11 lakh PAN deactivated? That’s worrying. You need your PAN for many purposes including opening a bank Savings Account, getting a Home Loan and opening a Fixed Deposit. However, you must know that duplicate Permanent Account Numbers (PAN) have always been a menace. The Government has taken the measure of deactivating PAN cards to check this.

The Government has deactivated or deleted 11,44,211 PAN cards as of July 27, 2017. These were cases where an individual was holding multiple PAN cards. The government also found 1,566 cases of fake PAN cards. In these cases, the PAN was either allotted to a nonexistent person or was in the name of individuals with false identities. These have been deactivated too. This move is expected to prevent cases of identity theft.

Additional Reading: Aadhaar PAN Linking Mandatory From 1st July 2017

The law says that a person cannot hold more than one PAN card. If you hold more than one PAN card, you will have to pay a penalty of Rs. 10,000 under Section 272B of the Income Tax Act, 1961. If you have more than a single PAN card, you must surrender the additional ones immediately.

Worried that your PAN card may have been deactivated? Here are the steps you need to follow to check if your PAN is still active.

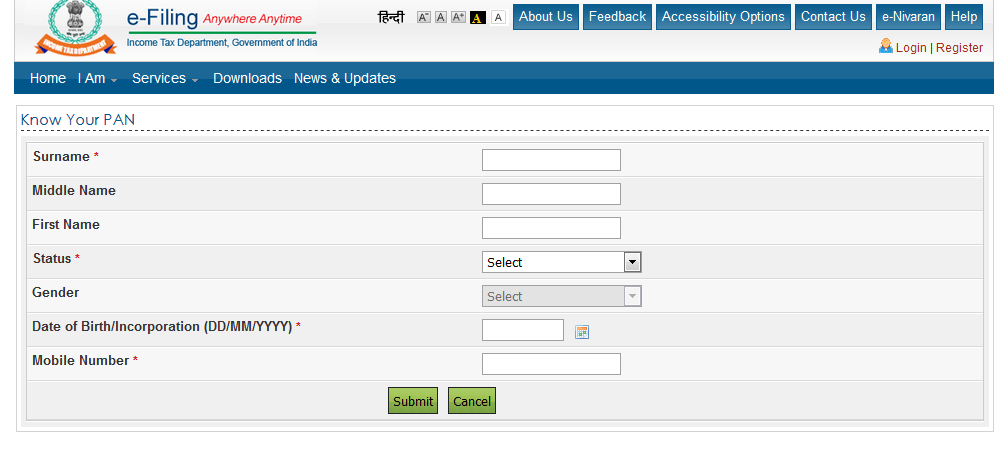

Step 1

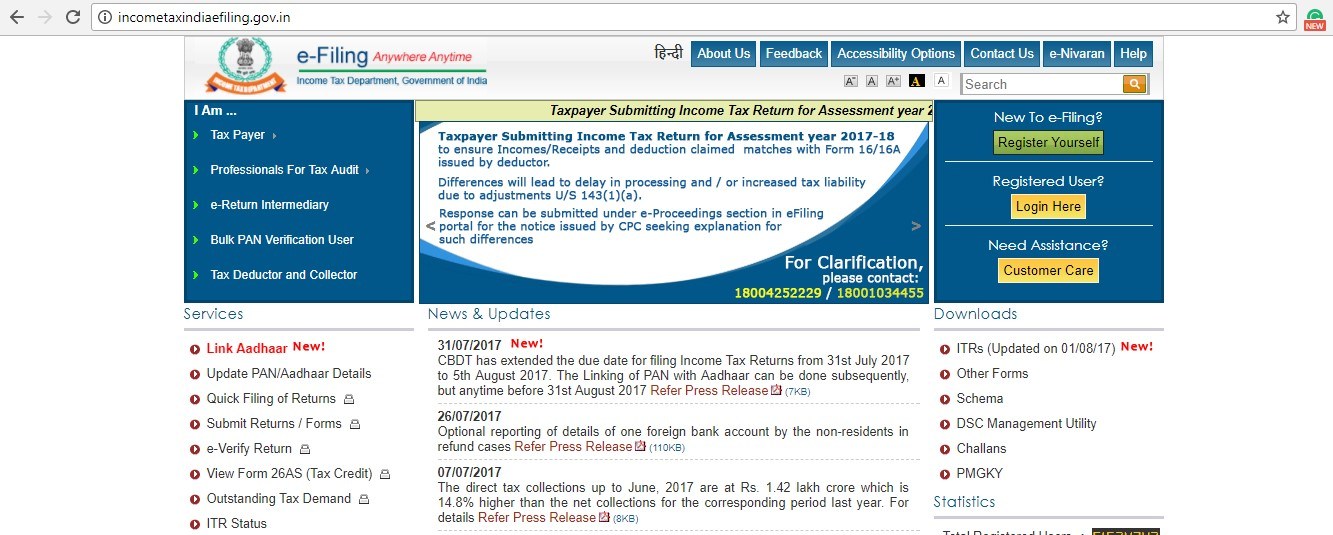

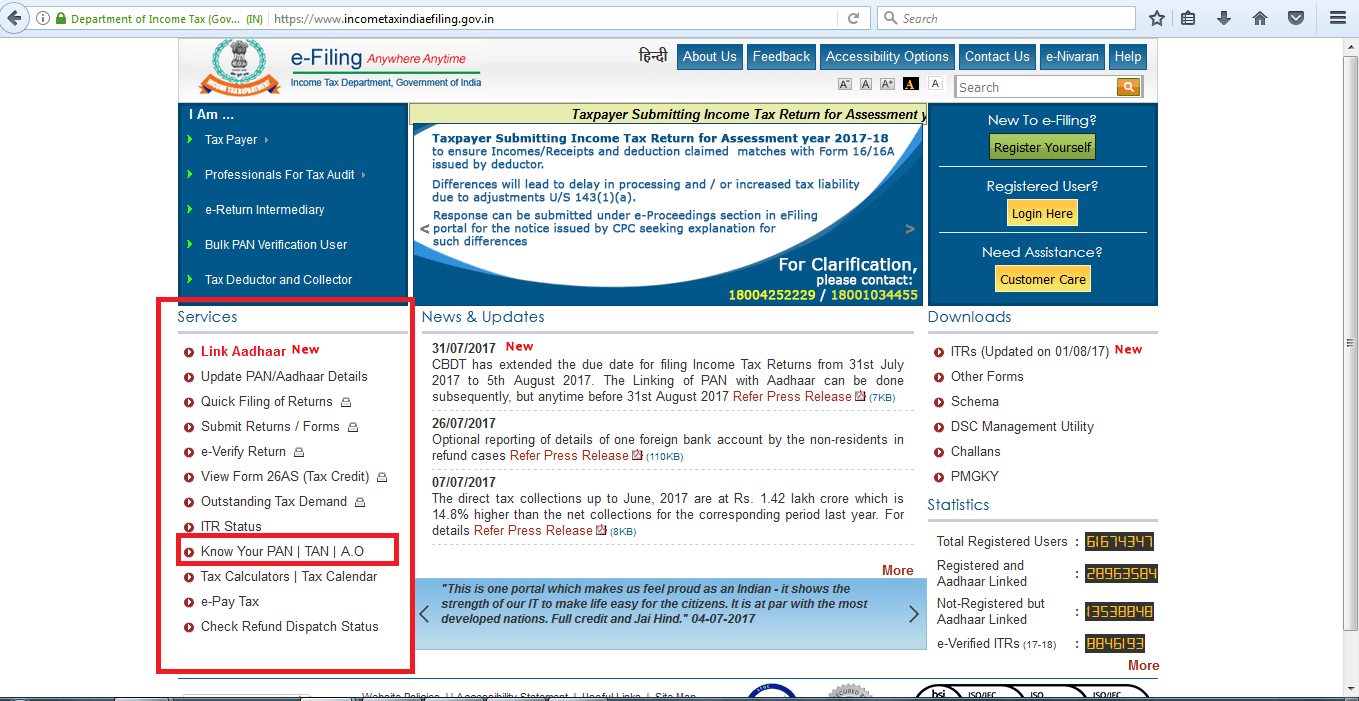

Visit the Income Tax department’s website – www.incometaxindiaefiling.gov.in

Step 2

Click on ‘Know Your PAN |TAN | A.O’

