Using a mobile app to track your spends and yet ending up spending recklessly at the end of the month? Here’s a novel way to rein in those mindless spends: the Kakeibo saving method.

Spending and saving money can seem like mutually-exclusive concepts that are often at loggerheads with each other, but they both can actually go hand in hand. This does not require painstaking calculations or spending a bomb on financial advisers. You can do it all by yourself if you pay close attention to where your money is going. These days, you’ll find an abundance of mobile apps that help you keep a track of your monthly spends. But, even if that doesn’t cut it for you- here’s a novel way of saving that you may want to take a stab at – the Kakeibo method of saving.

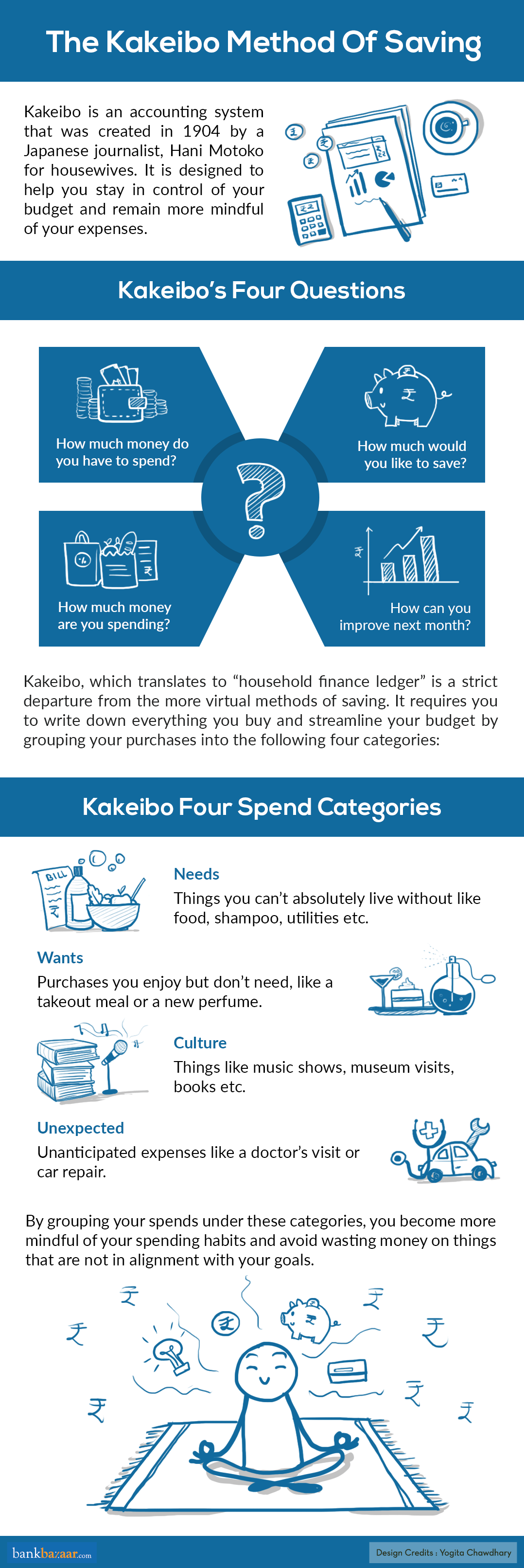

How To Use Kakeibo:

-

Fix A Budget:

When your salary gets credited to your account, subtract your monthly fixed expenses from your monthly income to determine how much you have for all your monthly spending.

Additional Reading: Dynamic Currency Conversion And Why You Should Avoid It

-

Set Your Savings Goal For The Month:

Savings goals form an important component of Kakeibo. When you’re following the Kakeibo method, you have to set realistic monthly goals and jot down what you’re saving them for. Once you’ve decided on your goal, set aside your savings by deducting the goal amount from your available spending money.

-

Track Your Spends:

Every week as you make purchases, jot them down in a ledger. Kakeibo requires you to track your spending real-time, with pen and paper. This helps you to slow down, pay attention to the present moment and to think about the future impact of your spending.

-

Calculate Money Spent In Each Category:

At the end of the month, take a stock of how much money you ended up spending on your needs, wants, unexpected expenses and cultural purchases.

Additional Reading: How Much Can You Save When You Live Healthy

-

Calculate Money Spent And Saved:

Add up all your purchases and deduct the amount from your total budget. This is the amount you saved. Compare it to your savings goal amount.

-

Assess Your Performance:

One of the most distinctive ways Kakeibo differs from other budgeting methods is its mindful approach towards reflecting on your performance. At the end of the month, check if you’ve met you goals. If so, jot down what went well this month and how you plan to carry your success forward. If not, write down the reasons you didn’t meet your goals and how you can improve the next month.

Additional Reading: When Should You Lower Your Credit Limit?

The analog method of Kakeibo can offer a realistic way of saving for you, if saving money is an issue that has always eluded you. It encourages you to pay closer attention to your spending than is required in digital methods. One of the other ways in which Kakeibo is a departure from other methods is that it emphasizes mindfulness and prompts you to both plan in advance and think about your past performance.

Need help with saving or just your finances in general? We might be able to help!