Category Archives: Tax Planning

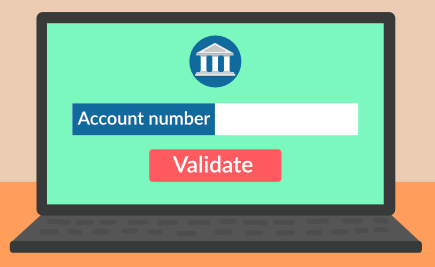

High-Value Cash Transactions That Could Trigger Income Tax Scrutiny

Large cash transactions, particularly those exceeding specified thresholds, can attract attention from the Income Tax Department. While these regulations are designed to uphold the integrity of the financial system and prevent illicit activities, they are not intended to discourage legitimate transactions. Understanding which transactions might draw scrutiny can help taxpayers avoid unnecessary notices or penalties.