Parents often unwittingly expose their children to financial troubles of their own which leaves a lasting impact on their lives- a phenomenon, psychologist Brand Klotz describes as ‘financial incest’.

While separation and divorce can be messy and frustrating for the parties involved, children often unwittingly become the collateral damage of these conflicts. Unknowingly, parents often turn to their kids for help and emotional support during these trying times and end up using them as sounding boards for their pent up emotions and vent-outs. A similar situation unfolds when the family meets with a sudden financial setback arising from a sudden job loss, bankruptcy, a divorce etc. Behaviours in relation to money displayed by parents during such phases often create a lasting impact on children and manifest in traits that appear only much later in their lives. Brandon Klontz, a psychologist and certified financial planner termed this phenomenon ‘financial incest’ or ‘financial enmeshment’.

What Is ‘Financial Incest’?

Brand Klontz, who is both a certified planner and psychologist coined the term ‘financial incest’ to describe a money disorder that results in “the inappropriate involvement of minor children in parental financial matters, including conversing with one’s minor children about one’s financial stress and using children as messenger’s to pass along financial messages between adults”.

Financial incest happens when adults unintentionally burden their children with money-related stress and push them to take on an unreasonable and inappropriate role in their finances or relationship. This unhealthy exposure causes lasting damage to the child’s attitudes towards money and can result in behaviours that include anxiety over money, workaholism, unsteady jobs, poor financial habits etc.

Some of the ways ‘financial incest’ can manifest itself are as below:

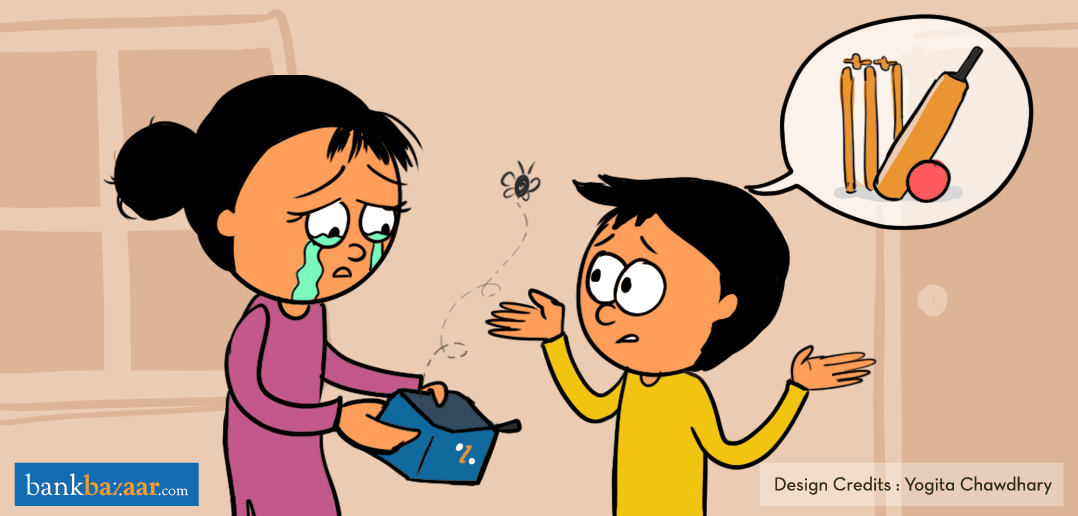

- When parents make their child feel guilty about the effort they are putting in to fund his education or recreation needs.

- When the mother blames the child’s father for lack of money, whether it is due to his poor spending habits or non-payment of maintenance after divorce.

- When parents share their stress about the loss of a job or lack of increment with their kids.

- When a kid’s pocket money is suspended or spending is limited owing to frustrations about financial spats with each other.

- When parents use their kids as a buffer for their failure to honour their financial commitments and obligations-payment of EMIs, loans, bills etc.

- When parents get children to act as intermediaries and answer phone calls from debt collectors.

Additional Reading: How Working Mothers Can Get Smart About Their Finances

How Does Financial Incest Impact Its Victims?

According to researchers, adults who experienced financial incest as kids are likely to mete out the same treatment to their children. The troubled relationship with money can show up later in adulthood in the form of insecurity, overspending, workaholism or any other money disorder.

Take the case of Avantika Pansare who runs her own tiffin delivery business in Nagpur. Avantika’s parents had a long drawn-out divorce that left her mother financially crippled. Raising two kids (Avantika and her little brother) as a single mother was no easy task and Avantika had to take on the role of a caretaker in the family very early on. With her mother leaving for work early in the morning, Avantika was in charge of feeding, bathing, and dropping her little brother to school every day. Her financial burden increased more as they grew up-she used up most of her savings to fund her brother’s pilot training course. Avantika to this day can’t stop herself from helping people out–she’s lent people money to the tune of Rs. 50,000 and when it comes to repayment, some of them have even disappeared with her money. Avantika is aware that her relationship with money is bordering on dangerous and she is now beginning to see how it is negatively impacting her business too.

Additional Reading: What Money Scripts Reveal About Your Finances

How Do You Have Money Conversation With Your Kids Without Stressing Them Out?

If you find yourself involving your kids in all money-related conversations that should ideally be restricted to just you and your partner, it’s time to stop and pay attention to your behaviour. If you have to share money-related information with them at all, remember to share as much as is appropriate for their age and without introducing negativity and aggression. It’s important that while talking to them, you give off an impression that things are in control and that they don’t need to stress over it.

Here are a couple of situations where just by rephrasing and explaining the situation in a more mindful way, you can avoid inducing anxiety in your kids:

Situation 1: Financial problems arising out separation or divorce-

Wrong way: “I can’t afford a new dress for you because your dad doesn’t pay the maintenance regularly!”

Right way: “Since I have a limited income, I need to take care of the essentials first. I will buy you a new dress next year once we have saved up enough for it”.

Situation 2: Dealing with debt collectors-

Wrong way: “Tell the uncle on the phone that your father is away for a few months and will not be able to pay him now”.

Right way: Never push your child to lie on your behalf. You should chart out a plan to repay your debts and not involve him/her in these situations.

Situation 3: Loss of job-

Wrong way: “Forget about going on a vacation or eating out every weekend since I don’t have a job anymore!

Right way: “I am looking out for a higher-paying job and since it’s going to take some time, we have to cut down on our discretionary expenses like eating out, shopping etc.”

Parents are human too and it’s only natural that by unloading your worries on your children, you may feel like a burden is off your chest and this makes you feel better temporarily. But rather than turning to your children, who frankly, can’t do anything with that information, it’s better to speak to a therapist, a financial adviser or an adult friend.

Having trouble with your finances? Is your credit in shape? The best way to start rebuilding your credit is by checking your Credit Score first. Hit the button below to get your report in less than 3 mins!