International Men’s Day is a time to celebrate the positive contributions of men to society and focus on men’s well-being and, importantly, their financial well-being. As November 19th comes closer, it’s an opportune moment to explore the intricate relationship between men’s mental health and financial decision-making.

From the pursuit of financial stability to the exploration of investment avenues, from understanding the nuances of debt management to planning for retirement, our journey through this blog will touch upon various facets of personal finance.

First, we’ll discuss the psychological impacts of finances that men grapple with, and then we’ll discuss simple ways of navigating through the complexities of money matters.

This dual approach aims to provide a comprehensive understanding of the mental aspects involved in financial management, coupled with actionable steps to navigate these challenges effectively.

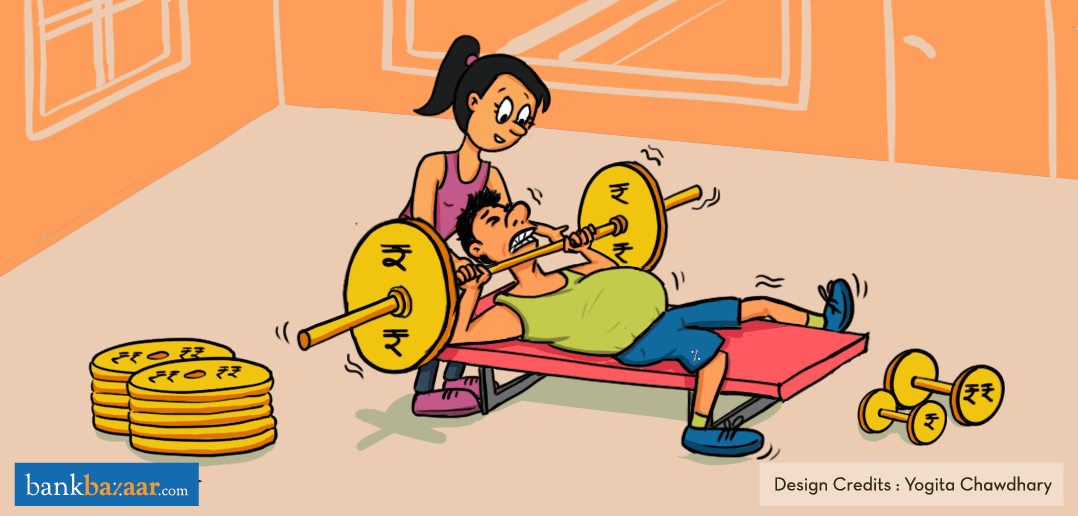

The Weight of Financial Stress:

Financial stress casts a heavy shadow on men’s mental health, emanating from various sources that weave into the fabric of daily life. The uncertainty of career paths, the weight of familial responsibilities, and societal expectations create the perfect storm of anxiety and pressure. Men often grapple with the stress of meeting professional milestones, providing for their families, and adhering to traditional roles.

By acknowledging the silent connection between financial stress and mental health challenges, we pave the way for a healthier, more supportive approach to managing both aspects of life.

Impact on Decision-Making:

Mental well-being is intricately weaved into the fabric of financial decision-making, influencing critical aspects such as risk tolerance, investment choices, and spending habits. A positive mental state often enhances one’s ability to assess risks judiciously, make informed investment decisions, and maintain disciplined spending habits. Conversely, poor mental health may lead to impulsive spending, adversely impacting savings and overall financial stability.

Breaking the Stigma:

Societal stereotypes often reinforce the expectation that men should embody stoicism and resilience, dissuading them from openly expressing vulnerabilities. It is crucial to dismantle this stereotype as it significantly hinders the creation of a culture rooted in understanding and support. Until we confront and challenge this stigma, it becomes challenging to foster a more resilient and strategic approach to navigating the complexities of financial well-being.

To address the complex interplay of mental aspects in financial management, the subsequent paragraphs will delve into actionable steps, providing a comprehensive guide to navigate these challenges with strategic precision.

Additional Reading: EPF Vs PPF: Which Is Better?

1. Build a Strong Financial Foundation:

Financial success begins with a strong base. Start by:

- Creating a budget that outlines your income, expenses, and savings goals.

- Making a habit of checking your Credit Score regularly.

- Understanding and analysing where your money goes.

Additional Reading: Money Management Tips That Will Change Your Life

2. Investing for the Future:

START INVESTING! Whether it’s stocks, mutual funds, saving schemes or commodities. Explore investment options that align with your goals and risk tolerance. Diversify your investments to manage risks and increase potential returns.

- Equity Markets and Mutual Funds – Investing in stocks and other asset classes such a mutual funds can provide long-term capital appreciation. Individuals can invest directly in stocks or opt for equity mutual funds for portfolio diversification and professional management.

- Fixed Deposits – This investment option is suitable for those who have a low-risk appetite. You park your money at banks or post offices, and they offer guaranteed returns based on your deposit amount and tenure.

- Public Provident Fund (PPF) and National Pension Scheme (NPS) – PPF is a long-term savings instrument with a lock-in period of 15 years, whereas the NPS is a savings scheme designed to enable systematic savings. Both investment options come with tax benefits, competitive interest rates, tax-free withdrawal and are a must for retirement planning.

- Gold and Sovereign Gold Bonds – The price of gold is not greatly affected by macro- and micro-economic factors that affect the returns of most asset classes. This means that gold can protect a financial portfolio from volatility. You can buy physical gold, or you can invest in gold ETFs or buy sovereign gold bonds.

What are gold ETFs and sovereign gold bonds?

In simple terms, you don’t possess any physical form of gold, but you do hold it like an investment and get the option to redeem it as and when you need them.

3. Emergency Fund Essentials:

Given the unpredictability of life, it is important to have an emergency savings account designated specifically for emergencies. Try to save enough to sustain your living needs for at least three to six months. This fund can be a lifeline in the event of unforeseen circumstances.

In certain emergency scenarios, you can also rely on Credit Cards at times. There are plenty of Credit Cards on the market that come without any joining or annual fees. This means you always have access to a line of credit without any costs involved. However, the key here is to be responsible and not impulsive.

Additional Reading: Top Seven Simple Tips For Early Retirement

4. Navigating Debt:

Effectively managing debt is crucial when it comes to mental peace and financial well-being. Start by understanding the types of debts you have, with a focus on prioritising high-interest loans like Credit Card debt.

Develop a realistic repayment plan, considering your monthly budget and exploring strategies such as the snowball or avalanche method. Automated payments and allocating extra income towards debt can accelerate the repayment process.

Additionally, negotiating with creditors and being mindful of your Credit Score are integral to long-term financial health. Ultimately, the goal is to become debt-free, redirecting those funds towards savings and investments for a more secure financial future.

By taking control of your finances, you not only secure your own future but also contribute to the collective prosperity of your community.

Here’s to financial empowerment, growth, and success for men everywhere! Happy International Men’s Day!