If you are a salaried employee facing a cash crunch amid the COVID-19 pandemic, you have a few options to help you over the short term, including a loan against your PPF account, a non-refundable advance from EPF, a loan against your Life Insurance policy, a Personal Loan from certain banks or even, as a last resort, liquidation of investments.

The Covid-19 pandemic has affected our lives in myriad ways. From the way we shop for groceries, socialise with people, to the way we work, the virus has made its presence felt. It has also ravaged the economy, resulting in widespread layoffs, pay cuts and furloughs that have taken a toll on salaried employees. With many people facing a loss of income, the government, the Reserve Bank of India and other banks have stepped in with various measures to support those facing a cash crunch.

Additional Reading: Money Management Tips For Covid-19

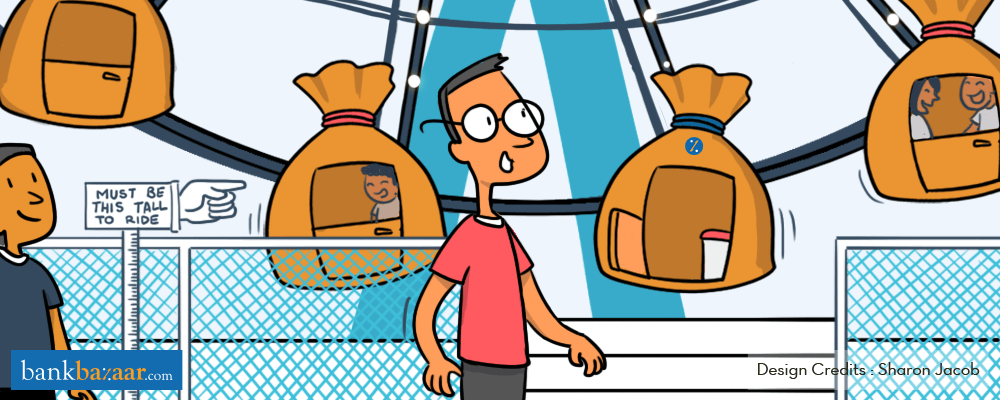

If your bank balance is looking rather the worse for wear and your cash inflow has dried up or slowed to a woeful trickle, let’s take a quick look at your options to tide over a cash crunch in the short term.

Take A Loan Against Life Insurance Policies

While banks do not typically give loans against term policies, policyholders can avail a loan against traditional Life Insurance plans, including endowment, money-back plans and unit-linked insurance plans. Provided you have paid premiums for at least three years, you can avail a loan amount that’s decided on the surrender value of a whole life insurance policy, which may be up to 80% against traditional plans with guaranteed returns. The fund value will be used to determine the loan amount for a loan against a linked plan. Remember that you will need to repay the loan within the term of the policy.

Take A Loan Against PPF Account

You will be able to avail this loan against your investments if you hold a PPF account in a bank or post office. However, this loan comes with several caveats as you’ll see. For one, you will not be eligible for this loan if you haven’t repaid any earlier loans in full (along with interest). Secondly, you’ll have to repay the principal amount within 36 months, either in one lump sum or in installments. Further, the loan amount cannot exceed 25% of the outstanding amount at the end of the second year immediately preceding the year in which the loan is applied for. Finally, you can take the loan after the expiry of one year from the end of the year in which the initial subscription was made but within five years from the end of the year in which the initial subscription was made.

Additional Reading: All About Prematurely Closing A PPF Account

Withdraw From EPFO

The Central Government has allowed employees to avail a non-refundable advance from their Employees’ Provident Fund (EPF). A salaried employee can withdraw up to 75% of the outstanding balance in his account or three months’ basic pay plus dearness allowance, whichever is lower. The outstanding amount includes interest as well as the contributions of both the employee and employer. This claim is being settled within three working days. You’ll need to apply online for the advance through the EPFO website, fill in claim forms 31, 19, 10C and 10D, upload a cheque leaf displaying your printed name or the first page of your bank passbook or a bank statement with your name, account number and bank IFSC code.

Liquidate Investments

This isn’t advisable and should be done only as a last resort. Remember that withdrawal from Mutual Funds/ stoppage of SIPs, closing of PPF account, breaking Fixed Deposits and so on, may carry a penalty as well as have tax implications. So always weigh the costs involved in liquidating your investments. If the costs are too high, it may be better to look at other ways to raise cash.

Additional Reading: How To Liquidate Investments

Apply For A Personal Loan

Several banks have rolled out Covid-19 Personal Loan offers of up to Rs. 5 lakhs for existing borrowers and those who hold salary or pension accounts with the bank with an interest-rate range of 7.2% to 10.5% per annum as against 9% to 24% for a regular Personal Loan. Talk to your bank about your options.

Avail A Contactless, One-Hour Disbursal Personal Loan

You could also take advantage of preapproved Personal Loan offers from banks such as IDFC First Bank. When you apply via BankBazaar, the loan application process is 100% online and contactless, which means no physical meetings with a bank rep or document signings. There’s no need to furnish income documents either. Further, you’ll get the money credited to your bank account within one hour. Sounds interesting? Let’s get you started by simply clicking the button below.