Does it make sense to reduce one burden by taking on another? This is the first question that would be top of mind when faced with the question of whether to refinance an existing home loan. Given the fact that a home loan is the biggest reason for cash outflow in most Indian households, this decision has to be taken after a lot of thought. Here is some food for thought to help you arrive at the best decision.

Refinancing a loan can give multiple benefits depending on the situation of your current personal finance

– Get you a lower interest rate thus reducing your EMI and monthly burden

– Give you the option to go for lower tenures and be out of the burden soon

– Reduce your EMI by going in for longer tenures

– Shift from a Floating rate to fixed rate or vice-versa depending upon interest rate trends.

Wow! With so many benefits, I should immediately go and refinance my loan! On second thoughts, should I?

Every home loan buyer will agree that it is a paper work loaded process to get the loan, as all the previous procedures have to be repeated afresh. Add to this the many levels of small print and jargon and it gets more confusing. This one fact alone can trouble you while deciding whether to go for a refinance or not. Here are some facts to help you take the decision.

Refinancing refers to the replacement of a loan from one entity, with a new loan from another in order to gain some benefits. The word refinance though could seem a bit confusing as there is no reworking on your old loan but you simply take a new loan in order to repay the old one.

How do I know if “my” situation warrants going in for a refinance?

The fundamental behind every personal finance decision has to be cash flow. This same principle needs to be applied to your decision. Life is a lot simpler with online tools readily available. A simple “refinance calculator” search will give you some great tools, which will help you know with clarity as to how much lesser or how much more you will pay by deciding to go for refinance.

These calculators have multiple options to try out every scenario. You can choose your tenure, interest rate etc and find out the outflow for each scenario.

Refinance – Yes! When? -If any scenario gives you a positive saving of over 15,000/-, then that would be the ideal choice. The Rs 15000 benchmark is to cover up all the miscellaneous costs that will be involved including your time spent.

Refinance – Maybe, When?- Taking a refinance to get a lower EMI at the cost of a higher net outflow can be harmful in the long term as you will have to pay more interest (negative cash) over the period. But it also depends on your current ability to service the loan. If you feel that the cash saved every month on a lesser EMI can help you lead a better life, then it could make sense.

Refinance- Never- When? If the refinance is going to result in a net outflow of more than 15% of the outflow of current loan, it is better to stay away from the refinance.

How Aparna took her decision regarding Refinance?

