When you ask a friend how to get a driving license, he tells you to get an agent – “It’s quicker.” When you ask a relative how they got those flight tickets so cheap, she says, “My travel agent did it for me, yaar!” How did your neighbour get that flat that he so dreamed of, in exactly the location that he wanted? Any guesses? An agent, of course!

India is a country where agents seem like the friendliest people and will do anything that you need if you pay them. However, many don’t realise that agents, the unauthorised ones, have vested interests and try to maximise their profits. They have many tricks up their sleeves.

We aren’t advising you to distrust every agent that you meet but there are a few things you should keep in mind so you don’t end up being duped. We’ll tell you about a few common tricks that unauthorised agents have been known to try on their customers and give you tips on how to avoid them.

Fixed Deposit Fraud

Company Fixed Deposits and Fixed Deposits offered by Non-Banking Financial Companies (NBFC) are usually sold by agents. In order to garner a commission, they might not tell you all that you need to know.

What they do: Agents show you a list with the ‘best’ Fixed Deposit rates for each of the companies.

What’s the trick? The idea is to sell you the ones with the maximum commission.

What you should do: Note that many companies provide Fixed Deposits for tenures such as 22 months, which might give you higher returns than a deposit for a rounded tenure such as 2 years. Since people tend not to prefer odd tenures, agents are given a higher commission to sell these. Note that it is important to look at the yield from such deposits rather than the actual interest rate. The yield will tell you the actual return that you will get from the investment.

Consider this: You invest Rs. 1 lakh in a company Fixed Deposit with an interest rate of 9.5% per annum for 2 years. The compounding being quarterly. Your yield, in this case, will be 10.3%. Suppose there is another Fixed Deposit that offers 9.8% per annum for 22 months. It seems like a better option. Yes! But if the compounding for that Fixed Deposit is yearly, your yield will be only 9.8%. So, the first Fixed Deposit will be a better option. Keep this in mind while choosing a company Fixed Deposit.

Also, low-rated company Fixed Deposits tend to offer higher interest rates and of course, higher commission to agents. Company Fixed Deposits with ratings below AAA are considered to be risky. So, choose your deposits wisely.

Best way forward: If you are worried about the safety of your capital, opt for a bank Fixed Deposit. You can consider a sweep-in account for quick withdrawals. Also, you can choose between interest payouts and cumulative options. What’s more, you get a guarantee for your deposit for up to Rs. 1 lakh in case the bank goes bust.

Credit Card Cons

When your application is rejected

You may have received several calls for Credit Cards, mostly from authorised agents from banks. However, there are some agents who say that they’ll help you get a Credit Card when your Credit Card applications are rejected. You must be wary of such agents. Here’s why.

What they do: Agents assure you that you will get your Credit Card if you pay a small sum of money to them.

What’s the trick? They forge documents to get your Credit Card approved.

How to avoid it: Always choose authorised agents of the bank to get your Credit Card. If the bank finds out that the documents are forged, apart from cancelling the card, the bank will send a report to Credit Bureaus that prepare Credit Reports. This can badly damage your Credit Score.

Psst… you can check your Credit Score for free. Just click here.

Best way forward: If you have a low Credit Score, try to improve your Credit Score before applying for a Credit Card. In case you have a good score and your application gets rejected, check your eligibility for the card. Ideally, you should check your eligibility for a Credit Card before applying for one. This will minimise application rejections.

Free Credit Cards

What they do: Agents tell you that the Credit Card being offered is a free card and you needn’t pay a pie for it.

What’s the trick: Most times the card will have an annual fee from the second year.

