We conducted a Financial Literacy Survey just to gauge how much people know about finance and the results were interesting, to say the least. The survey was taken by over a 100 people and consisted of a mix of BankBazaar employees as well as people from outside BankBazaar.

What kind of people took the survey?

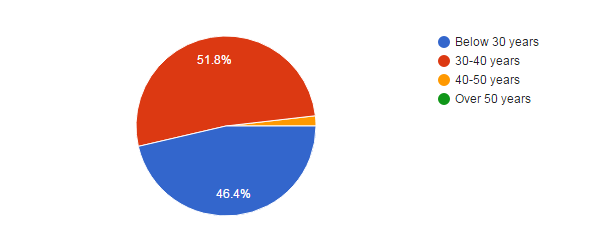

About 74% of the respondents were male, indicating that men might be ready to take on challenges such as this more easily than women. The age group of the respondents was as below:

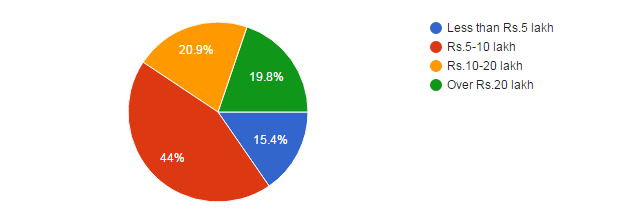

As you can see, all respondents are below 40 years. The incomes of the respondents were as below:

We had respondents from all tax brackets.

The Survey Results

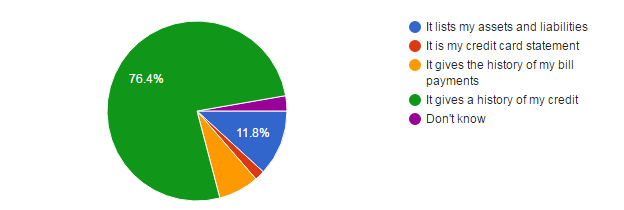

Question 1: What is a Credit Report?

About 76% of the respondents got this one right.

Answer: It gives a history of my credit.

Explanation: A Credit Report is a report prepared by credit bureaus which helps lenders make decisions regarding lending to individuals. This report has information regarding your credit, including loans taken, repayment history, usage of credit and other related details.

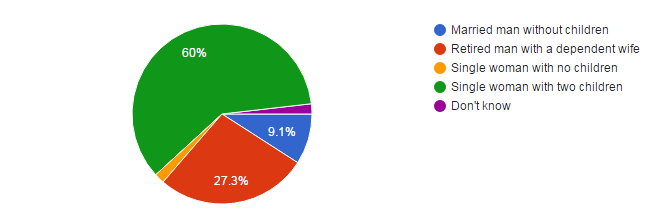

Question 2: Who would need the highest sum assured (Life Insurance) among the below people?

This seems to have been a tougher question, as only 60% of the respondents got this one right.

Answer: Single woman with two children.

Explanation: Life Insurance is most important for one who has dependents who are young. Therefore, this category of people would need the highest sum assured. In case the insured is not around, the dependents will have the insurance money to take care of their expenses.

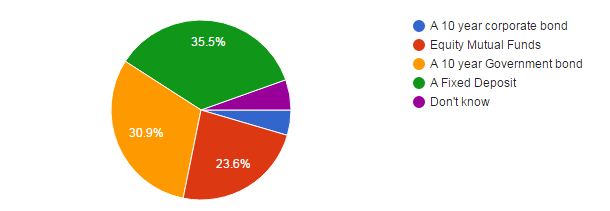

Question 3: Which of the following investments would be the least affected by inflation?

This seems to have been a real toughie. Only 23% of the respondents got this one right.

Answer: Equity Mutual Funds.

Explanation: All products that give a fixed rate of interest have a direct correlation to inflation. Equity Mutual Funds are based on equity market movements, which in turn have minimal correlation to inflation.

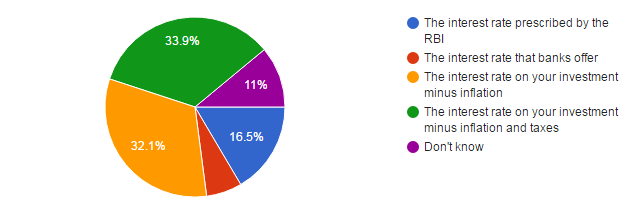

Question 4: What is real interest rate?

This one was a googly. The answers seem to be all over the place, with 32% getting it right.

Answer: The interest rate on your investment minus inflation.

Explanation: Real interest rate is the rate of return on your investment after you take inflation into account. The formula is: Real Interest Rate =Nominal Interest Rate – Inflation. Inflation can be actual or expected.

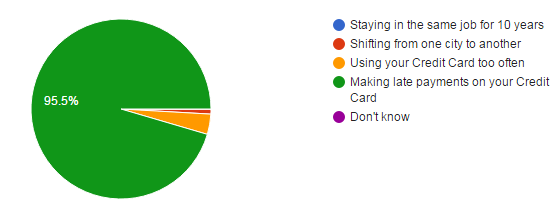

Question 5: Which of the following can affect your Credit Score?

Everyone seems to have aced this, with 95% of the respondents getting it right.

Answer: Making late payments on your Credit Card

Explanation: A Credit Report takes into account the way you handle credit, and a major part of it includes whether or not you pay your loans on time. Other factors such as where you live, what job you hold and using your Credit Card too often, do not affect your Credit Score.

