If you have invested in multiple Mutual Funds, you can now track them through a Common Account Number (CAN). Read on to know more.

If you’re new to investing, then you may be wary of exploring Mutual Funds. However, for a seasoned investor, investing in equity is as easy as pie. So, if you have multiple Mutual Funds that you find hard to track, there’s a solution for you. Today, you can track your investment portfolio through a Common Account Number (CAN).

The Mutual Fund Utilities (MFU), which is a shared service platform of asset management to companies can now help you track and manage your investments with a lot of ease. Using this is quite simple too, all you have to do is register on the MFU platform and obtain a Common Account Number. You can also get this done online or at AMC (Asset Management Company) offices or POS (Point Of Sale) locations.

Let’s tell you all about it.

Registering Online

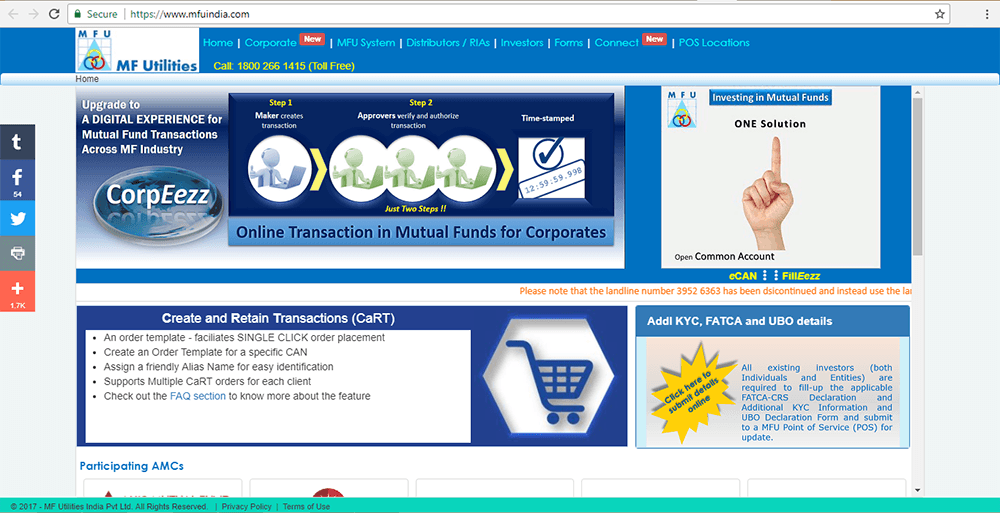

To do this online you have to log on to the MFU website which is https://www.mfuindia.com/

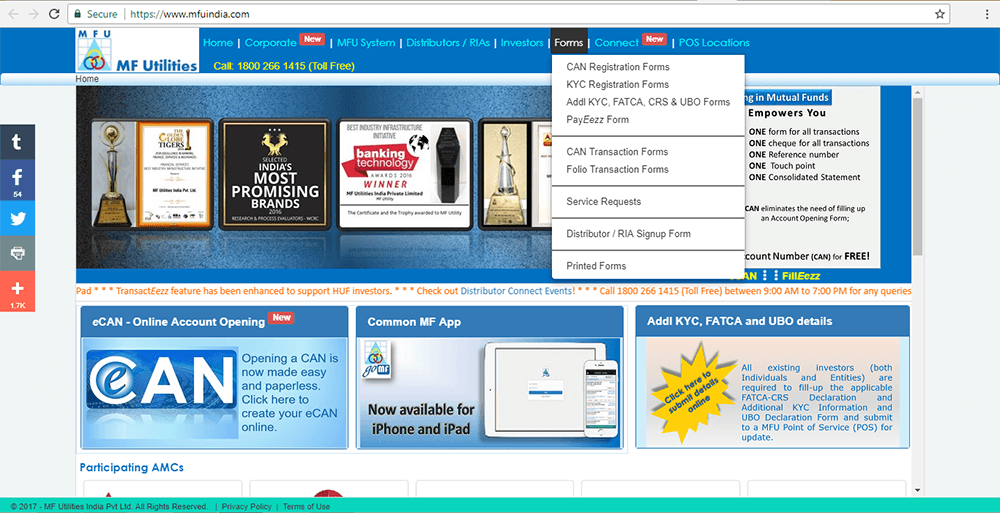

Once you’ve reached the homepage, go to the top menu and click on “Forms”. The first option out there is the “CAN registration forms”. Simply click on it.

