Do you know what the numbers on your Credit Card really mean and what do they represent? Read on to find out how Credit Card numbers work.

We all use our Credit Cards on a day-to-day basis for online shopping, groceries, movies, petrol & much more. But, do you know what the numbers on your Credit Card really mean and what do they represent?

Well, you’ll be surprised to know that these numbers aren’t just random digits printed on your card – they give specific information about your Credit Card and also prevent fraud & payment errors. Read on to find out how Credit Card numbers work.

Additional Reading: Multiple Credit Cards: Yay Or Nay?

International Standards:

Credit card numbers are issued by the International Standards Organization (ISO). It is a standard-setting body that has representatives from various national standards organisation who help promotes global industrial and commercial standards.

The size, placement of the numbers, material and other characteristics of your Credit Card is set by the ISO and is standard across the globe.

Breakdown of the numbers:

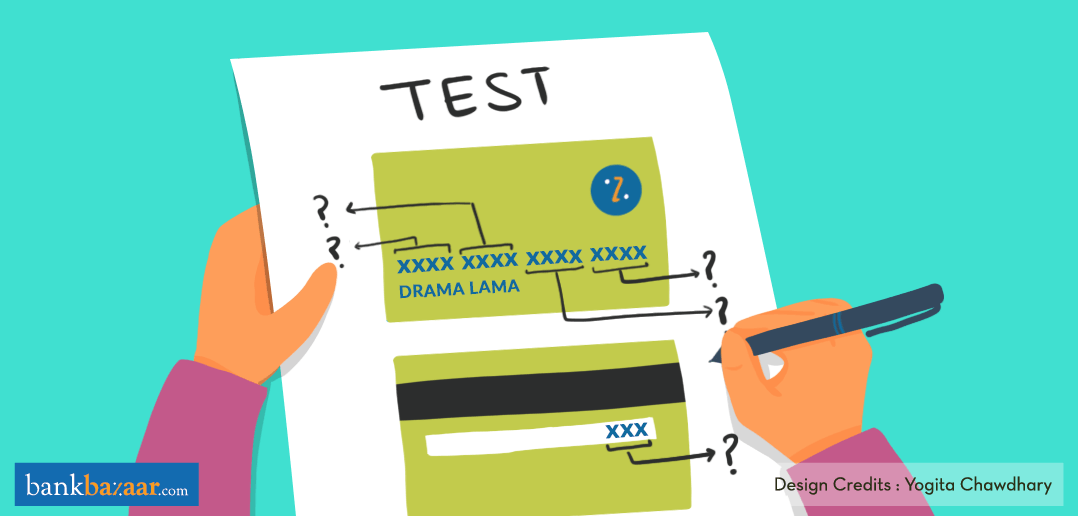

Credit Card numbers generally consist of three components – your account information, card issuer information, and a checksum. Let’s learn about them in details:

Issuer Information

Industry number: The very first digit of your Credit Card represents the Major Industry Identifier (MII). This number gives you details about the card issuer.

Issuer identification number: The first digit along with the next five digits is known as the Issuer Identification Number (IIN). These numbers specify what type of card you are using and help the merchant with routing payments. For example, travel and entertainment cards start with the digit 3, whereas banking and financial cards begin with the digit 5, etc.

Your Information

Account Number: After that, the remaining digits on your card, except for the last digit, refer to your account number. This is a unique number that is used for identification and allows the issuer to

Last Number: The last digit on your card is known as the “check digit” or “checksum” which helps to ensure the validity of your card. This number is set by an algorithm called the Luhn formula, patented by an IBM scientist named Hans Peter Luhn in 1960.

The checksum is useful in catching data entry errors and also prevents fraud and casual attempts to create Credit Card numbers.

Additional Reading: How To Add Your Child As An Authorised User On Your Credit Card

There you go! Psst…don’t have a Credit Card yet? Cheer up! We have instant-approval offers exclusively for you – cashback, rewards, travel, dining and more!