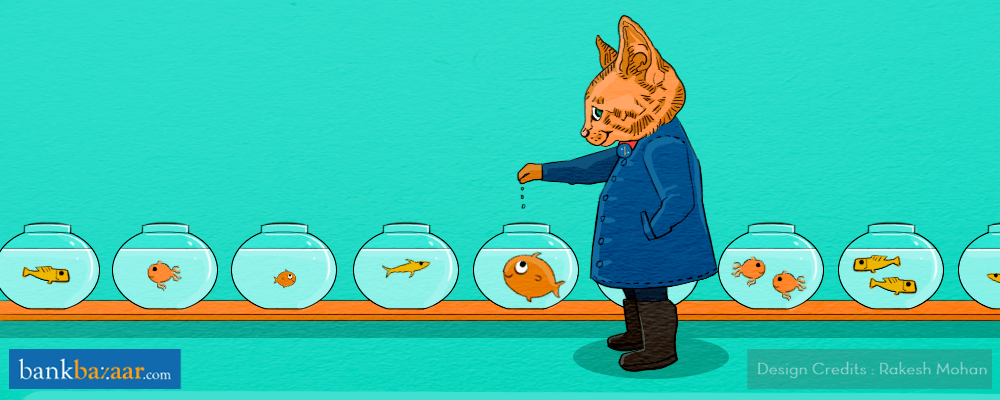

Insufficient Portfolio Diversification

What is portfolio diversification? Many Do-It-Yourself investors get the general idea behind portfolio diversification but seldom do they realise the importance of creating a suitably diversified investment portfolio.

It is advisable to have a good level of diversification in your investments. Diversifying your investments helps to minimise the effects of market volatility. Choosing to invest only in one or two types of funds may not be a wise idea because then your investment portfolio is at risk of losing value rather than gaining. Here’s why diversification is beneficial. If you have investments in both low-risk and high-risk funds, the volatility that high-risk funds bring to your portfolio is balanced out by the low-risk funds.

Additional Reading: The Beginner’s Guide To Creating An Investment Portfolio

Ignoring portfolio rebalancing

As important as it is to ensure that you have a diversified investment portfolio, it is also equally essential to regularly rebalance your investments. What? Are you confused? When you create an investment portfolio, you select investments from different investment categories, such as equities and debt. Over time, based on market trends, it becomes necessary for you to realign your investments. Simple. This only means you move your investments around.

For instance, say you had invested 30% of your corpus in Debt Funds and 70% in Equity Funds. If the markets are volatile after a few months of staying invested, you might want to reassess your portfolio and shift more of your money into Debt Funds, allocating a lower percentage to Equity Funds.

Not rebalancing your investments can erode the overall value, resulting in losses. You wouldn’t want that now, right? If you need more specific advice on realigning your investment portfolio, well, that’s where financial advisors can help you.

Additional Reading: Intelligent Asset Allocation

Attempting to beat the market

Well, that’s a real gamble. No, we are not saying that it’s possible to beat the market. However, with intelligent investment decisions, you can definitely minimise the risk of losses on your investments. Once sure-fire way to do this is to choose to invest in Mutual Funds through Systematic Investment Plans. Investing small amounts of money regularly over a period of time will build your investment value and limit your exposure to market instability.

Additional Reading: Everyone’s Going The SIP Way

Choosing stocks because they have brand value

That’s a sure mistake. Don’t simply close your eyes and choose to invest in any stocks only because they are of a reputable name and have a high brand value. When you decide to invest in a stock, you must carefully analyse the past performance of the stock and see if the choice suits your individual financial goals. A stock that has consistently underperformed will be a bad choice. Every investor has different financial needs, where different types of stocks and investment products may be more suitable than others.

No backup plan

Let’s say you’re an older investor. It is important to have a backup plan in the event that you are somehow incapacitated and cannot continue to contribute to your investments. What happens if you are laid off work and are unable to find a new job for a certain period of time? What will happen to your investments? You must think about creating an emergency fund apart from your regular savings that will be earmarked specifically to fund your investments during a financial crisis. Do you have an emergency fund with some money salted away for rainy days?

Read This: An Emergency Fund To Rescue Your Investments

Becoming obsessed with investments

Nobody says you can’t handle your investments on your own. If you create a well-balanced and diversified investment portfolio, you will not need to monitor your portfolio too often. This will mean less hassles for you. It’s not a good idea to allow your zeal to invest interfere with your other activities, even on personal level. Don’t allow yourself to become too obsessed with your investments so much that you always have your head buried in the balance sheets. If you ever find things are coming to a head with your investments, maybe it will be good to let a professional advisor take control of your investments.

Now that you are wiser about exploring investments on your own, be wise about it and steer clear of these Do-It-Yourself investment blunders. Rest assured, success will not be far behind.