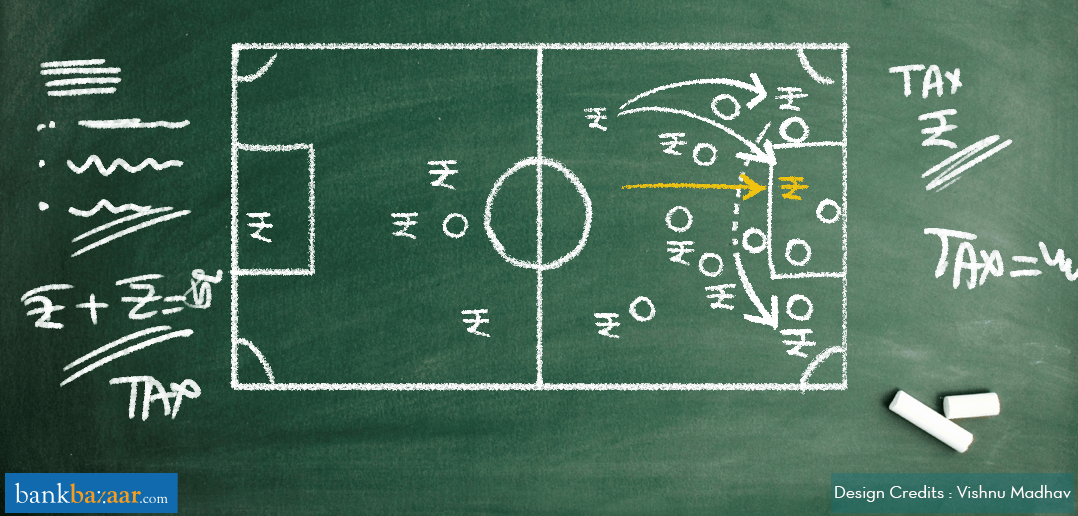

Are you a late Latif when it comes to tax planning? Then you must read this article! Others who plan their taxes well in advance can find out why they are right.

Many salaried people tend to look at tax-saving investments only during November or December. Why? Because during this time, their employer’s finance department will be sending out reminders asking for investment details. These will be used to ascertain the final tax deductions they need to make.

Some others start looking at tax-saving investments as late as March! They rush to invest in tax-saving Fixed Deposits and ELSS Mutual Funds. But is it ok to plan your taxes at the end of the year? This article will address this question.

Additional Reading: Pay Tax, Get Rewarded!

Why people love the year end?

Life Insurance companies launch over 80% of their new products and get about 75% of their annual sales during the ‘Tax Planning Season’, which is December to March of any year. In fact, in recent years the sales of Health Insurance products are also at an all-time high during this season. This is due to the awareness of tax benefits that can be availed from paying the premium for Health Insurance for self, spouse, children, and parents. This confirms that the majority of Indians plan their taxes during the end of the year!

Now, the question is whether this is a good thing. Actually, there are many disadvantages to planning your taxes late. You will also encounter many hassles. Here are some of them.

Borrowing for investing!

Sometimes people pledge their gold jewellery or even borrow money for these tax-saving investments. Such practices become counterproductive since the actual tax saved in almost all these situations will be much lower than the interest paid.

Charges are forgotten in the rush

Often, you might forget to check the kind of charges associated with tax-saving investments. For example, an agent sold a tax-saving insurance product that carried a 30% charge in the first year. The loss for the investor – Rs. 30,000!

Additional Reading: 5 Uncommon Tax Deductions That Will Help You Save Big

Difficult route

ELSS Mutual Funds have become preferred tax-saving investments. By planning your taxes at the end of the year, you have no choice but to invest a lump sum in Mutual Funds.

ELSS funds invest in the stock market. When making a single lump sum investment in the stock market, timing becomes very important. January to March, or for that matter no particular month by any statistic, is proven to be the best month for a lump sum investment. Regular investment on a monthly basis is the best bet to tap the benefit of rupee cost averaging.

Advantages of planning taxes at the start of the year

Products that match requirements

By planning your taxes in advance you get the time required to choose the product that matches your requirements. With competition increasing, companies are using quirkiness when making products that address unique needs. Today, we have financial products that are custom made for women, children, senior citizens, homemakers. The financial product list is huge. Making a choice requires time. When you start planning your taxes at the start of the year, you will be able to understand the products, how they work and whether they suit your needs.

Compare products across companies and categories

Having identified the product category, one needs to compare different products that are available in the market from different companies. This again requires time. Most companies in India today have products that have varying charges. There are also hybrid products like ULIPs that invest in both the debt and the stock market and give you tax benefits. Again planning at the beginning of the year will give you enough time to analyse the products and make wise decisions.

Additional Reading: How To File Tax Returns Online!

Easy on the wallet

Instead of making one big investment in, say January, it is better to make a series of 12 investments starting from April itself. This gives you 2 benefits – one is rupee cost averaging (as discussed earlier) and another is a lower outflow. Is it easier to make one investment of Rs.12,000/- or a monthly payment of Rs.1,000/-? You decide.

We can say that tax planning done at the end of the year negates the very purpose of saving taxes. Hence, it’s prudent to plan your taxes when the fiscal year begins. This will help you make the best choices and get the best benefits.

Looking for tax saving investments? We have plenty of them!