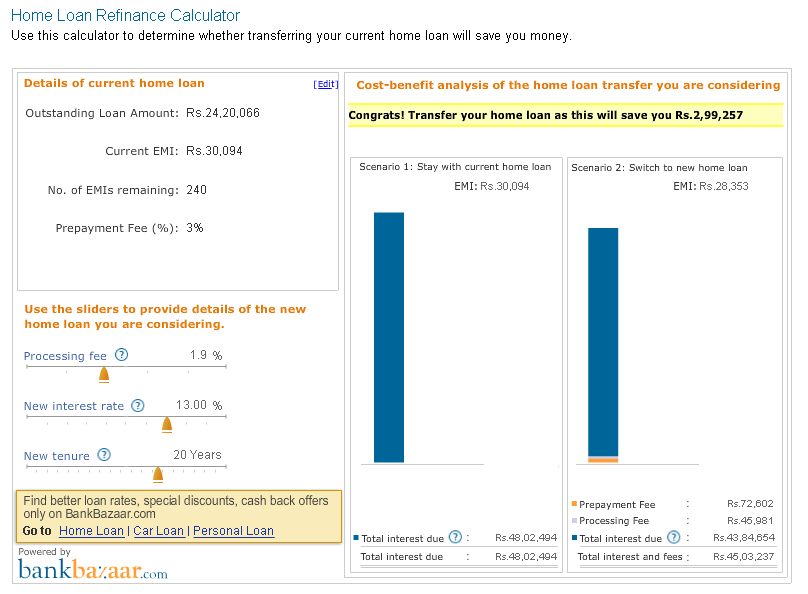

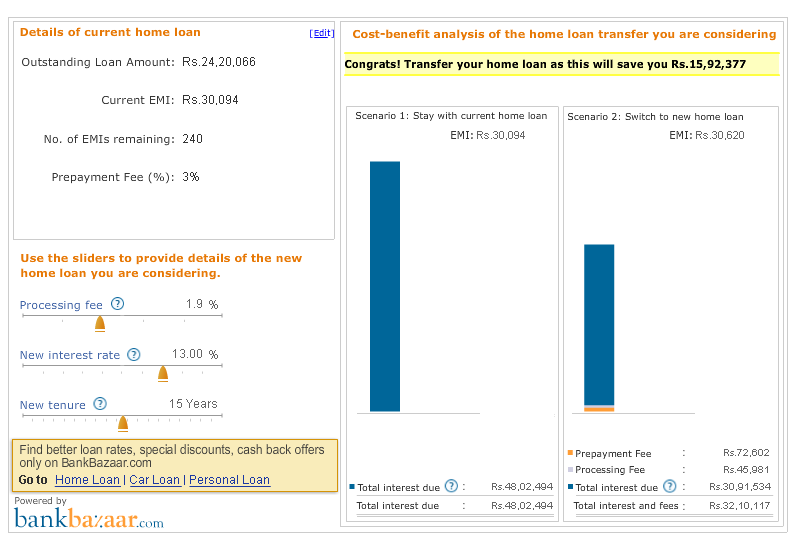

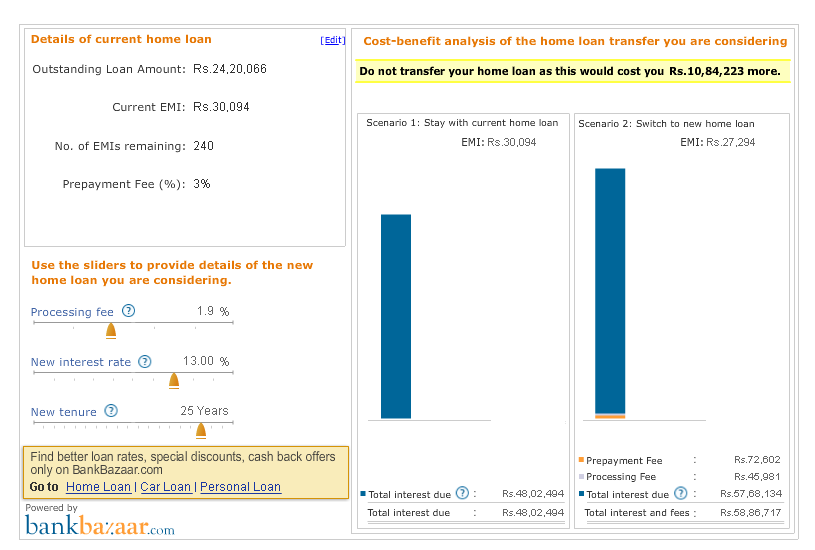

Aparna had taken a home loan of Rs 2,5,00,000/- for a 25 year tenure at a fixed rate of 14%. She had already paid the EMI regularly for 5 years when, she happened to go to a loan mela. Dinesh, a sales manager offered her a refinance at an interest rate of 13%. The offer of 2% lesser combined with the fact that her EMI would be lesser made Aparna think of the offer seriously. She met her personal finance advisor to take an informed decision utilizing an online calculator (refer pictorial alongside).

Aparna’s current principal outstanding was Rs. 24,20,066/- this was the amount that Dinesh was ready to fund as a new loan.

Aparna had three choices:

1. Lower rate, 20 Years tenure (Lower EMI) – from the Home Loan EMI Calculator she could see that if she reduces her EMI by around Rs.1700 every month and also saves Rs.2,99,257 in interest over the next 20 years.

2. Lower rate, 15 year tenure (Higher EMI, Lower months to pay) – This results in a marginal increase of Rs 526/- but saves her Rs 15, 92,377/- over a period of 15 years.

3. Lower rate, 25 year tenure (Lower EMI) – This results in reducing the EMI by Rs 2800 but an extra interest outflow of over Rs 10 Lakh.

Aparna’s Choice: Based on the calculations Aparna and her financial advisor decided to not only take the refinance option but also to go for a lower tenure.

Next time you are faced with a similar decision making process all that you need to do is to just go online and do the math for yourselves.

Pingback: Commercial Business

If I have a loan of Principle Amt of 21,25,000 for 20Yrs & paying an EMI of @ Rs.19900.If I increase the EMI amt by @Rs.5000/-PM how much period will come in this case.

I liked your article is an interesting technology

thanks to google I found you

How much one requires /month after retirment If the retirment follows in couple of month.