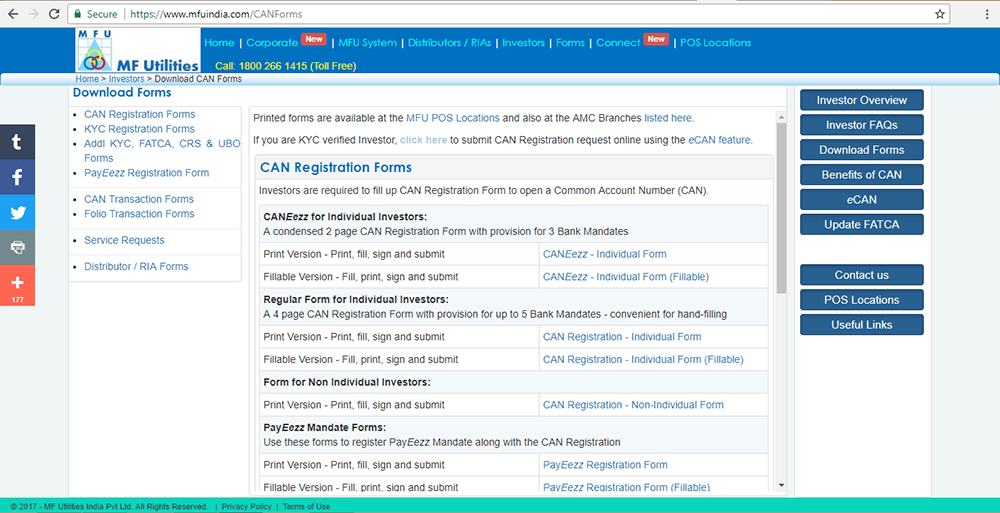

The page is self-explanatory and all you have to do is follow the instructions on it.

What information is required?

As an investor you will have to provide sufficient proof as documents while registering for a CAN. This will include documents like;

- self-attested copy of your PAN card or PEKRN (PAN Exempted KYC Reference Number),

- self-attested copy of your bank statement or cancelled cheque, or letter from your bank manager

- Necessary documents pertaining to FATCA (Foreign Account Tax Compliance Act)/CRS (Common Standard on Reporting and Due Diligence for Financial Account Information)

Additionally, it will be useful to keep your Aadhaar Card details, and other Know Your Customer (KYC) documents such as bank account details etc. handy. The form will also require you to furnish information for registering a nominee.

Additional Reading: What Is A Cancelled Cheque?

Here is what the page looks like:

What happens when you submit the form?

After furnishing the relevant valid documents for the form, you will have to submit this online form. Then the pre-filled CAN form is generated. You can then re-check all your information and print this form. Once printed, sign on it and submit it at any of the POS locations or AMC offices. If you are unable to physically submit this form, you can also choose to courier it to the MFU office address (along with all your supporting documents of course!)

What is the process thereafter?

Once your documents are verified by the MFU, a unique CAN is generated. And all your existing investments in Mutual Funds folios which are under the same PAN are then mapped to your CAN. How cool is that?

Points to remember

- Ensure you are filling in the correct details on the form before submitting it.

- Investors can carry out changes to the CAN form by accessing it online before printing it and submitting it physically

- You also have the option of printing the form and filling it by hand. You can use the PDF editable version from the online page

So, now you don’t have to write down or make a mental note of your Mutual Fund investments. With a CAN you surely can keep track of your multiple investment portfolios. Don’t have too many Mutual Funds? Worry not, we have a couple of them you may just be interested in. Care to check?