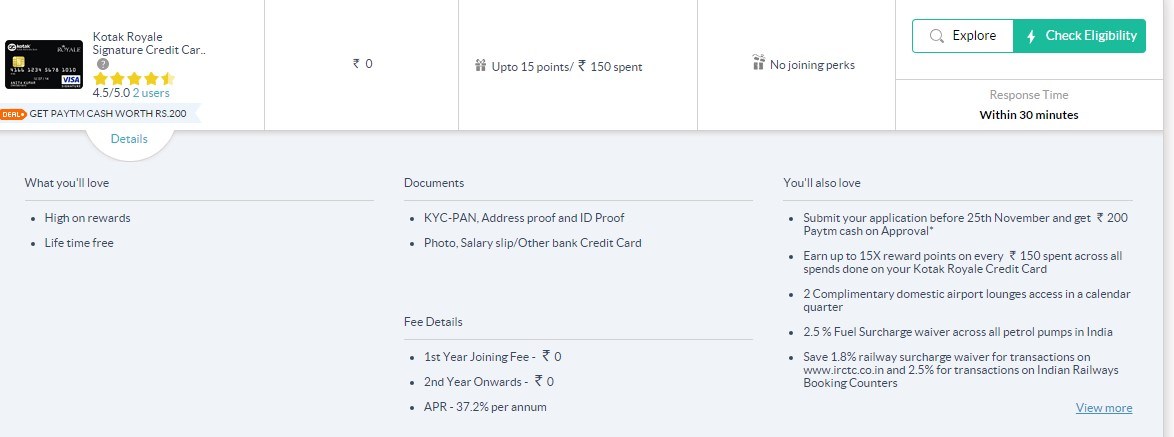

How to avoid it: Ask if it is a lifetime free card and ask them to send you a brochure for the card. The brochure will have all the details regarding charges and the Annual Percentage Rate (APR). This will help you choose the right card.

Best way forward: You can browse bank websites or sites like BankBazaar.com for authentic information regarding the Credit Card you are opting for. All details regarding the card’s charges in the first year, the second year onwards, the APR and other information is given up front. The below screenshot will give you an idea of how BankBazaar gives you information upfront.

Loan Lines

There are many agents who claim that they can get you loans if you are willing to part with some amount of it. They are clearly unauthorised agents.

What they do: Agents tell you that you need to pay a certain percentage of the loan amount you seek upfront and they will get your loan sanctioned by the bank. They demand that you pay the money by cash.

What’s the trick: They run away with your money, of course!

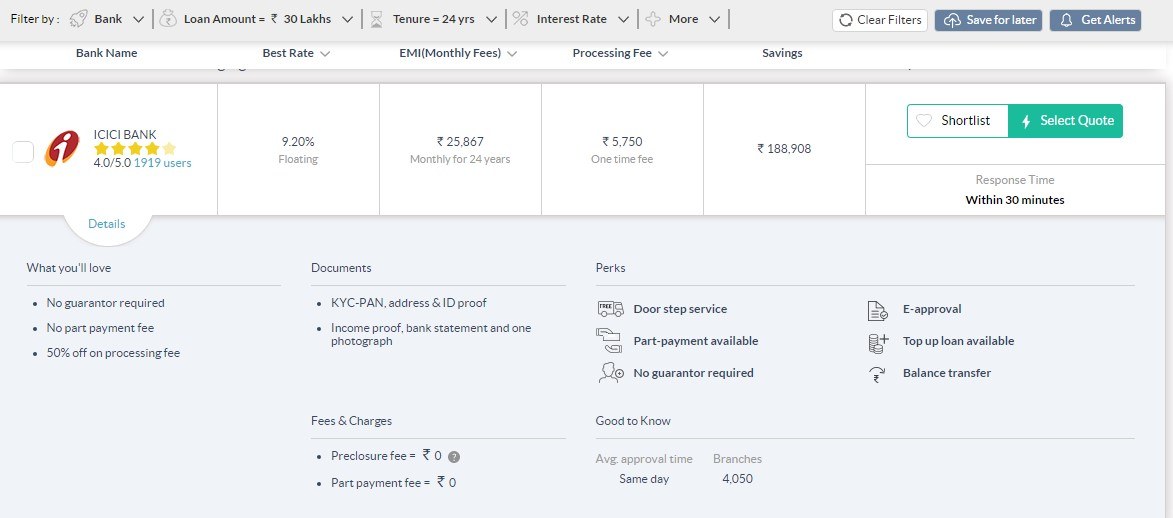

How to avoid it: Banks do not deal with agents who take money up front for granting loans. Banks do charge a processing fee to grant loans but it is received by them in the form of a cheque in the bank’s name. Check if the bank has authorised the agent to collect loan applications.

Best way forward: Deal with only bank officials to get your loan sanctioned. This way, you can be sure of your eligibility as well as charges. You can also do this on BankBazaar.com. We let you know all the charges associated with your loan such as processing fee, pre-closure fee and part-payment fee, up front. The below screenshot will give you an idea of how BankBazaar gives you all the information you need for a Home Loan.

