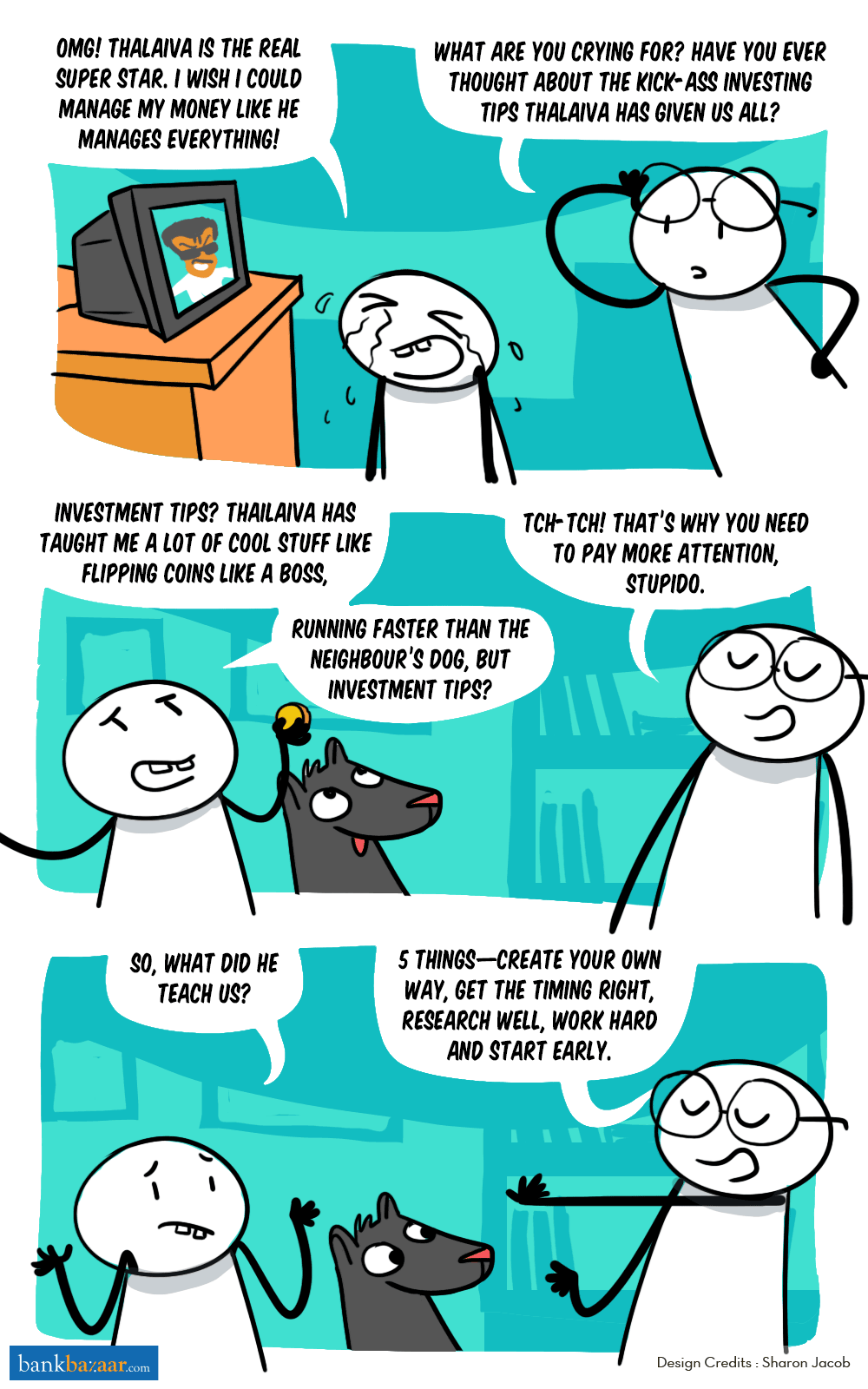

We all love his movies, especially the action sequences. But this Father’s day, let’s look at why it’s safe to call him the ‘baap of investing the right way’.

There are only two types of people in this world—die hard Rajini fans and people who claim they aren’t fans. Even if you aren’t a fan, you may change your mind about a lot of things after reading this article. He’s not merely a superstar, he has some sound investing lessons for each one of you.

With the release of his latest movie, Kaala, Thalaiva has yet again created a sensation with his powerful performance. Like always, he inspired more people to believe in what they stand for and take small steps every day to reach their goals.

Additional Reading: How Mutual Funds Work

Let’s look at what he’s taught us so far. Here are five of his most famous dialogues and what they secretly teach us about investing.

- “My way is a unique way.”

Instead of following your friends or relatives and trying to mimic their ways of investing, it’s always better to forge your own path. The needs and wants of every individual are different and so are the factors affecting each one of them. Before looking out for an investment route that will suit you the best, you need to do a careful analysis of your short and long-term goals.

If you have an amazing backpacking adventure in mind, you need to focus on quick ways to make money. Short-term SIPs can be a good investment option in this case. Whereas, if you have a long-term action item in mind like financially securing your post-retirement years, you need long-term investment options like long-term bonds, National Pension Scheme (NPS) etc.

- “No one can tell when or how I’ll arrive. But I always do, when the time is right.”

Timing is one of the most important factors that affect investments. One of Thalaiva’s greatest strengths, unlike the cops in the movies, is that he ALWAYS arrives on time to save the day. That’s how you need to roll if you want to make the most of your investments.

If you have invested in stocks, you need to analyse everything carefully. Will disposing some stocks now make more sense in the present or should you hold on to them for a bit longer? Ask yourself these questions before taking a hasty decision that could possibly change everything.

If you have invested in equity Mutual Funds, waiting for a longer period might make more sense. This involves a fair bit of risk, but if you play your cards right, nothing can stop you from making a profit.

Additional Reading: Equity Mutual Funds Investor? Here’s How You Can Download LTCG Statement

- “You’ll gain nothing without hard work. And if you do, it won’t last for long.”

Quick gains are easy to achieve and it’s okay to just aim for them every once in a while. But when it comes to a more sustainable investment plan, opt for things that will help reduce the risk involved and maximise gains.

To make things clear, start by making a list of your short and long term goals and the amount of risk you are willing to take. Along with this, you also need to figure out how much you can actually invest at a given point of time. Once all these points are covered, you can finally shortlist and choose from a set of Mutual Fund options.

If you don’t feel confident about this, it’s always better to ask for some expert advice. It could be anyone—your best friend, your sibling or a colleague. Someone who has in-depth knowledge about markets and investments will definitely help you make the right choice.

- “I don’t speak without thinking. I don’t think after speaking.”

Never do anything without thinking it through. You need to be aware of the repercussions of every step you take before you finalise a financial move. Right and extensive research is the only way to make it happen. Understand every available possibility and invest accordingly.

Once you analyse everything and have an investment plan in mind, don’t let yourself fall off the tracks.

Additional Reading: 5 Tips To Select The Best ELSS Product

- “Even if I come late, I’ll be the latest.”

Starting early is the key to becoming a successful investor. There are so many things to learn since the markets constantly keep evolving. You can never be overconfident. You must be eager and willing to learn, and the earlier you start the better.

Even if your first investment is as low as Rs. 1,000, it’ll help you figure out so many things about how the market works.

Did you ever realise that Thalaiva was teaching you so many cool things about investments through his evergreen dialogues? Now that you know, it’s time to find the right places to invest.