Category Archives: Avoiding debt

Shred Those Credit Card Debts To Nothing!

It’s the beginning of the year! With new beginnings, new resolutions naturally follow. We can bet that for some of you, one of those resolutions involves a credit card bill settlement. We all know that the racking up of Credit Card bills has put many people in debt. We’re here to put the focus on managing your Credit Card debt, with these five helpful tips.

How to Draw the ‘T’

As kids, we’ve often ‘stolen’ change from our parents and pooled in the coins to share an ice-cream with our friends. There was always that one friend, to your awe and annoyance, who seemed to be able to keep track of exactly how much you owed him from months ago. Of course, as adults finances… Read More »

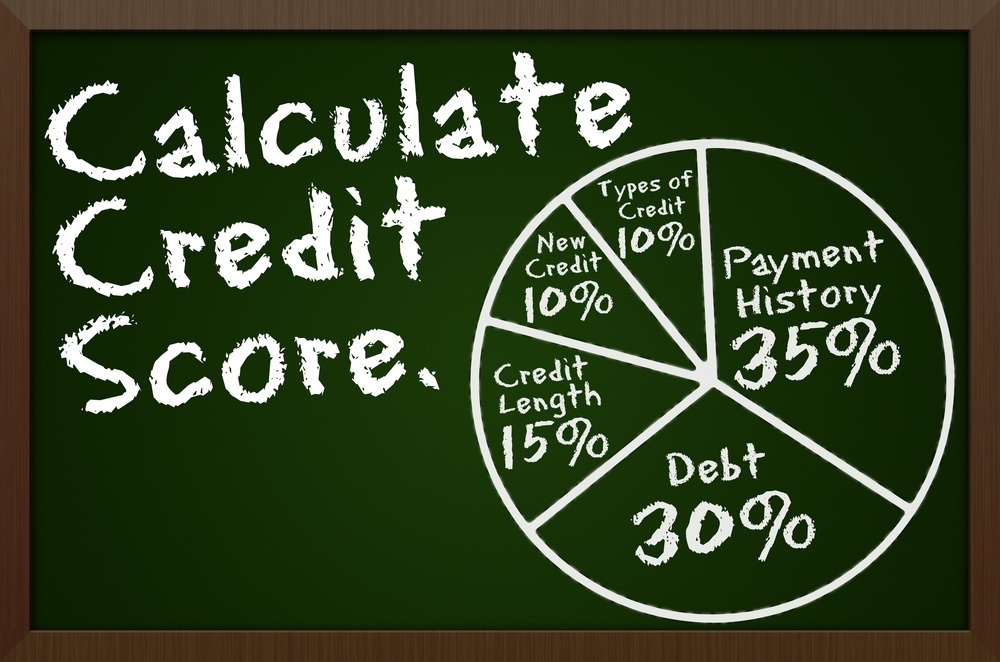

6 ways credit cards wreck your credit score unknowingly

It is just a three-digit number, but as far as your financial life is concerned, it might as well be your grading on how well you manage your finances. So, it’s time you took a serious look at your credit score. Banks use it to determine your loan eligibility and in some cases it decides… Read More »

5 Reasons why you spend more with credit cards

Have you ever wondered why people splurge with cards even after knowing that it’s only borrowed money that they have to return to the bank someday? Various researches on the profiles of credit cards owners and their spending patterns says that there are several factors leading people to spending more using plastic. Here are the… Read More »

5 Questions to ask before doing balance transfer on your card

Sapna, a Mumbai-based copywriter was on a shopping spree during the last festive season as she was excited about her brother’s wedding. It helped that plastic money had been invented – her shopping went by in a blur as her credit card maxed out. The after-tremors hit her only later when she realized that she… Read More »

The good, bad and ugly of loans!

There are two aspects to everything in life and the same is true in the world of finances. Today loans are easily available for instant gratification. Be it a home loan, a loan to own that dream car or a consumer durable loan to buy the latest plasma TV, loans are available at the drop… Read More »

5 ways to avoid holiday debt!

I can’t put my finger on it but there is just something about the holidays that tempt us into buying stuff that we do not even need. Ok, granted that gifts are an important part of these festivities and you ought to share them with family and friends but on what cost? On overall financial… Read More »

10 money resolutions for 2015!

Making financial resolutions over the common ones will have their merits this New Year eve. As it goes, it has been found that those who resolved to save more this year had more success than those who took a resolution to cut down smoking. Money resolutions, undoubtedly, have a tendency to stick in mind more… Read More »

Keep your credit history clean!

Blasted with advertisements for everything, ranging from an apartment, to a holiday to clothes, smart phones and other gadgets, how can anyone not be expected to be swayed? The purchasing power of individuals is increasing and so are the desire to own the best and the latest. Here’s a case of spending and beyond capacity.… Read More »