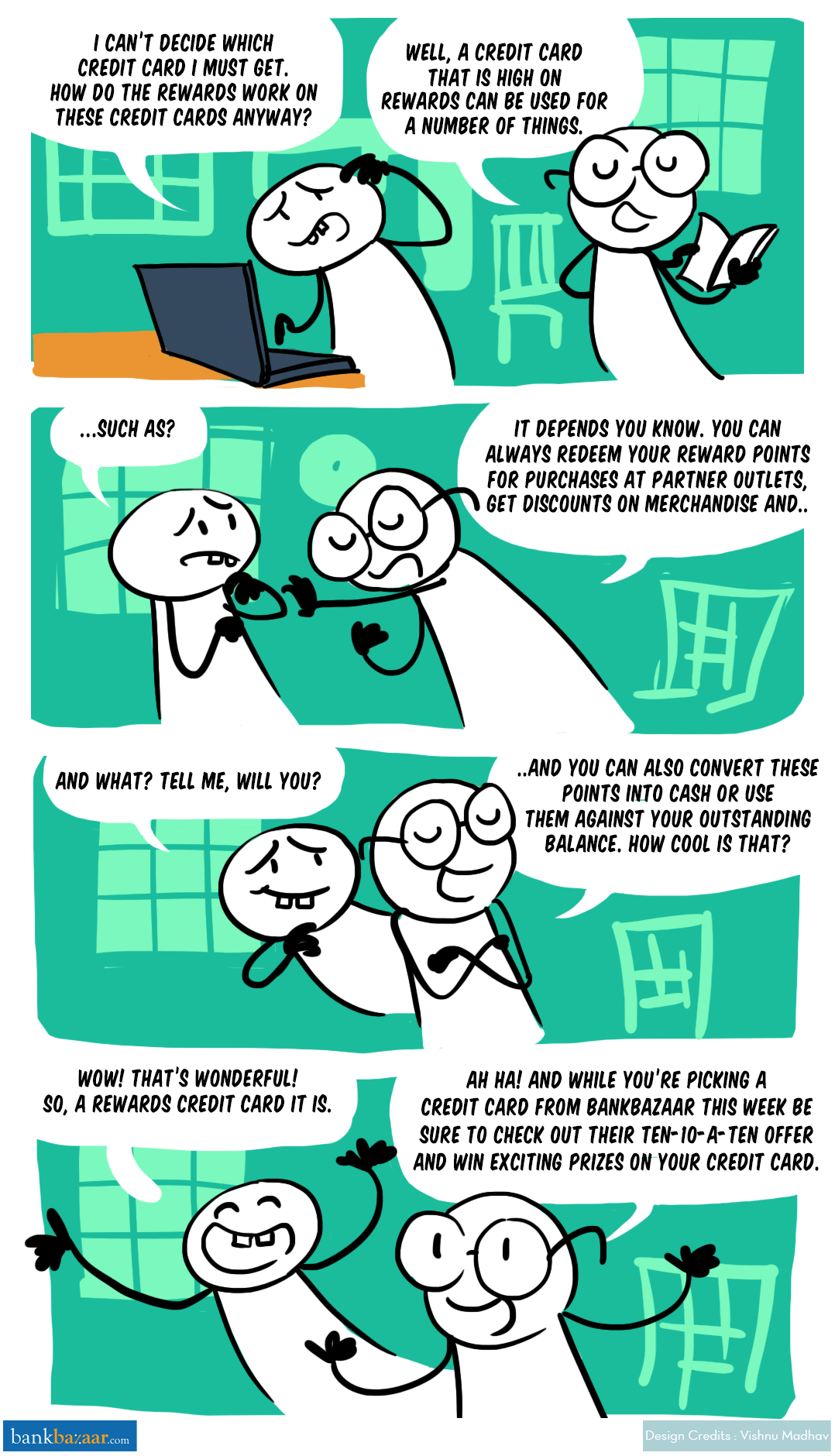

Wondering how reward points work? Read on to find out all you need to know about Credit Card reward points.

How do Credit Card companies motivate you as a user to use your card more frequently? The answer is reward points, and by the time you’re done reading this article, you’re going to want to stack up your points; trust us!

Why do rewards points matter to me?

Well, these points can be accumulated over a period of time and later can be redeemed for cashback, air miles, goods, and services depending on the reward program on your Credit Card. Some card providers offer plenty of redeeming options with points that never expire whereas others provide limited choices in exchange for their reward points with a limited validity.