Real Estate Rowdies

What they do: Agents tell you that if you pay the total cost of the under-construction house upfront, they will give you bulk discounts.

What’s the trick: The project might be delayed by many years.

How to avoid it: Don’t fall for offers like this unless you are sure that the builder is highly reputed and has never delayed delivery on any of the previous projects.

Best way forward: When you take a loan from a bank, the bank will release the funds in phases. This means that the real estate firm is forced to complete the project if it wants all the money.

Memberships, Products, and Services

Prizes and Discounts

What they do: Ever filled in discount coupons where they ask for your name and phone number? Or a coupon for a lucky draw? We are sure you received a call soon after you did that. Many companies such as finance firm, gyms and clubs, ask you to come to attend an event because you have won a prize or got a discount. They say that this will be accompanied with lunch/dinner and drinks.

What’s the trick: The idea is to sell you a product that you might not need in the first place.

How to avoid it: Check with the agent the reason for taking your phone number. If they fumble, you know what to do. Also, if you receive a call for such events, you have the option to say no if you think it’s going to be a waste your time.

Timeshare Companies

What they do: Timeshare companies will tell you that you can cancel a contract if you do not want to go ahead with it.

What’s the trick: They often do not mention the time period and cancellations charges.

How to avoid it: Ask for the terms and conditions upfront. Tell them that you need them in writing when you sign the contract.

At BankBazaar.com, we value your relationship and time. So, all charges are given to you upfront. Whether it is processing fees associated with your loans or annual fee for your Credit Card, you get to know all about them before you sign on the dotted line. We also mention the pre-closure and part payment charges for all our loans.

Free Gift Vouchers

What they do: Many companies lure you with free gift vouchers if you buy a product from them. For instance, travel companies can sell you travel vouchers saying that you can take a holiday for so many days and so many nights at any date of your choice.

What’s the trick: They often do not provide the voucher at all or don’t mention that there are tricky conditions attached to them.

How to avoid it: Thoroughly check such offers before you go for them. Ask the company how the vouchers will be sent to you. Understand that genuine firms have now switched to providing e-vouchers that you can use instantly.

At BankBazaar.com, you get your gift vouchers as soon as your loan or Credit Card is approved. There will be no difference between the offer promised and the vouchers that you receive.

Insurance Imposters

Family Plans

What they do: Agents often don’t tell you about Family Floater Policies.

What’s the trick: Instead of using this policy that will cover all members of a family in a single policy, agents sometimes sell you individual policies to earn more commission.

How to avoid it: Ask your agent for a Family Floater Plan if you are looking for an insurance cover for all members of your family. This might work out to be cheaper than buying different policies for each member of your family. Cashless hospitalisation is available for this policy too. If you want to reduce the premium, you can opt for co-pay on these policies. Co-pay is where you pay part of the hospitalisation expenses while the insurance firm pays the other part.

Low Insurance Cover

What they do: Agents tell you that a low sum assured is not a bad thing because you get a policy cheaper.

What’s the trick: Insurance companies don’t always ask customers to take a medical test when the sum assured is low. To avoid any delay in issuance of a policy and get their commission as soon as possible, agents ask the customer to opt for a sum assured that is very low

How to avoid it: Understand that a low sum assured is not a great option. The higher the sum assured the better will be the cover for your family. So, opt for a sum assured that will cover the needs of your family while keeping the premium affordable. This is true for all Life Insurance policies.

Endowment Policies

What they do: Agents push you to pick an endowment policy every year stating that it will help your retirement without telling about all the options available to you.

What’s the trick: They keep selling the same policy to you every year, without allowing you to look at other options.

How to avoid it: There are several other options available for creating a retirement corpus including annuities and ULIPs. An endowment plan is not the only option. Also, buying the same policy every year increases your investments risks. Always have a mix of products in your portfolio to minimise risks. If you want to check out all the options available in case of insurance, browse policies online. Do your own research, make your own comparisons and choose the policy that suits your needs.

If you are not alert, you might get duped by those agents. It is always good to keep your eyes and ears open. If you want a neutral website that will help you check out financial products, we are always around. Choose wisely. It is your money, after all. We are sure you will want to put it in safe hands.