Rajesh is an insurance professional who had heard a lot about stock market giving humongous returns to some of his friends. With their advice, he started following the market but did not dare to enter it. However, in 2007, he could not control himself anymore and invested 2 lakhs in stocks of blue chip companies. Then the market crashed in Jan, 2008. He lost almost 70% of his capital. In panic, he sold and recovered whatever he could.

Jasmit is a software engineer and had lost money in the same Jan, 2008 crash. He got completely disenchanted with equity and invested his money in bank accounts and post office savings. He knew that the market in 2009 did offer great opportunities but he did not enter it fearing the worst. The market then went up by 80% in a year. Few of his friends made good money while he is getting 8% interest in his savings.

These stories are our stories. We have behaved like Rajesh and Jasmit many times. We have lost money, taken wrong decisions, and either been too afraid or too greedy.

How can we avoid these situations?

Portfolio Management

Portfolio management is a mechanism which spreads our investment in different asset classes to reduce the risks. The allocation management and rejigs are functions of our age, risk profile, and investment horizon.

While there can be innumerable types of assets in a portfolio, we will focus mainly on equity, debt, and gold; assets that we are all familiar with.

Factors that impact portfolio decisions

Investment Horizon

Investment horizon is the most important factor that dictates the portfolio mix. A relatively younger person can afford to invest more in assets which entail high risk. There is no uniform rule for this but a person of 30 years of age can afford to invest 70% (=100-30) of his money in equity while 30% can be distributed among debt and gold.

Similarly a person of 50 years of age should invest smaller part of his or her money in equity and more on debt and gold.

Risk appetite

The portfolio mix depends on the risk profile of investors too. An investor with high risk profile will invest major part of investment into equity while an investor with low risk profile will invest major part of money in safe assets such as debt and gold.

Market status

Though many financial planners do not discuss about market status as a factor in deciding your portfolio mix, you should consider this. In a bull market when everything looks overpriced, it makes little sense to invest major part of your money in equities even though you are 25 years old.

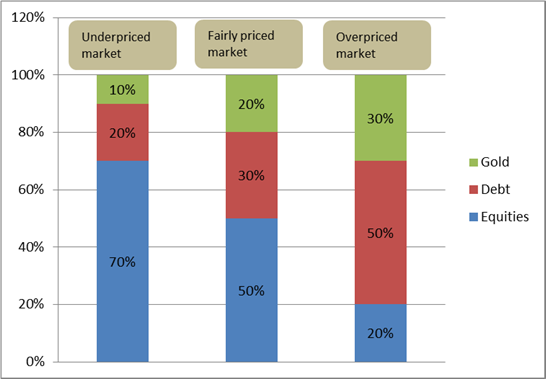

Typically an investor who is 30 years old can do the following in different market condition. The market status can be defined by looking at the PE ratio of the market. From our experience, we have taken the following PE ratio to define under priced, fairly priced, and overpriced market.

Under priced market: PE < 15 | Fairly Priced market: PE =15-20 | Overpriced market: PE > 20

Changing Portfolio Mix

The investor should change the portfolio mix when the following changes happen:

Change in the investment horizon

When the investment horizon itself changes, you should change the portfolio mix. For example, when you are in your 30s, you may have invested major part of your money in equities. As you get older, your investment horizon decreases. Hence, you should change the equity proportion of portfolio.

Change in market status

As shown in the picture, you may have invested major part of your money in equities because market seemed under priced. But as market goes up to fairly priced and overpriced mode, you should change the portfolio mix by reducing your investment in equities an increasing them in other assets.

Finally

Had Rajesh and Jasmit built their portfolio mix while investing in the market, they would have done much better. Rajesh would have lost some money in equity but his debt and gold proportion would have given him enough to cover the loss and make some decent money too. Jasmit would have reaped the benefit of the bull-run that market experienced in year 2009 and would have increased the performance of his portfolio.