Additional Reading: Correct Errors In PAN/Aadhaar Online

Step 3

You will be asked to fill in details such as your Surname, First Name, Status, Date of Birth and Mobile number. Only some are mandatory. Fill in the required details.

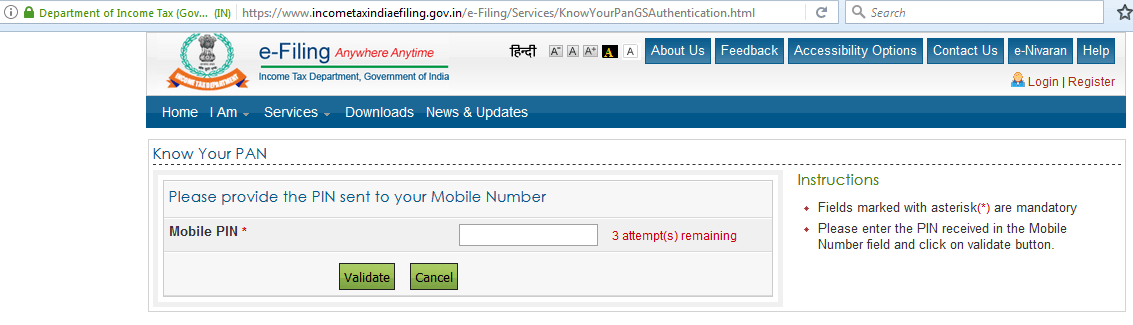

Step 4

You will receive a PIN or One Time Password (OTP) on your registered mobile number. You need to enter the OTP sent to you. Note that you have only 3 attempts to get the PIN right.

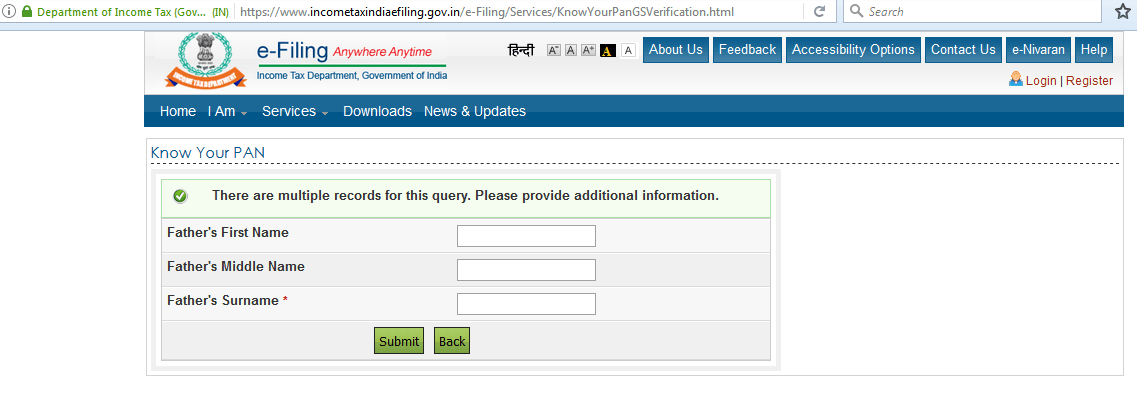

Step 5

You will be asked to give additional details in case there are multiple records found for your entry. These include your Father’s first name, Father’s middle name and Father’s surname. Only one of them is mandatory. Enter the required details.

