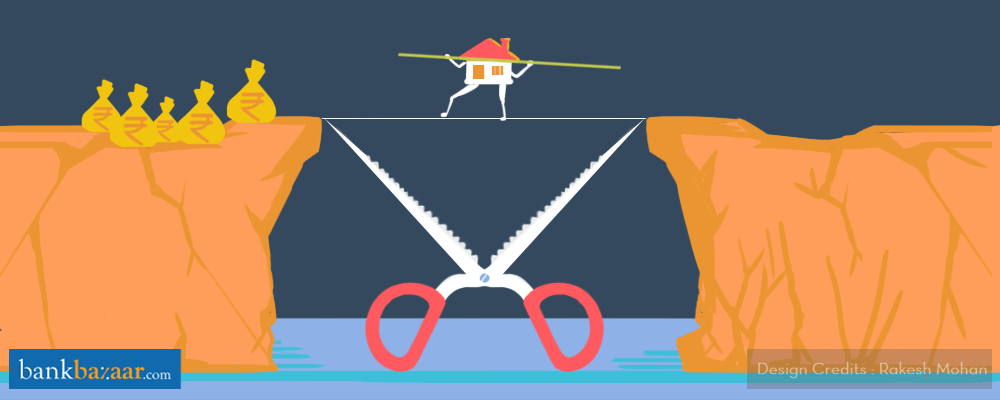

When it comes to selling your house, timing is everything. We’ll tell you why right here.

Selling a property before the end of 3 years from the date of purchase

Bad idea! Here’s why. If you sell a property before the end of three years from the date of purchase, all profits from the sale will be considered short-term capital gains.

These capital gains are then added to your total income and you will be taxed according to the tax bracket you fall under, which in some cases could be quite a hefty amount.

Tax benefits of buying a house

Buy a house as a long-term investment. Don’t be in a hurry to sell your property because if you sell the house within a period of 5 years from the end of the financial year in which it was bought, you can forget about the tax benefits you claimed on buying the property.

In this case, tax deductions claimed under Section 80C of the Income Tax Act will be reversed and the amount will become taxable in the year that you sell the property.

However, the deductions claimed for the payment of the interest component under Section 24B remains intact.

Additional Reading: Important Tips On Buying A Home

What is advisable?

If you’ve bought property, then try and hold on to it for 3 years at the very least, because any profits that you earn after selling it after this period will be considered as long-term capital gains.

This is taxed at 20% after indexation. If indexation is considered, the purchase price is adjusted, reducing the seller’s tax burden.

More benefits

Did you spend on repairs or renovations when you bought the house? Add these costs when calculating your long-term capital gains. If you haven’t already claimed the interest paid as deductions before the construction of the property began, you can add this to your capital gains calculations.

Additional Reading: Know Your Capital Gains When You Sell A Property

How you can avoid taxes

Yes, you can avoid those taxes when you sell your house. How? Use the gains from the sale to buy another house within a period of 2 years. Want to construct your own house? Do this within 3 years of selling your property.

Don’t want to buy another house?

If you’re not keen to spend the sale profits on another house, don’t worry. There is another way to sidestep paying taxes.

Invest the long-term capital gains for a period of 3 years in bonds such as those from the Rural Electrification Corporation Limited and the National Highways Authority of India. Do this within 6 months of selling your house.

Remember you can only salt away a maximum of Rs. 50 lakhs in these bonds in one financial year. You can claim tax deductions on this investment under Section 54(EC) of the Income Tax Act.

Additional Reading: Your Guide To Buying A Second Home

Don’t ignore TDS on purchase

Don’t forget to deduct TDS when you buy a house worth more than Rs. 50 lakhs. TDS equal to 1% of the property’s value should be deducted by the buyer before paying the seller.

A seller can claim a TDS refund if he is making a loss on the sale of the house or if he claims a long term capital gains tax exemption.

Additional Reading: Bought Property? Deposit TDS Or Get A Tax Notice

How does a seller claim a TDS refund?

In order to claim a TDS refund, the seller must provide the details of capital gains tax investment in the tax return that he files.

Now that you have all the information about the tax implications of selling a house, do you think you’re ready for that Home Loan?

Additional Reading: Home Loan Hadbook

Hi Sir, Please consider the following statement in your article: –

“Don’t be in a hurry to sell your property because if you sell the house within a period of 5 years from the end of the financial year in which it was bought, you can forget about the tax benefits you claimed on buying the property.”

Please let me know if the date of purchase of property is the date of allotment or date of possession. Let’s say I got the allotment of my flat in 2010 but possession in 2014, then 5 years to be calculated from which date. Thanks.

Hi Amit, It would be the date of allotment. Cheers, Team BankBazaar