Let’s take a look at the online facility launched by EPFO through which EPF account holders can update their exit date in the records.

With their latest update, the Employees’ Provident Fund Organisation (EPFO) has made the transfer and withdrawal of funds from the Employees’ Provident Fund (EPF) accounts much simpler. Let’s take a close look at the changes and its benefits.

With their latest update, the Employees’ Provident Fund Organisation (EPFO) has made the transfer and withdrawal of funds from the Employees’ Provident Fund (EPF) accounts much simpler. Let’s take a close look at the changes and its benefits.

From January 2020, EPF introduced a new feature in UAN website for employees, enabling EPF members to update his or her date of exit (DOE) or the date of leaving the organisation without the help of an employer, after 2 months of leaving the job. The date of exit gets updated instantly. No employer approval or EPFO approval is required.

Earlier, the DOE could only be updated by the employer. If the exit date is not available in EPFO records, then an EPF account holder cannot withdraw money from his EPF account or even transfer funds from the Provident Fund (PF) account of previous employer to the PF account of the current one.

Additional Reading: How EPF Helps You Save On Tax

An EPF account holder can update the exit date in EPFO records online via the Member e-Sewa portal. Follow the steps mentioned below in order to update the ‘exit date’ in EPFO records:

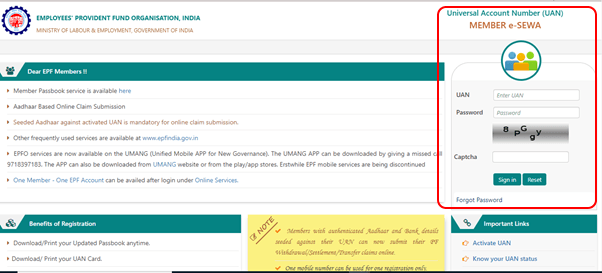

Step 1: Log in to the Member e-Sewa portal by entering your credentials such as your Universal Account Number (UAN), password, and captcha code. Remember it’s necessary for your UAN to be activated on the portal for you to log in to the portal.

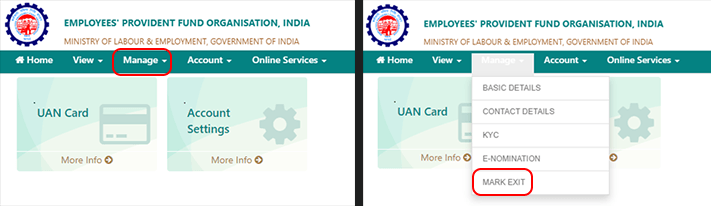

Step 2: Click on the ‘Manage’ tab and select the ‘Mark Exit’ option.

Step 3: A new tab will open on your screen. Proceed to select the employer and EPF account for which you wish to update the exit date. The date of exit can only be marked two months after the last contribution made by the employer. While entering the date of exit, you can enter any date of the month in which last contribution was made by your previous employer. You can find this in your EPFO passbook records.

Step 4: Proceed to enter the date of exit and reason for exit.

Step 5: Once you have updated the date, click on ‘Request OTP’. A one-time password (OTP) will be sent to your Aadhaar-linked mobile number.

Step 6: The last step is to click on ‘Update’ and then click on ‘Ok’.

The exit date will be updated in your EPFO records.

Additional Reading: EPF Vs PPF: Which Is Better?

Wondering why it is necessary to transfer your PF from your old employer to the new one?

Once an individual takes up employment in any of the PF-registered organisations, he or she will be registered for PF, and both employee and employer will have to make regular, monthly contributions to the employee’s PF. This accumulating fund earns interest till withdrawal. Further, in the event that the individual switches his or her job, what happens to the PF account of the employee already created with the previous employer? The employee will have two options in such cases. Either the employee’s contribution with interest can be withdrawn if the employee continues to be on break for up to 60 days; or the PF balance in the account created by the previous employer can be transferred to the account created by the current employer.

In order to transfer your funds to the PF account created by your current employer, it’s necessary that you update the date of exit for the previous employment.

Additional Reading: Quit Your Job? Here’s How To Withdraw Your PF And EPS Money

Looking for financial products such as Credit Cards or Personal Loans? Click below to get started!

Dear sir after selecting organization in mark exit it is mentioned, no contribution was recieved date of exit updation is not possible please contact your employer. What to do sir in this situation.

Hi Durgesh,

You will need to contact your employer or write to EPFO regarding this.

Cheers,

Team BankBazaar

i have quit the job a year ago, but when i try to mark myself “Exit”, There It Shows “Date Of Exit Can Only Be Updated After 2 Months Of Last Contribution Made By Employer.

Hi Wasim,

Please raise a complaint on the EPFO grievance portal to get this addressed.

Cheers,

Team BankBazaar

Hi Sir.

I worked in a company for three months. I quit my job at the end of the third month, so I did not receive any salary nor any PF contribution for last month. But in my relieving letter, it states I worked for three months but in my EPFO account when I try to fill Date Of Exit, I have the option to select any date only in second month(a month prior to my exit), since last contribution was made during second month.

If I file my last date of Exit in second month as per EPFO it will differ from my Relieving Letter. What should I do ?

Is this the normal behaviour where PF contribution of last working month will be skipped for employees generally in all organization ?

Also, I have another query can Exit Date in EPFO be updated only in last month when the PF contribution was made. Or else can it be updated to any Date by my previous employer ?

My previous employer is not responding to my queries, what should I do ?

I am eagerly waiting for your factual and quick reply. Thanks

Hi Raghul,

An organisation cannot withhold their PF contribution for your last working month. We would suggest you file a grievance with the EPFO grievance portal to get this issue resolved at the earliest.

Cheers,

Team BankBazaar