Additional Reading: 20 Reasons Why You Need A PAN Card

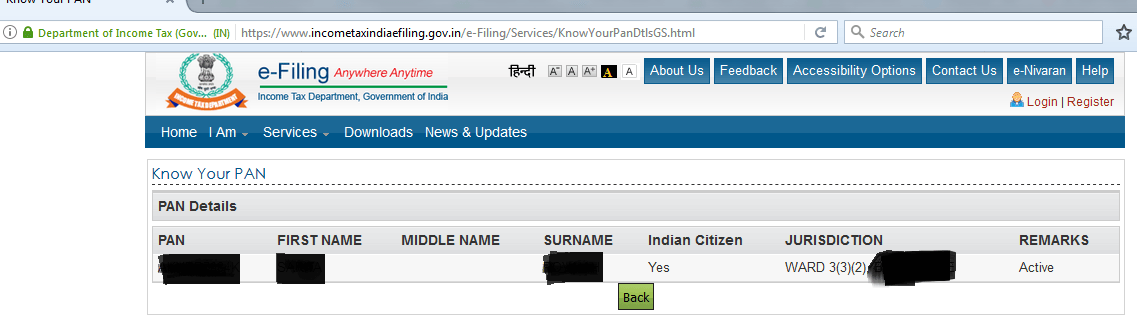

Step 6

The status of your PAN card will be displayed along with details such as your PAN, First Name, Middle Name, Surname, whether you are an Indian citizen, your jurisdiction. The remarks column will have details regarding the status of your PAN i.e. whether your PAN is active or not.

Is your PAN deactivated? Fret not! In case a mistake is made by the Income Tax department you can follow these steps to reactivate your PAN.

Write a letter to your jurisdiction Assessing Officer (AO) in the Income Tax department, requesting them to reactivate your PAN. This is given in the form of an indemnity bond.

A sample letter will look like this:

AFFIDAVIT

I, _____________________, do hereby solemnly affirm and declare as under:

- My Permanent Account Number (PAN) is:

- I have been regularly assessed in your ward/jurisdiction with PAN: ___________________.

- I have only one PAN as stated above and is used by me for filing income tax returns. I have enclosed my income tax returns for your reference.

- I do not have any other PAN in my name and if any have been allotted in the records of the Income Tax department, I request you to kindly deactivate them.

- I undertake to indemnify the Income Tax department for any loss that may be caused in the future.

- Kindly activate my PAN: ___________________.

The above statements are true to the best of my knowledge and belief.

(Signature)

VERIFICATION

Verified at <PLACE> on __ (day) of <MONTH>, <YEAR>, that the contents of the above affidavit are true and correct to the best of my knowledge and belief. No part of it is false and nothing material has been concealed.

(Signature)

Additional Reading: Get Your PAN Via The IT Dept Mobile App

Once you prepare the affidavit, you will have to get copies of your income tax returns and attach them along with your affidavit. You will need to submit returns for at least 3 years. You will also have to attach a copy of the PAN that has been deactivated. Once you submit all the documents to the Income Tax department, it will take at least 2 weeks for them to verify the information and reactivate your PAN.

What if you receive an intimation from Income Tax department on cash deposits made during demonetisation? You will need to file a response online, apart from the manual letter to the Income Tax department.

Multiple PAN Cards

Got multiple PAN cards? You need to cancel the additional ones. You will have to visit the Income Tax e-filing website and click on ‘Surrender Duplicate PAN’. Enter the details of the PAN cards that you want to surrender along with details such as your name, date of birth and contact number.

You could also use the National Securities Depository Limited (NSDL) website to cancel your PAN card. Use the ‘PAN Change Request’ application form link to mention the PAN which you are using currently. You will also have to mention all other PANs inadvertently allotted to you. Keep in mind, you might have to submit copies of the corresponding PAN cards for cancellation along with the form.

All sorted? You can use your Aadhaar card as identity and address proof while you wait for your PAN to get reactivated. This goes for many financial products such as Personal Loans, Car Loans or Credit Cards. You can even opt paperless approval with BankBazaar. What are you waiting for?