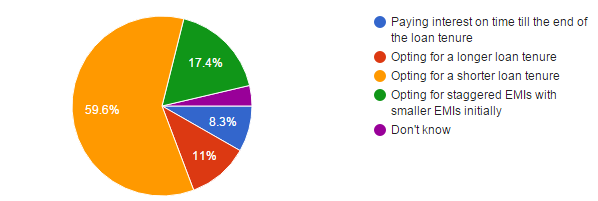

Question 6: How can you lower the cost of your Home Loan?

This was a mixed bag, with 59% giving the correct answer.

Answer: Opting for a shorter loan tenure.

Explanation: The quicker you pay back your loans, the lower will be the interest payout (which is the cost associated with your Home Loan). Opting for a longer loan tenure or smaller EMIs will only increase the cost of your loan.

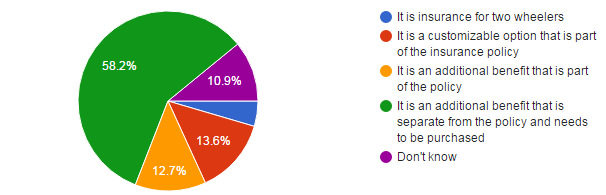

Question 7: What is a rider in insurance?

58% seem to have got this right.

Answer: It is an additional benefit that is separate from the policy and needs to be purchased.

Explanation: Riders in insurance are additional benefits that are separate from the policy and need to be purchased, if you require them. You generally cannot modify or customize a rider.

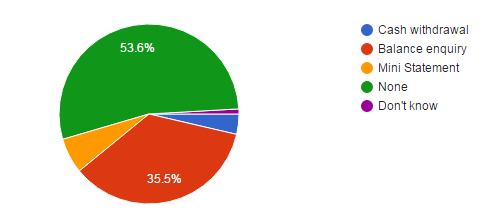

Question 8: According to RBI guidelines, which of the following transactions in other bank ATMs (apart from your own) are not chargeable?

53% of the respondents gave the correct answer.

Answer: None.

Explanation: According to RBI guidelines, all non-financial transactions are chargeable at other bank ATMs. However, there are banks like IndusInd Bank that allow customers to avail of this service, free of cost.

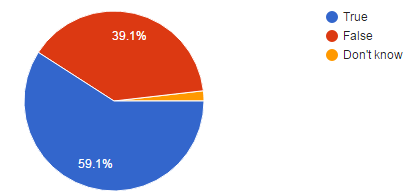

Question 9: Health Insurance doesn’t cover pre-existing illnesses

It is indeed surprising that most, (59%) of the respondents, got this wrong.

Answer: False.

Explanation: Health Insurance Plans do cover pre-existing illnesses but there is a waiting period. Insurance firms will cover expenses related to pre-existing illnesses after the waiting period is over. Check the terms of your policy for the specifics.

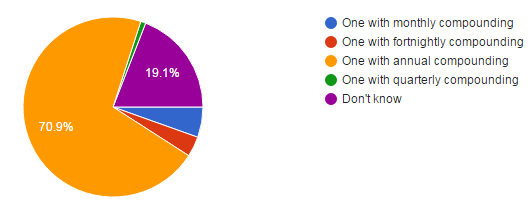

Question 10: Which loan will have the least interest if everything remains the same?

Respondents aced this questions with almost 71% answering correctly.

Answer: One with annual compounding.

Explanation: Just like compounding increases the returns on your investments, compounding hikes the interest on your loans too. The more frequent the compounding the higher will be the interest.

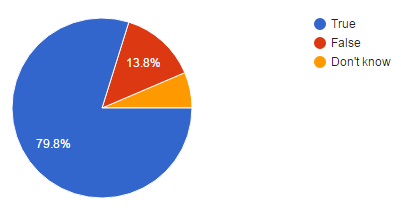

Question 11: A 10 year loan will have higher EMIs than a 20 year loan but the total interest payment will be less if everything else remains the same.

Respondents seem to get questions about loans right. This question was answered correctly by close to 80%.

Answer: True.

Explanation: The shorter your loan tenure, the higher the EMI because the number of months within which you need to repay the loan reduces. In the same way, your interest payment will be lower as you will repay the loan quickly.

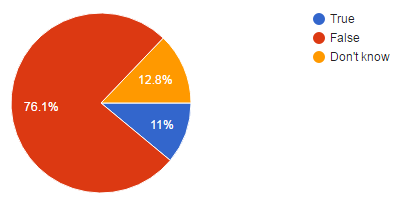

Question 12: Investment in the shares of a single company can provide safer returns than an equity mutual fund?

It’s good to see that most respondents (76%) got this one right.

Answer: False.

Explanation: The more diversified your investments are, the safer would be your returns. This is because your money gets spread across different investments, which move differently. When one falls, the other needn’t. So, a mutual fund that invests in a number of different companies would be safer than investing in the shares of a single company.

Conclusion: You might be educated and knowledgeable, but only if you are financially literate can you manage your money well to get the maximum out of your loans and investments. For instance, if you didn’t know that a shorter loan tenure reduces the cost of your loan, you will end up paying high interest rates in the long run. You wouldn’t want to waste your money like that, would you? So, get armed, read the BankBazaar blog regularly (put that at the top of your to-do list) and over time, you will hopefully be smarter when it comes to finance.