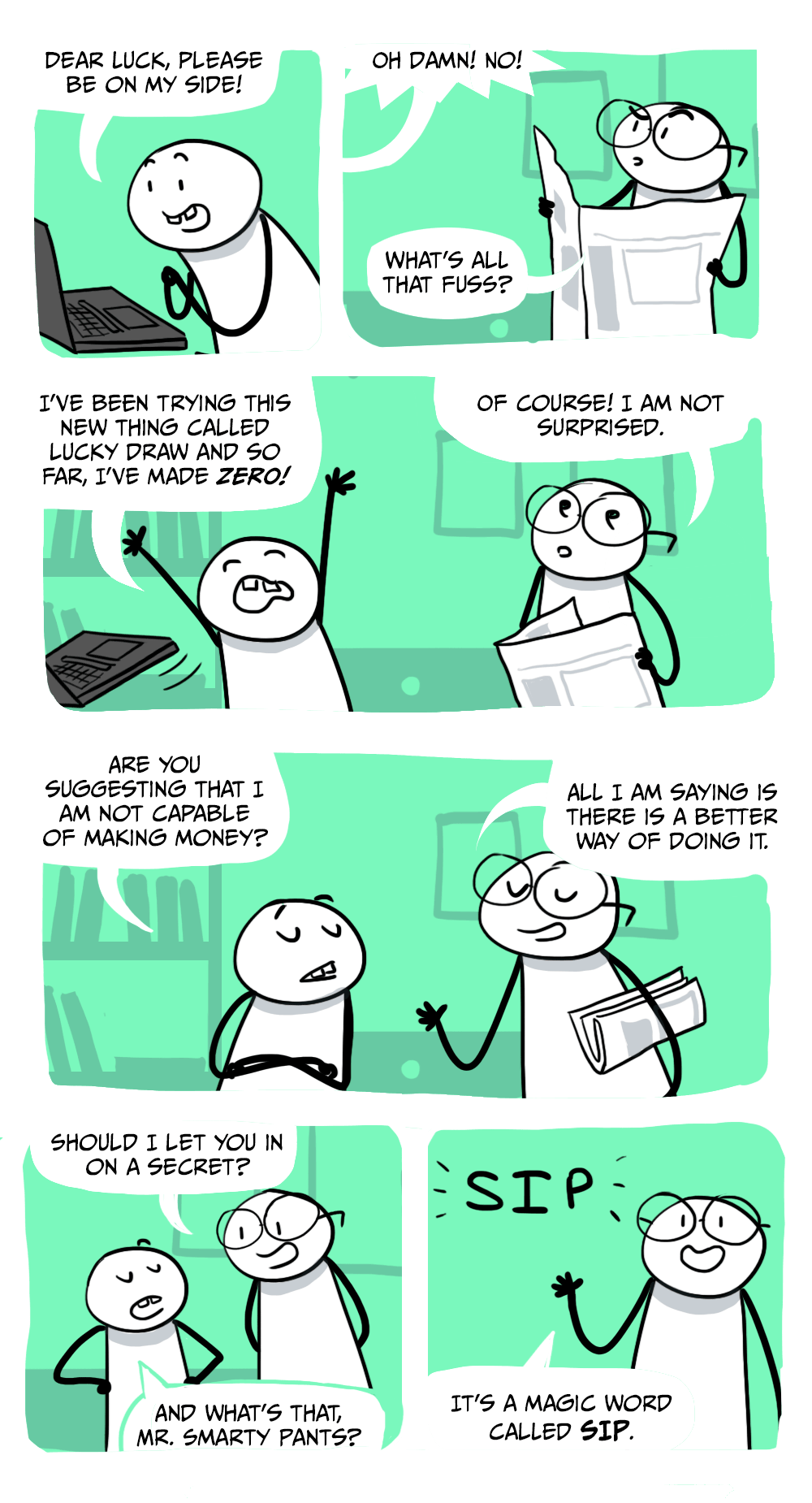

Stupido needs to make a lot of money and the options before him are clear – buy lottery tickets or invest via SIP. Which way will he head? Find out.

Believe it or not, SIP is actually a time-tested way of making money.

What Is SIP?

Systematic Investment Plan or SIP is nothing but investing small amounts periodically in a Mutual Fund Scheme. Contrary to popular belief, your Mutual Fund investments needn’t wait until you have accumulated a lump sum. You can start right away with an amount as little as Rs. 500.

Additional Reading: 5 SIP Schemes That You Can Invest In With Only Rs. 500

How Does It Work?

With a SIP, you can invest on a weekly, monthly, or a quarterly basis. A fixed amount will be debited from your account and the same will be used to buy you more units in a Mutual Fund. Also, you have the option to increase your SIP amount any time you like.

Additional Reading: Daily SIP Mutual Funds- What’s The Impact On Your Returns?

It Makes You A Disciplined Investor

Investing is not a get-rich-quick scheme. It’s a matter of patience and discipline. SIPs enforce a sense of financial discipline by auto-debiting a fixed amount every month. It also helps you re-examine your financial plan and cut back on the unnecessary expenses.

You Needn’t Time The Market Anymore

Is the market going up or is it going downhill? – This question has been bugging investors from the beginning of time. Thankfully, with the SIP route, you don’t need to deal with this ordeal. Want to know how? Well, it’s simple. First of all, you are investing small amounts and hence your risk size is automatically reduced. On top of that, if something’s amiss, you can always opt out of your SIP at the click of a button.

Can You Really Grow Your Wealth With SIP?

The biggest takeaway from investing via SIP is that it allows you to nurture your wealth. Can it help you get rich? Well, yes, of course, but not many people are aware of it. We’ll let you in on our secrets.

Step Up Your SIP Amount Periodically

Instead of spending the yearly bonus on a lavish party, invest it in your SIP. If you increase your SIP amount from time to time, you will reach your goal sooner than you had planned. Wouldn’t that be nice?

Use The Power Of Compounding

Compounding is a long-term investment strategy. When you make an investment in a Mutual fund, it pays you back in the form of interest. Every year, the interest gets added up to the principal amount, thereby, increasing the value of your investment. In order to get the most out of compounding, you need to stay invested for longer. The longer you stay invested, the better returns you get.

Things To Keep In Mind

While it’s a great idea to get the ball rolling right away, it’ll be unwise to make an uncalculated move. Here are a couple of things you need to bear in mind before you get started with your first SIP.

Work Towards A Goal

Many people stumble into Mutual Funds every year – some hop in to save taxes, some hope to get rich, but only a handful of those who invest do it with a specific goal in mind. If you are serious about investing in Mutual Funds, be clear about why you are doing it. Set an achievable timeline for yourself and gradually work your way towards it.

Additional Reading: Buying A Bike? Should You Go For EMI Or Self Fund Through SIP?

Choose The Right SIP Amount

Choose your SIP after taking into consideration your investment goal. You’ll need to pitch in a higher SIP amount if you are looking to meet your goal within a shorter time-frame.

If you are new to the world of Mutual Funds, begin with a SIP amount that’s easy on your pocket – experience it first hand and then go in for the higher denominations.

That’s it for starters.

As you get more adept at it, you will learn about things like NAV, P/E ratio and a whole bunch of cool stuff that makes investing worthwhile.

Does that get you excited already?