Stay away from these six deadly sins that can ruin your child’s financial future and money habits.

As parents, one of the most crucial responsibilities we have involves teaching our kids the value of money and how to use it wisely. None of us want to see our kids growing up into spendthrifts who don’t understand the concept of money management at all. So, the question that arises here is —have you been teaching your kids the right money lessons or not?

Don’t get confused. We can help you find out. All you’ve to do is ensure that you’re not committing any of the following six sins. These can prove to be super deadly not only for you and your money, but for your kids and their financial future as well.

Additional Reading: Money-Saving Hacks Every Student Should Know!

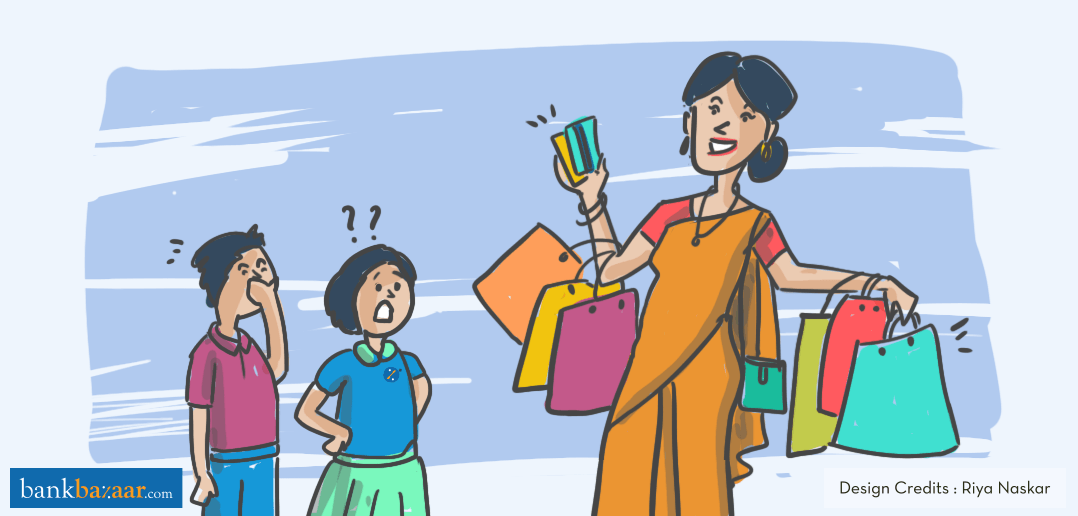

Sin #1: Setting A Bad Example

We often tend to ignore how we behave in front of our children. They tend to pick on our habits (whether good or bad) and that’s something we need to keep in mind all the time. This makes it important for us to act like financially responsible people, especially in front of them.

Showcasing bad habits like regular shopping sprees, huge Credit Card bills, no budgets etc. can scar our children for life. If they see us acting like this, they start feeling that it’s perfectly normal to behave the same way and ignore the more important things.

What needs to be done: Set a good example! Show them how a perfect budget is made. Pay your utility and Credit Card bills on time. Make them understand why things like EMI payments take priority over lesser-important things like shopping.

Additional Reading: Real-Life Personal Finance Lessons For College Freshmen

Sin #2: Not Distributing Financial Responsibilities With Your Spouse

Children notice the smallest of things. Stuff like who’s paying for food, shopping, groceries etc. may seem like a small deal for you, but for them, it’s not. They tend to notice if only you are paying always or it’s just your partner. Either way, this is not something you want your child to learn. They need to understand that there’s an equal distribution of everything at home, including who’s paying for what.

What needs to be done: Make sure your children see you guys sharing every responsibility, including finances. You guys can either take turns to pay or come up with a better arrangement.

Sin #3: Swiping Your Credit Card Like There’s No Tomorrow

Kids easily get fascinated by things like using a Credit Card to pay for stuff. The whole concept of credit sounds fancy as they think they don’t really have to pay. While you’re in front of your kids, make sure you restrict the use of Credit Cards to buying necessary purchases only.

What needs to be done: Make them understand the concept of credit and how a Credit Card works. Then, teach them the right way to efficiently use a card.

Additional Reading: Essential Credit Card Lessons For Your Child

Sin #4: Avoiding The Money Talk

It might sound like your kids won’t understand much about money and will get bored if you talk about it. While it might be true to some extent, you also need to understand the importance of doing so. If you make it a point to talk about money in front of your kids, they are more likely to understand money-related topics. Moreover, such talks will make them understand the importance of money too.

What needs to be done: Involve your kids in money discussions. Be patient as they are new to financial concepts and clear any doubts that they may have.

Sin #5: Money-Related Fights In Front Of Your Kids

Be it about money or something else, fighting in front of your kids is not a good option at all. Arguments are a part of married life, we get it! Just make sure you don’t let get into a heated one with your spouse when your kids are around.

If your fights are usually around money and your kids witness these fights often, they’re likely to develop a fear towards money matters as they might think that money is the root cause of all fights. Don’t let that happen.

What needs to be done: Try sorting your money matters when your kids aren’t around.

Additional Reading: 10 Tips To Help Your Kids Become Moneywise

Sin #6: Not Being Able To Control Those Shopping Sprees

Like we mentioned earlier, your children are going to mirror you and your habits. You need to ensure that you set the right example. If you keep buying things impulsively in front of your kids, they are less likely to take money seriously ever. They will only think of it as an instrument to fulfil their wants, irrespective of the situation.

What needs to be done: Teach them how to pamper themselves every now and then, without indulging in impulsive purchases. They need to understand the importance of money in order to utilise it efficiently in the future. Also, help them understand the difference between needs and wants. Once that’s done, your work’s done too.

Be extra cautious around your children. What they learn from you during their childhood days usually stay with them forever. So, make sure you teach them well and lead by example.

Psst… Help your kid get a hang of managing and saving money early on. A Fixed Deposit can help inculcate the habit of saving in your kids. Why don’t you open one for them today?