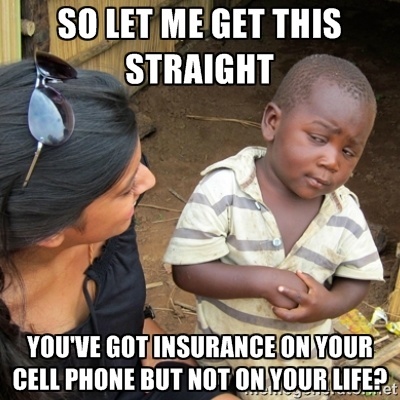

You don’t really talk about life insurance when you are taking a walk in the park with your loved ones, do you? Actually, you don’t wish to talk about it at all! You think that you need it only when your hair turns grey.

How far are you from the truth?

Okay! Consider that you got this brand new uber-cool supercar (spending a fortune!). Your favourite rock track is on and you zoom past the considerably “slower” or “older” folks in life. Then comes a sudden wrong turn.

You do realise that it’s not just the car that turned. Your life took a turn too!

Insurance is like that airbag in your car which protects you from the accident and reduces the intensity of the damage.

So why should you get that insurance?

- We all know the fact that you do not get the insurance money until something really messed up happens. But that shouldn’t stop you from getting an insurance as long as you care about your loved ones. Insurance is a long term security, so you must choose wisely.

- If you wish to boost the funding after your retirement you could choose a life insurance plan. Considering the Yin Yang theory, Life Insurance qualifies as the Yin whereas retirement is the Yang. So, basically, they can combine with each other in a manner that is complimentary.

What are the basic types of insurance then?

There are two types of life insurance, when you look at it broadly. The term insurance plans are the ones that expire whereas the permanent plans generate cash value. Let’s say, you have a permanent insurance plan in place. Voila! You can now use the cash that is generated after your retirement. Even better, the benefits that you get are absolutely tax free.

Single vs. Married: How does this affect insurance?

There are several benefits of being single too. No. We are not deviating. We are still talking about the benefits of insurance.

Now, the question is, ‘What happens after you get married?’ What if one spouse works, but the other spouse stays at home? What if one of them is earning substantially more than the other? No matter how you look at it, insurance for the only earning member or the higher earning member can be good in the long run.

What happens when kids come into the picture?

Let us go further ahead in life. Kids. They bring in new hope, joy and expenses in your life. Oh! The third word there is very important. Education, clothes, food, day care; everything is freakishly expensive nowadays. So, planning a life insurance policy is equally important as planning a baby. Well, if you did not plan the baby, you need it all the way more!

There could be acts of peril and a life insurance policy will be there to watch your back, all the time. God is there for you, but the insurance is there with you too.

Maybe, one fine evening, while sipping on your coffee, you get this awesome idea about a business. You are so charged up, you feel like building a Wayne Tower for yourself! You discuss the idea with a buddy who eventually becomes your partner. Life Insurance is what you need next. Why? What if something terrible happens to one of the partners? Batman falls too (not off the Wayne Tower, though).

Hit the road, Jack. Choose a good life insurance policy and get back on track.