Confused? Fret not; we’re going to take you through the various types of reward programs so you can make the most out of your Credit Card usage by stocking up on points!

The rewards on your Credit Card can be redeemed in the following ways:

i) Merchandise: In India, most of the Credit Card providers reward their customers with points that can be redeemed for purchasing goods and services listed on the card’s website. This may include the purchase of clothes, electronics, home appliances, discount vouchers for any retailer/service provider, holiday package etc. Some Banks allow you to make a partial payment using your Credit Card and the rest through your accumulated points if the listed price of a product is more than the reward points you have.

ii) Cashback: The reward points on your card can be used in exchange for cashback. However, the amount of cash paid by Credit Card companies may be lesser in comparison to the money value of goods and services. For example, a Credit Card company may provide Re.0.25 as cashback whereas, at the same time, it may offer Rs.1 of merchandise value in exchange of 1 reward point.

iii) Merchant-specific offers: The cards that have a tie-up with any specific merchant like Lifestyle, Shopper’s Stop etc. may offer great discounts or free shopping for their customers in exchange for reward points. These type of reward programs should be preferred especially if you often use specific stores. And second, some issuers partner with merchants to give you special offers that may slice another 5 percent to 15 percent off a product’s price.

iv) Fuel Cards: Credit Card companies sometimes offer free fuel in exchange for their reward points which is extremely beneficial for those who travel using their own vehicle. This may not be a useful reward for those who do not drive.

v) Air Miles: Redeeming Credit Card reward points for air travel is very popular among people who are frequent fliers and is considered extremely beneficial to pay for expensive flight charges.

Additional Reading: 5 Popular Travel Credit Cards Of 2018

So, how do Credit Card companies manage to give rewards?

The banks or the card issuers make money through:

- Interest, late fees, annual fees, etc.

- Merchant establishments that pay a certain fee for using a point-of-sale terminal (swipe machine) to the bank that installs it (the acquiring bank).

Additional Reading: How to Correct Late Payment Record On Your Credit Report

Now, some part of this income is passed on to the customers in the form of reward points. This is done to reward them for their relationship and promote the usage of their cards. The increased use and acceptance of Credit Cards thereby increase the footfall at merchant establishments. As this is a win-win situation for all, the cycle continues and some benefits are passed on to the buyers in the form of reward points.

Is the reward program worth it?

Many of us don’t know about the reward program and its benefits. And there are many who do not value the importance of rewards on Credit Cards. But believe me, if picked wisely and used right, your Credit Card rewards can work magic for you. Yes! It can actually provide you with free flights, free fuel in your car (many times a year) and allow you to shop for free.

To draw maximum value from a Credit Card, you need to play the reward game right. Following are a few points that you need to ensure on your side before you expect any returns:

- Never spend more than your paying capacity. The first rule of pulling the most out of your Credit Card is to “know your limits” and never spend more than what you can pay off at the end of each month.

- Repay your Credit Card dues in full each month i.e. do not roll over or revolve your credit to next month. Avoid paying the only minimum due and clear all your dues by the due date. Revolving your credit to next month will attract additional payment in terms of either late payment fees, interest charges etc. which can nullify/ adversely impact your reward benefits.

- Select a Credit Card on the basis of your spending behavior and reward program. Also, look at the redemption rate provided by the Credit Card you pick. If you travel more, then opting for a travel Credit Card or a card that provides rewards in the form of air miles is suitable for you. To maximise your rewards, zero in on cards that reward you generously for everyday activities like shopping or banking.

- Understand the Terms and Conditions in advance, especially related to the usage of Credit Card and reward points. Some reward programs have an expiration date, and some cards charge fees for redeeming their points. And Credit Card companies sometimes will change their rewards and their values without notice. It is important to understand your reward program in detail to get the maximum benefit.

- Spend more to earn more. It is true that the more you spend on your Credit Card, the more rewards you get. This rule implies when you spend more on cash vs. a Credit Card. You can start using a Credit Card for paying your utility bills like telephone bill, mobile bill, electricity etc. that you generally pay through cash or internet banking. Transferring all your monthly expenses on your Credit Card will enable you to keep a track of your expenses and enable to earn rewards at the same time. But one should not forget his spending limits and should keep a control on the expenses made using a Credit Card.

Keep in mind that the whole idea of drawing benefit from a reward program fails if you do not follow any of the above-mentioned rules. You have to be vigilant not to overspend and ensure to repay all your dues on time to win this game. If you use your Credit Card in a right way, then you can positively enjoy the perks provided by Credit Card companies.

Now that you know all about rewards, want to get in on the action?